CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Dec 29, 2022

Cory Diary : Financial Investment Updates

Nov 20, 2022

Cory Diary : Stagflation - Net Worth

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Nov 14, 2022

Cory Diary : This is the One !

Nov 10, 2022

Cory Diary : Hedge of Cory Portfolio

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Oct 15, 2022

Cory Diary : US Sept Inflation Rate

there is about another 40 pts to go to hit that bottom. That's after more than 28% drop from all time high in 2020 excluding dividends. Assuming DPU not significantly impacted and with serious correction already happened that will be a solid entry point. Personally I don't think it will happen as explained on inflation projection but we should never say never as is just projection coupled with market reactions can varies.

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Oct 7, 2022

Cory Diary : How do SG reit performs ?

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Oct 4, 2022

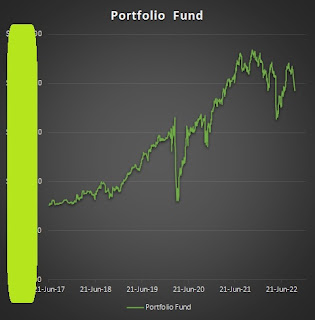

Cory Diary : Performance YTD 9 mths

|

| Pic 2 Portfolio Fund |

Portfolio value has decrease by about 9% YTD with Dividend Play segment accounting for just half the losses. However dividend maximum expectation has risen for year 2022 to S$73k. Last year dividend received was only $53k. YTD received $56.5k. The power of collecting at low while DPU maintaining steadfast.

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Sep 12, 2022

Cory Diary : Exploration of US Property REITs listed in SGX

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Sep 2, 2022

Cory Diary : Jittery Market

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Aug 9, 2022

Cory Diary : Green SGS Bonds

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Aug 3, 2022

Cory Diary : Ascendas 1H22 Report

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Aug 2, 2022

Cory Diary : Sheng Siong 1H 2022

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Jul 30, 2022

Cory Diary : Returns Report on YTD '22 Inflation Theme

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Jul 27, 2022

Cory Diary : FCT Q3 2022 After Thoughts

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Jul 23, 2022

Cory Diary : Sabana Results 1H22

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Jul 22, 2022

Cory Diary : F.I.R.E - Financial Independence Retire Early

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Jul 18, 2022

Cory Diary : Investment Portfolio Allocation - Fighting Inflation

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Jul 14, 2022

Cory Diary : How much is Enough in CPF ?

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Jul 10, 2022

Cory Diary : Net Worth Progress - Diversification of Assets Classes

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Jul 9, 2022

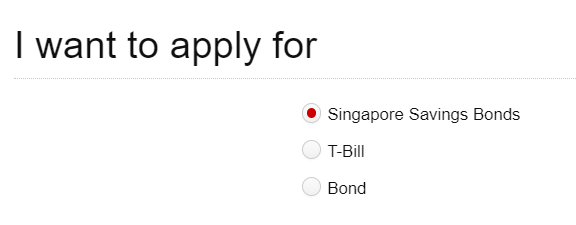

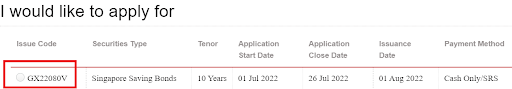

Cory Diary : SSB Application and Strategy

CoryLogics Invest Chat - No Coin, No Porn, No Penny