Performance

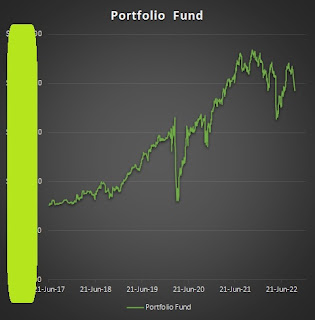

Portfolio wise, STI index has been holding up relatively well thanks to the banking sector. However my portfolio (Pic 1) suffered hits on dividend stocks and Tesla lower shipment last night. Added the end point in the chart as I was not tracking closely for past few weeks. The gap has widened against STI. For mainly dividend investor, cheaper market means BUY unless you are trying to time and able to sell at the top of the cycle which is way past this period.

Portfolio Fund

|

| Pic 2 Portfolio Fund |

Portfolio value has decrease by about 9% YTD with Dividend Play segment accounting for just half the losses. However dividend maximum expectation has risen for year 2022 to S$73k. Last year dividend received was only $53k. YTD received $56.5k. The power of collecting at low while DPU maintaining steadfast.

Staying Invested

Finally, one should not lose sight on long term return as market correction or crash is part and parcel of investing long term. Staying invested is still the way to go especially in high inflation environment where cash get smaller each day.

Staying Motivated

At this time, having CPF, SSB, Multipliers and fixed instrument capital protected is a bliss to mental well-being. Even property helps. Still not enough ? Looks at the annual dividend to get !

Cory

2022-1004

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Telegram CoryLogics <= Link to Telegram

Articles in this Blog is personal take and sharing purposes only. Reader should seek their own professional help when making financial decision and be responsible for their decision.

No comments:

Post a Comment