CoryLogics Invest Chat - No Coin, No Porn, No Penny

Oct 12, 2025

Cory Diary : Net Worth Update

Jul 26, 2025

Cory Diary : Net Worth update

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Jun 15, 2025

Cory Diary : Recovering Salaried Income Loss from Retirement

CoryLogics Invest Chat - No Coin, No Porn, No Penny

May 3, 2025

Cory Diary : Net Worth update

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Jan 5, 2025

Cory Diary : Net Worth

For a salaried person as me, unless sizeable of networth in market, is not possible to have persistent double digit increase in Net Worth. This is basically Math. Which is why it works against common folks that do not invest generally and we will see increasing wealth gap as time past.

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Nov 20, 2022

Cory Diary : Stagflation - Net Worth

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Jul 10, 2022

Cory Diary : Net Worth Progress - Diversification of Assets Classes

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Apr 2, 2022

Cory Diary : Alignment of Net Worth Tracker

Jan 8, 2022

Cory Diary : Net Worth Trend Updates

Primary Tasks1. CPF Top-Up to Max ( VC3AC )2. Increase Investment in Growth Stocks. Need to explore how much.3. Dividend Target 60k4. Sell Vested Stock allocation5. Put a portion of the emergency cash into Fixed Deposits6. Use more stroller instead of cab

7. Trip to Tainan for Holiday

8. 8% minimum warchest allocation

9. 5% - 5.5% cash allocation

10. No major adventure. Look for mitigation investment strategy.

11. Annual Parent allowances - completed

Secondary Tasks

1. Children CPF Top Up / CDA Top Up

2. Personal MA Top Up3. Try S&P500 if there are enough correction

Jan 2, 2022

Cory Diary : Financial Report 2021

Nov 6, 2021

Cory Diary : Net Worth Nov'21

Sep 18, 2021

Cory Diary : Annual Net Worth Growth Rate

Jun 4, 2021

Cory Diary : Net Worth Updates

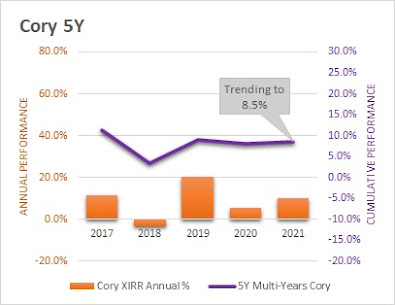

Seems a long time that I last did my Net Worth report. Some time ago I do some revamp on my Chart to make it even more easier to manage with lesser time. During this period I learned how to use macro in Excel to do VBA. Quite excited about it as this add a layer of automation to my learning. It is much simpler than I thought it would be. Maybe I can start to learn to do some tool for my colleagues as automation is sorely lacking even though we have some power tools using VBA, BI and Power BI.

I added a trend line in my chart just for fun. Though it might gives the impression of exponential type of feel into my net worth growth, seriously I doubt it can last. I am going 52 and looking forward to age 55 as a milestone which I could ask for retirement. Frankly I am not sure I would when time arrives. Nevertheless is something I look forward to in the aging process as an option which is favorable by then.

Back of my mind is I could be "retired" before 55 but this seems less likely for now as the company business is doing well. They even give a special bonus to boost Work-From-Home Morale. When you are at my age, we are earning a much higher salary that is near the peak of our career. The cost of retirement would be costly. So there is always the motivation or to some fear factor in play.

I am thinking should I do a comparison against my previous net worth report but is quite a hassle when I want to go sleep asap. I am nodding off.... . Instead I would focus on a particular highlight in the chart and talk about it which is the securities + MMF line in the chart. Is getting more steeper which basically is the result of my action to optimize wealth generation. Therefore channeling idle fund to more active use. There is still some gap to fill except that sizeable amounts allocated for War Chest needs. So the easy picking is reduced.

Cory

2021-0603

Articles in this Blog is personal take and educational purposes only. Reader should seek their own professional help when making financial decision and be responsible for their decision.

Mar 31, 2021

Cory Diary : Historical Milestone - Net Worth

Aug 22, 2020

Cory Diary : Net Worth - Fighting Mode

Jun 28, 2020

Cory Diary : Net Worth - Just looking at the Chart

The Cyan line is the liquid line and current YTD is roughly the same as start of year. Basically recovery of the stock market and some saving from the first half year. At personal level there is V-shaped recovery in asset.

The Cyan line is the liquid line and current YTD is roughly the same as start of year. Basically recovery of the stock market and some saving from the first half year. At personal level there is V-shaped recovery in asset.The Yellow line is the investment in Stock market and Gov securities which in total maintained. Showing some similar story of nearly a V-shaped recovery. However, equity dividend expectation has increased to $62k at current invested amount.

With major items like Tax, Parental allowances, Confinement costs and most of normal cost for 2nd daughter delivery already paid, 2nd half should see higher net worth unless the stock market has 2nd dip. This is mitigated with sizable FD, SSB and cash. Investment wise, retaining dividends, saving and 75% of warchest amount remaining for it.

Cory

2020-0628

Jan 13, 2020

Cory Diary : Investment Income

As one grow older, various income source comes into play. What best to represent it is to show the Net Worth chart and the allocation within. Financially few things Cory did or don't.

1. Move most OA funds to CPF SA

2. Continue to leave some amount of CPF in Property Loan for another year

3. Continue to have SSB Max Out

4. Have at least 3 years buffers to support housing loan in FD

5. Transferred Allowances to parents. Happy New Year !

6. Annual Bonus to Nanny. Very Professional Nanny.

Cory long term goal is to have salaried income replaced by equity income that is more passive. This seems quite illusive with annual adjustment ! LOL ! Like many people who come from humble background, and has no business acumen, we just have to learn to save or we have to learn through business failures of which most of us could not afford without safety net. How long it takes to save and build up do depends on how much delay gratification we want. This amount becomes very handy once a door open.

One main door open is Stocks Market. While Cory cannot run business, he can find good managers who can do this for him. So this is rather passive income. The trick is how to stay profitable in this business. This is especially make possible when the information gap is narrowed between institutions and retailers. And technology allows cheaper trading and more sophisticated products. Of-course experience in the market matters a lot. And then the saving slowly move in.

The next door opened when he starts to invest in property. This hurdle is harder to cross due to property curbs and needs for cash-flow to sustain. This is different from buying a property for one stay. The mindset is for investment gains and rental components. So why explore this ?

Like to mentioned Cory is not an expert and needs more buffers but the logic seems clear as below.

Cory is no longer young. Getting a loan will be harder. And it will be tough when one is without work one day. So if one want to invest in property, time is an essence too.

20% down for single property is like 5x leverage of a big sum of money. The mindset is quite different from stock investment where Cory do not leverage at all.

Loan is relatively cheap with low rates. Even after all the misc costs, and even so rental unable to cover all the loans, as long the interests part (not the principal) of the loan is well covered into good portion of the principal payment, theoretically one is making good money.

The rates may go up but by then the loan would have been serviced for some period of time and there will be more options. Ideally we like it to be in as long as possible, and as much as possible with comfortable buffer as property loan is one of cheapest to tap on.

Capital appreciation factor for those with good location. Is more pricey logically. With land limited Singapore, unless we are seeing something like no future for Singapore, with inflation the price general trend is upwards with fluctuation in-between that can be quite volatile.

As long one is able to service, after rental, is quite hard to lose money after all the costs. The main risk is cash-flow which is why Cory put this as top priority to mitigate and not to assume Rental Income is sufficient.

What will be the next door ?

Cory

2020-0113

Dec 20, 2019

Cory Diary : Income and Expense 2019

Year 2019 is special because Cory becomes a father to a baby girl. Unlike most parents, financially Cory is much more ready. The thing lacking is experience which Wife will always take care or be ready to remind Uncle Cory ..... . Nevertheless, raising baby is really not easy. The good thing is we have Baby Bonus supports and this do help some. Fortunately, company is also supportive and provide as much work from home time and leaves as needed.

Expenses wise, as previously blogged ( link ), kind of exploded and will not come down significantly for years. Good problem to have. How to fix it is to ensure that we have higher saving prior, predictable income, investments or saving to mitigate which the last option is not a viable plan for wife 😂.

For 2019 Income, Cory has a good bonus. This helps to pay for Income Tax and Parents Allowances. A nice surprise is that some of the Company Stock has also come into vesting period and this help to add into the year end 2nd Bonus. Hmm, why has this becomes a so look forward thing ...

For 2019 Expenses, the value expects to cross $140, 000. This is inclusive of home loan which is a major ticket item. However, Net worth and Income Returns looks able to match the increase in spending ( above chart ).

As Cory has stake in lower levels investment returns such as SSB and FDs, all additional savings could go into higher equity returns in Year 2020 to build higher dividend income plan. Investment returns wise, returns has been quite significant which will be blogged later once year ended. Touch-wood it will not change negatively by then.

Before signing off. Two wishes from Birthday Boy.

1. To do : Things that we could change. ie. Continue working.

2. Not to do : Focus on things that we could not change. Negative thoughts.

Cory

2019-1220

Jun 3, 2019

Cory Diary : Leapfrog your wealth

There are ways to leapfrog our wealth. Coming from below middle income family, and choosing a down-to-earth wife ( hee hee ), marriage do helps but inheritance from our families are out. Neither do our families have business acumen. So I would say today my siblings and we are above middle income. Hey, that's what makes Singapore incredible isn't it ? As long we work hard and smart, with a little luck and opportunity, we are contented.

As previously blogged, I am a "Value Saver" but I aren't frugal. I can spurt a dinner that cost few hundreds, and renovation in good 5 digits. As a value/dividend stock investor, this bring me quite a good sum to my net-worth. Of-course this won't happen fast enough if I do not have monthly salary and saving, and then equity investment.

Now, I can add that Property Investment as another option to propel. See chart below. With the mark-to-market valuation based on recent residential transactions of surrounding properties on the same development. Of-course some friends would say as long I don't sell, is only paper gain. This actually applies to my dividend stocks too. Nevertheless, Net-worth is the market value you have.

My thinking is whether we sell it or not is subjective. Holding cash in an inflationary environment is losing money too so I rather put my money to work continuously. Unless we are doing short term speculative trade, taking profit to realize the gain is cutting our game short as a good hedge against inflation.

Property provides a strong underlying asset base so I am in the mentality of "Never Sell". It can be also be an insurance that if needed, I could use it for downgrade therefore the more I would like to hold it for long term appreciation to be meaningful.

What I find amazing from this experience is how fast the pace of property appreciation and loan leverage can do to one's net-worth. No wonder our government needs to introduce curbs to rein them in to ensure more stable market. As for another sharing based on my limited experience, I realised the surrounding properties about few hundred meters away do not appreciate much at all for the same period. A real example of location of property matters in value appreciation.

In summary, the list of Wealth Accumulation.

1. Monthly Salary - Yes

2. Property Investment - Yes

3. Stock Investment - Yes

4. Marriage

5. Saving - Yes

6. Inheritance

7. Business

Cory

2019-0602