Tracker

Even on allocation itself between Reits, Non-Reits, Growth etc the allocation may need to be re-balance and adjusted over time against wider portfolio such as Bond and CPF including cash. Nothing is permanent in the sense opportunity and situations may arise that we need to act on. Ignoring them is a Strategy of Environment Changing our Portfolio Size therefore I rather be the Change agent.

Performance

As above Chart, the gap of Cory Performance YTD has been closing up. Cory YTD -1% whereas STI Index YTD is at 2.8%. We still have 5 months to go and the world is still on unchartered territory. How the Supply Constrains, Recession, Inflation and War will shape the world by year end is still up in the air. Things could turn drastically down to Boom.

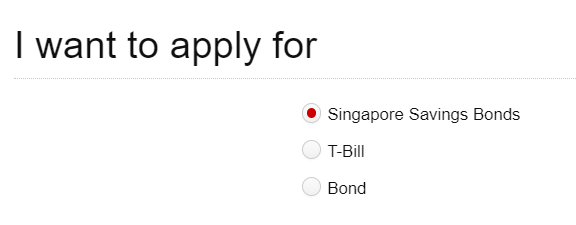

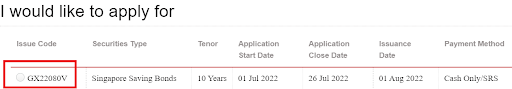

If we look holistically, the strategy in current format is to fight inflation. Renewing to higher SSB, even going to higher yield bond that has dropped ironically, and expanding into stocks that have pricing power. However Recession is a different ball game altogether with significant hardship on those retrenched. Hopefully we will avoid that.

Inflation

So why is inflation so horrifying ? If I read it correct is the compounding effect. Taking from Worlddata for United States.

During the observation period from 1960 to 2021, the average inflation rate was 3.8% per year. Overall, the price increase was 829.57 %. An item that cost 100 Dollar in 1960 was so charged 929.57 Dollar in the beginning of 2022.

For June 2022, the year-on-year inflation rate was 9.1%.

This includes in particular energy (+41.6%) and food (+12.2%).

Singapore is better for the same period at 324%. On top of that governments are better informed and managed as the world advances economically. If we take the 1st half and 2nd half of the 60 years period, the data is 161% and 57.3% respectively. The later 30 years have been well managed.

To put this in context of the compounded inflation for Singapore,

1961 - 2022 : 324%

1961 - 1991 : 161%

1992 - 2022 : 57.3%

Using 1992-2022 period of 30 years, Purchasing Power reduced by 57.3%. An average of slightly less than 3%, this could be a good number to use in our annual inflation computation guide. 30 years also likely cover a large segment of people retired period.

Cory

2022-0730

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Telegram CoryLogics <= Link to Telegram

Articles in this Blog is personal take and sharing purposes only. Reader should seek their own professional help when making financial decision and be responsible for their decision.