There are quite a few Re-balancing going on before Indian Variant Covid wave hits our shores.

1. Moving some shares from CICT to FCT. My Rationale is that Suburb will do much better in the long run to ride over Mall impact with recent outbreak. This is the second time I reduced my stake in CICT but for different reason. The result did not meet my expectation when price level was at 2.27. FCT stake is already much larger than CICT today but it can be more. Another reason is I want to reduce my dependency on Capitaland considering I have exposure to Ascendas Reit who they are also the sponsor. At current price, Ascendas is attractive but I would want to time my DCA for YTD Cost. With Covid in play more again, Industrial Reits are preferred.

2. Cleared my Cromwell Reit Position as they still have significant amount of office spaces. Their recent 5 to 1 share reduction leaves room for desire on not focusing on the business. The sale of asset also keeps me thinking why it was included into the IPO. This reflect badly on the sponsor. Since I am in profit year to date on this counter, gives bigger push for me to move on. There is a small hit on my dividend as it gives more than 7%. So why not iReit. Simply key tenants are much more sticky so their office will be hardly impacted in term of occupancy.

3. Started my process on averaging down Tesla by a few shares at a time. Even though is quite costly to use Poems for a few K value at at time as I want to do this over long period. A very slow process after clearing off my HP Inc and APPL shares. With that I consolidate my positions to just Alibaba (HK), Microsoft, AMD and Tesla for Foreign Shares. Managing their returns due to rate changes can be quite interesting.

4. Increased Sheng Siong shares recently before the run-up due to Indian Variant. Still not significant position to benefit much in absolute amount even though percentage return wise looks nice. Still monitoring but considering position is not large I will be holding it long term for this amount as this will allow them more time to expand their stores and therefore chance are will be near to maintain high level of Covid returns.

5. Managed to increase my Vicom holding to 4.5% of my equity portfolio. This is more a bang for the buck to worth my time to follow up on this counter. Long term wise I still find it relatively attractive as a defensive counter. Regardless gas or electric car, testing is still needed. So my thought process is this will be needed long term. The catalyst is other testing expanded which so far needs more focus.

6. Average down on Mapletree Commercial Trust. Surprising this counter is not performing well in price Year to Date compared to other reits despite it's strong fundamental. This gives me opportunity to average down at lower price. I think this stock will help drives future earning of the portfolio as I think Business Park is more robust and that Vivo City despite impact from Pandemic, will still do ok.

7. After hearing DBS CEO sold some of his shares, I realized the price is quite good for me to offload a little as well. I think at this current price, it can go further but there is also a good chance it will fluctuates or even go lower with market condition. However DBS I am still hoping MAS will lift the cap on dividends. To be fair, there is many reason why one sells and to him is just a tiny portion of his DBS shares. Nevertheless the price must be quite good even though not representative of the future of DBS. Considering we are in good profits, is good to take some away from the table to build up cash. Still have to be careful not to offload too fast despite Fed repeated reminders that they won't raise rate near or mid term if I interpret they language correctly.

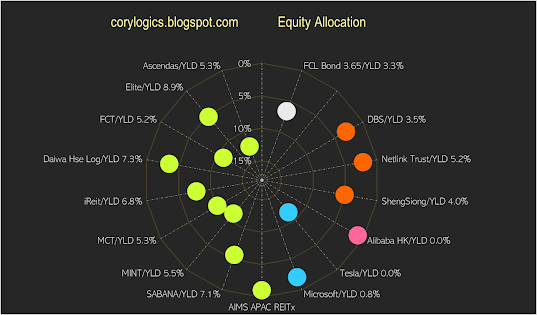

Finally, what I like to see my Radar chart coming to be. If there is opportunity, more Sheng Siong, Elite, Tesla and Alibaba. I also plan to acquire more MIT through Rights. Theoretical Annual Dividend Max 57k allows me to focus more on growth stocks which has been going through correction phase.

thanks

Dennis W.

Articles in this Blog is personal take and educational purposes only. Reader should seek their own professional help when making financial decision and be responsible for their decision.