CoryLogics Invest Chat - No Coin, No Porn, No Penny

Nov 29, 2025

Cory Diary : Portfolio Nov 25 Returns

Sep 22, 2025

Cory Diary : Performance Update

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Aug 21, 2025

Cory Diary : Mapping 2025 Segment Returns

Today a new interesting Chart to view portfolio diversification. As you can see below, the Equity portfolio has 4 main segments namely Banks, Reits, US Big Techs, and others.

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Mar 29, 2025

Cory Diary : Q1'25 Equity Performance

For Q1 my performance like last year has seen early deep dive and then recovery. Whether it will be strong later is yet to be seen. While the US exposure is relatively small and investing in Treasury helps some in understanding the market situation better, the tariffs reduces the sentiment to reduce rate cut quickly. This can also be seen on the rising Gold prices as safe haven. Interestingly, we don't see much strength in USD.

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Mar 1, 2025

Cory Diary : Performance Mar 25

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Feb 2, 2025

Cory Diary : First Month Equity

The Jan month looks good. Feb'25 will be interesting as in how will Banks continue to perform and Tariff impacts roll-out. The month also see a draw down in Nvidia but fortunately other US stocks managed to lift the segment up through diversification in context on distributed large tech stocks and recent US Treasuries addition. The money of Treasuries come from Meta (ouch) and Msft ( hooray ).

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Jan 3, 2025

Cory Diary : Year 2024 Equity Result

|

| Holding through Emotion Roller Coaster |

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Dec 7, 2024

Cory Diary : Allocation Strategies and Performance YTD

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Aug 24, 2024

Cory Diary : Strategy for 2025

CoryLogics Invest Chat - No Coin, No Porn, No Penny

May 12, 2024

Cory Diary : Sell in May and go away logic

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Jan 4, 2024

Cory Diary : Year 2023 Equity Learning Part 2

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Dec 31, 2023

Cory Diary : Year 2023 Equity Performance

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Jun 14, 2023

Cory Diary : Quick Snap on YTD Equity Returns 2023

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Oct 4, 2022

Cory Diary : Performance YTD 9 mths

|

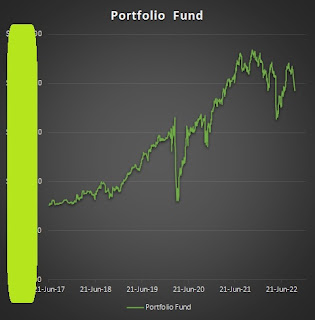

| Pic 2 Portfolio Fund |

Portfolio value has decrease by about 9% YTD with Dividend Play segment accounting for just half the losses. However dividend maximum expectation has risen for year 2022 to S$73k. Last year dividend received was only $53k. YTD received $56.5k. The power of collecting at low while DPU maintaining steadfast.

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Sep 2, 2022

Cory Diary : Jittery Market

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Jul 30, 2022

Cory Diary : Returns Report on YTD '22 Inflation Theme

CoryLogics Invest Chat - No Coin, No Porn, No Penny