CoryLogics Invest Chat - No Coin, No Porn, No Penny

Showing posts with label Expense. Show all posts

Showing posts with label Expense. Show all posts

Nov 1, 2025

Cory Diary : Family Expenses - Oct'25 Updated

Yesterday marked the final day that Rui will attend the nanny's care. This change will modestly reduce our overall costs while freeing up time previously spent transporting her back and forth in-between school and home.

A key clarification on our expense tracking: it excludes taxes and rental support. My assumption is that our income will comfortably cover these items, making them unlikely to become issues. With the primary objective for the retirement phase, our focus remains squarely on daily family essentials. This consistent methodology applies across all tracked expenses.

Next Step, to monitor the change implication, if any.

Cory Diary

2025-11-1

Telegram CoryLogics <= Link to Telegram Chat

Telegram Cory Channel <= Link to Channel

Disclaimer: The articles presented in this blog reflect personal opinions and are intended for informational and sharing purposes only. Not responsible of errors. Readers are advised to seek professional guidance when making financial decisions and should take full responsibility for their choices.

Oct 5, 2025

Cory Diary : Family Expenses update

Have been watching more carefully on transportation expenses. In-addition, food take-aways continue to be managed down. On my partner side which i always assume 15% of what i computed for family expenses are not added. Feel maybe 20% additional is better figure as she spend more on "Luxury" to save time.

Overall, the expense continues to trend down. The average of 5 of trailing 12 months expenses are now around $115k for my family. As mentioned i did not add her expenses and feel is ok since she is still working.

Short note !

Cory Diary

2025-10-05

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Telegram CoryLogics <= Link to Telegram Chat

Telegram Cory Channel <= Link to Channel

Disclaimer: The articles presented in this blog reflect personal opinions and are intended for informational and sharing purposes only. Not responsible of errors. Readers are advised to seek professional guidance when making financial decisions and should take full responsibility for their choices.

Jul 4, 2025

Cory Diary : Family Expenses update

To see past family expense tracking, make sure you click the expense label in Desktop mode to see all related articles. The monthly expense fluctuation can varied widely so i thought this is a better tracking measure.

The trend seems to stabilize around $120k on trailing annual basis which meet our expectation. If we could continue this same level of budget control, the trend will go towards $110k. The key controls are lesser food delivery, reduce air-con use and transportation cost.

The trend seems to stabilize around $120k on trailing annual basis which meet our expectation. If we could continue this same level of budget control, the trend will go towards $110k. The key controls are lesser food delivery, reduce air-con use and transportation cost.

The cost structure has potential to go back to 2 years ago level but if we are not careful it can spiral out of control again.

Cory Diary

2025-0704

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Telegram CoryLogics <= Link to Telegram Chat

Telegram Cory Channel <= Link to Channel

Disclaimer: The articles presented in this blog reflect personal opinions and are intended for informational and sharing purposes only. Not responsible of errors. Readers are advised to seek professional guidance when making financial decisions and should take full responsibility for their choices.

Mar 23, 2025

Cory Diary : Applying Stock Trends to Expenses

In retirement phase, there is no active income. We can well manage our portoflio to grow our passive income. However, this aren't useful if expense is not kept in-check. Often we hear about trailing or leading 12 months performance of a stock. What-if we are apply this with our expenses.

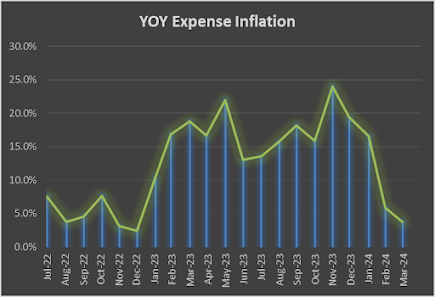

From above Chart, we got an interesting trends early on what's our expenses be like on annual basis on monthly data collected. What is more shocking to me is when i try to get the average increase on this YOY trend. The answer is 12.4% ! The last 2 months on YoY expenses is coming down. Hope it stays there.

From above Chart, we got an interesting trends early on what's our expenses be like on annual basis on monthly data collected. What is more shocking to me is when i try to get the average increase on this YOY trend. The answer is 12.4% ! The last 2 months on YoY expenses is coming down. Hope it stays there.

This Chart is more interesting. Even with expense curbed, it is still at high. Just slower climb. And this remind us the similar story we see in inflation data. The only way for inflation to come down is recession. Fortunately, for expenses we just have to cut. Austerity Measure ...

Cory Diary

2025-0323

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Telegram CoryLogics <= Link to Telegram Chat

Telegram Cory Channel <= Link to Channel

Disclaimer: The articles presented in this blog reflect personal opinions and are intended for informational and sharing purposes only. Not responsible of errors. Readers are advised to seek professional guidance when making financial decisions and should take full responsibility for their choices.

Feb 23, 2025

Cory Diary : Making Sense on Tracking Expenses

Over the decades i do quite a few attempts to track expenses. None of this works well because it requires alot of work and therefore I only do them briefly. Now, I have fine-tune much simpler way to collect expense data in-which I like to share.

Regardless using ATM or Credit Card Payment or Giro or .... they are recorded in the saving account. This includes salary, dividends, transfers etc. Therefore the data is already there. There is no need to manually replicate data into another tracking app.

On a regular monthly or bi-monthly basis depending on your bank search limit, we can download the information into Excel. Tag those with high expenses and those that aren't expenses. Usually different columns. Is that simple.

Afterwhich, play with the data as you wish in Excel.

The effort only takes like 15 min to 30 min depending on individual specific needs. For me, I will combine all the data into an excel tab for the entire year. And break them into monthly grouping. I also have remark columns for specific situation for example credit card is usually lump sum payment. So I would look at the card statement, and add remarks on key expenses. One thing to watch is to single out non-expenses or transfer to another saving, investment accounts etc.

Once the data is cleaned, we can investigate how to manage our expenses better. Ofcourse you can use this to track different income or returns.

A sample of Year 2024 Expenses. Ofcourse there is no decrease ....

Cory Diary

2025-0223

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Telegram CoryLogics <= Link to Telegram Chat

Telegram Cory Channel <= Link to Channel

Disclaimer: The articles presented in this blog reflect personal opinions and are intended for informational and sharing purposes only. Not responsible of errors. Readers are advised to seek professional guidance when making financial decisions and should take full responsibility for their choices.

Posted by Cory at Sunday, Febru

Jan 12, 2025

Cory Diary : Expenses Review 2H 2024

Family Expense is something hard to control personally. There is so much to use or buy for our kids constantly. As they grow up, when one specific item is no longer needed, two new expense item appears. It's kind of losing battle. The need to constantly review our expenses is critical before it get out-of-hand. This is especially so as I have entered retirement phase. I need to make sure investment returns can cover increasing expenses or conduct planned drawdown as a mitigation plan.

As such, there are two levers on managing my portfolio. The dividend portion and the growth part.

The hope is that there will not be draw down of the equity portfolio within 10 years as I will hit age

65 by then. This period like CPF, will allow the portfolio to compound.

Cory Diary

2025-0111

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Telegram CoryLogics <= Link to Telegram Chat

Telegram Cory Channel <= Link to Channel

Disclaimer: The articles presented in this blog reflect personal opinions and are intended for informational and sharing purposes only. Not responsible of errors. Readers are advised to seek professional guidance when making financial decisions and should take full responsibility for their choices.

Nov 25, 2024

Cory Diary : Cash Flow

Shifting to a Cash Flow Mindset in Money Management

As I shift my mindset to focus on short term cash flow in managing my finances, it becomes clear that understanding cash flow generation as a whole is essential, especially considering that most stocks pay dividends.

This concept is particularly important for those who do not possess significant wealth that can be safely parked in savings without worrying about potential shortfalls. For retirees and many others, being able to cover bills, fees, and expenses is critical, especially as these expenses are expected to grow over time. Therefore, putting every dollar to work and allocating it according to different risk levels seems like an intuitive approach.

Where to Start

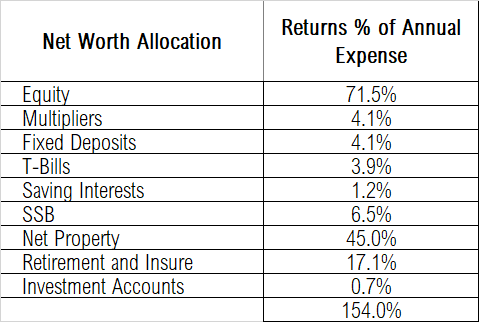

To begin, I can gather current expense estimates and draft a plan outlining various income sources to support these expenses. For instance, let’s assume an annual expense of $100,000. To clarify, the table below uses arbitrary numbers for simulation purposes. In this scenario, the total income is 54% buffer on the annual expenses. [ updated error ]

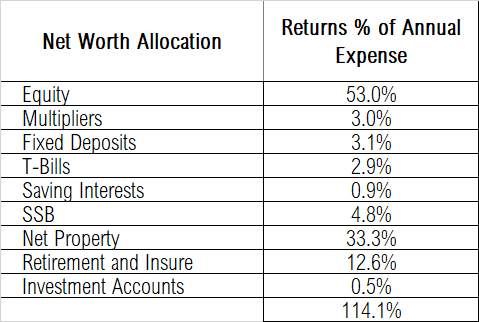

However, if I increase my estimated expenses to $135,000, the revised table would look like this:

Analyzing Expenses

This analysis provides a valuable guide for managing my expenses. I could refine my calculations by reducing the allocations for retirement and insurance since I typically won’t receive my first payout until age 65. Additionally, insurance policies may need to be surrendered to access funds.

There are various levers to adjust in this financial plan.

The fundamental idea is to continuously monitor and improve one’s financial situation while also maintaining motivation throughout the process.

If my planning goes exceptionally well, I might even consider including my spouse's expenses or other discretionary costs. If we find ourselves below our target income, we can optimize returns by reallocating savings or exploring other investment opportunities. The initial table heavily relies on equity and property incomes. As we approach age 65, additional pension streams will become available to us. However, there are always other options to consider as we navigate different levels of risk.

Conclusion

Adopting a cash flow mindset allows for better financial planning and resource allocation. By continuously assessing and adjusting our strategies based on our changing circumstances and goals, we can create a more secure financial future.

Cory Diary

2024-11-25

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Telegram CoryLogics <= Link to Telegram Chat

Disclaimer: The articles presented in this blog reflect personal opinions and are intended for informational and sharing purposes only. Not responsible of errors. Readers are advised to seek professional guidance when making financial decisions and should take full responsibility for their choices.

Jul 5, 2024

Cory Diary : Family Expenses 1H24

Have done a few blog on Expenses. Another half year has passed, and I am excited to table another review on how we progress in escalating expense containment. We have some discussion on why out expenses keep growing and it will good on how we progress after 6 months.

As table shown, it appears we have managed to stop the problem. 1% expense increase for 1H24 compared to 2H23. This is on the back of additional Travel and Private Tuition Fee.

As table shown, it appears we have managed to stop the problem. 1% expense increase for 1H24 compared to 2H23. This is on the back of additional Travel and Private Tuition Fee.

There is a special bill exception that we allocated to 2H23 and 1H24 instead of amortizing across say 5 years. Even if this is considered in the last two halves, the expenses look ok.

Can safely say our expense range between $9.6k to 10.6k range. Do note as in previous article, partner supported probably additional 15% expense. This work out to 132k annual expense. Interestingly we do not feel we have lavish lifestyle.

With this expense amount, we can work out passive income, investment return, rental support etc to ensure we can manage our financials.

Cory Diary

2024-0705

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Telegram CoryLogics <= Link to Telegram Chat

Disclaimer: The articles presented in this blog reflect personal opinions and are intended for informational and sharing purposes only. Not responsible of errors. Readers are advised to seek professional guidance when making financial decisions and should take full responsibility for their choices.

Feb 19, 2024

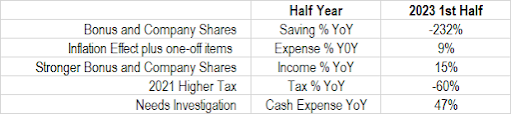

Cory Diary : Expense 2023

Currently on routine half-yearly tracking family expenses. To be exact the tracking is based on the outflow from saving account. Before I start it off there are a few items or assumption made.

There is basically negative cashflow for 1st half of Y2023. Lumpy Tax. What to focus is the cash expenses YoY 47% Increase but overall expense only 9% up. Compared to Full Year chart, the expense 42% as is much more actively watched in 2nd Half of Y2023

Figure includes

- "Home Loan"

- A few one-off Medical Expenses - Therapy Sessions etc

- On/Off there maybe Bonus Company Share Sales

- Parental Allowances

Figure excludes

- Income Taxes. I help cover my partner too.

- Partner contributed to some expenses. Assume 15%. May Revisit later on this assumption.

Full Year Comparison

To set the right expectation, it maybe quite big-eyed to see saving jumped 65% for Year 2023 when income do not rise as much. 13% includes company shares sold. Saving is typically a small subset for me due to family, housing, transport, holiday etc. The important rationale is that if we able to keep our expense in check, all the income increase will be channeled to saving. Hence, we see large % increase in saving.

1st Half Year Comparison

Cash Expenses do increase significantly due to many reasons. However, what is interesting to know is that for 1st Half comparison YoY.

|

There is basically negative cashflow for 1st half of Y2023. Lumpy Tax. What to focus is the cash expenses YoY 47% Increase but overall expense only 9% up. Compared to Full Year chart, the expense 42% as is much more actively watched in 2nd Half of Y2023

Sharing on Expense Ways

Obviously this aren't a sharing of low expenses. Is not intended initially when I start to write this article but strikes me that i could share what efforts have been put in to slow down expense increase with family as this aren't easy ....

1. More instances of more simple home cook food and outside meals.

2. Tighter control on transports. We do more walking.

3. Reduced Fruits wastage and less expensive varieties.

I wish there could be more. There aren't. Is so easy to blow our budgets. What keeps the mood up is the Net Worth still on increasing path. Maybe this is the way to control expense in moderation while increase total assets. We still need to keep fighting the demon within.

Cory Diary

2024-02-19

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Telegram CoryLogics <= Link to Telegram Chat

Disclaimer: The articles presented in this blog reflect personal opinions and are intended for informational and sharing purposes only. Not responsible of errors. Readers are advised to seek professional guidance when making financial decisions and should take full responsibility for their choices.

Jul 24, 2023

Cory Diary : Reflections on the US Market and Singapore Investments

US Market ( Nasdaq )

In recent times, the US market, specifically Nasdaq, seems to have completed a significant run-up. Despite Tesla showing decent growth results, it experienced a correction on the second day. This reminds us that the market will always find a reason to sell. Microsoft also followed suit with lower volatility. Looking at the three-year performance of just these two US stocks, it appears that I am almost breakeven, with only a modest 15k gain if I were to consider all US shares held during the past three years. This experience has taught me that growing out of dividend plays in the SGX market is not as easy as it seems. Timing plays a crucial role in the US market, and its wild volatility can lead to valuation fluctuations with each reporting or news release. Consequently, it is wise to avoid chasing stocks, especially when there are no or little dividend gains for holding them long-term.

Singapore Market

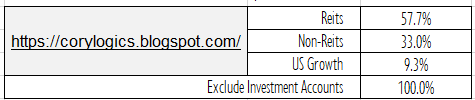

On the other hand, Singapore banks have experienced some revival due to recent Fed hawkishness, balancing out the hits on Reits. I have observed that the recent rights issue on iReit and Aims Apac Reit have been profitable, but the discounts are not as substantial as in previous years, resulting in less impressive gains. My current allocation is as shown above, with some USD cash remaining from earlier sales. Given the current lower US rate, I am undecided on whether to hold it until the next bottom cycle and park it in a high-interest rate account or convert it back to S$.

As I review my equity portfolio, it is becoming harder to rotate stocks, particularly since Fed rate hikes may have already peaked. The sell-off in Reits, however, presents a promising opportunity for investors as we could see significant capital gains alongside regular dividends in the future. I plan to maintain a cash reserve for the last one or two rate hikes or potential recession sell-offs, if any. This strategy could lead to another record-level annual dividend, and the opportunity is quite apparent.

Passive Income Reporting

Additionally, I've noticed a new trend in my financial planning that better suits me. I have shifted away from reporting Net Worth Pie Chart segment allocations to focus on Passive Returns ( Non-Salary based returns or other returns). This change comes from the realization that using asset methodology doesn't directly help me with my expenses. However tracking Passive Income gives me a gauge on income once I retire. Currently reporting excludes my partner.

Using the listed amount in the table, I have a good idea how they fit into my expenses. And how much I need to grow or control.

In the past three months, I have invested more into T-Bills, primarily adding an additional $2,350. There was also a slight increase in my CPF investments, though I am cautious about doing so since I am nearing 55 to fit my personal plan. I've learned to avoid this unless there is a significant boost in cash levels from an euphoric market. Please note that CPF is not tracked in this table and is currently treated as a bonus retirement amount at 65.

While there have been upticks in equity dividends from rights issues, I've sacrificed a significant amount of cash for safer investment allocations in the past three months. Currently, I am monitoring my cash levels carefully to ensure my T-Bills are adequately spread out to support property loans or meet any cash needs comfortably.

Overall, my experiences in the US market and the shifts in my investment approach have provided valuable lessons, which I hope will continue to guide my financial decisions moving forward

Cory

2023-0724

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Telegram CoryLogics <= Link to Telegram Chat

Disclaimer: The articles presented in this blog reflect personal opinions and are intended for informational and sharing purposes only. Readers are advised to seek professional guidance when making financial decisions and should take full responsibility for their choices.

Jan 23, 2023

Cory Diary : Life Style Creep Part 2

This is continuation of earlier post on Life Style creeps expenses running out of control. ( link ). With the year ended for 2022. 2nd Half data collected for analysis for comparison to 1st Half data.

There are some costs taken out for relative comparison. For example Home Loan and Insurance as they kind of covered from corresponding returns from it. If we include them the expenses will be way above the data listed in the table.

The expenses reduction for 2H 2022 is about $11,614 which kind of much more than the saving planned from 1H 2022. One for the key reason is structural saving from Nanny expenses when my elder go nursery. Credit cards expenses came down which has most of my daily expense in it. Have not run through the details but I suspect medical cost, some food and transport.

In a nutshell, expenses came down 11% comparing 2H'22 to 1H'22. However YoY, is still up 12.7%. There maybe some accounted due to inflation however quite certain there are family lifestyle developed which we can't go back easily.

Cory

2023-0123

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Telegram CoryLogics <= Link to Telegram

Articles in this Blog is personal take and sharing purposes only. Reader should seek their own professional help when making financial decision and be responsible for their decision.

Jan 16, 2023

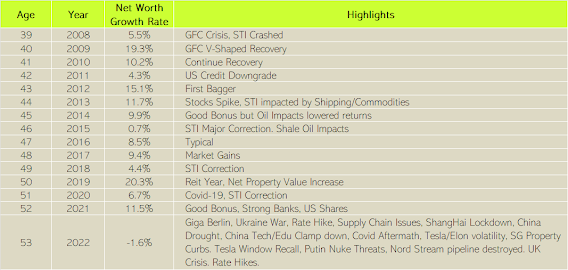

Cory Diary : Year 2022 Performance

The Year 2022 is one of the bad year in stock market. There were tons of bad news one after another. Black Swan comes in a Swam. While STI is in green, the index in my view is not a strong reflection of the actual environment most investors are seeing unless ones are just mainly into Singapore banks.

There is another plus that mitigate the fall which is property value has gone up slightly in Year 2022.

Equity

As I remember during GFC, Portfolio were down more than 50%. However, for the year 2022 Cory XIRR is down -12.8%. This is the 2nd worst after Year 2008 GFC. In absolute, today portfolio size is far greater than the one during 2008. It has been 15 years.

More than 50% drawdown is mainly due to Singapore stocks which are mainly in Reits. This are generally neutral mentally as from investment and cash flow perspective, we are getting more shares cheaper as their fundamental is good despite rising rate environment. This form bulk of cash flow dividend play strategy. To mitigate rights issue at this bad time, any new cash injection will be on Reits that is less likely not to give heavy discount if it does any. Theoretically it does not make sense as spiking rate environment is not conducive to shareholder returns to do rights issue as the loan will be expensive.

The other losses are mainly due to Tesla and some aspect Msft in the US Market. This are growth stocks which I embarked for long term. So far I am still quite bullish on them despite dramatic price falls of Tesla.

As in any investment, profit and losses are part and parcel of the investing game. Is how we size them such that we can sleep well. As we can see from this experience, even with less than 10% exposure in US market, we can see them taking sizeable loss onto the portfolio. A humbling experience even though the amount invested in this segment is sized with Year 2021 profits.

Net Worth

This year bonus is smaller than last. When totaled up, -1.6% reduction in asset. This is the first time we see reduction due in large part to Equity, and Personal Expenses which I plan to blog later.

There is another plus that mitigate the fall which is property value has gone up slightly in Year 2022.

Assets Allocation

Another view of the asset. There is some focus on fixed returns due to strong interest rates. They act as reserve for emergency and opportunity. Decided not to do CPF top up for now to allow more flexibility and higher rate income.

Cory

2023-01-16

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Telegram CoryLogics <= Link to Telegram Channel

Articles in this Blog is personal take and sharing purposes only. Reader should seek their own professional help when making financial decision and be responsible for their decision.

Labels:

Asset Allocation,

Expense,

Portfolio

Jul 5, 2022

Cory Diary : Building Up Passive Returns - Income Streams

Equity Portfolio ( link )

One of the weakness in the portfolio is the persistent under representation of Finance stocks. Therefore, has been buying into DBS stock which provide good dividends. Size wise still not there yet due to concern with digital banking competition. Nevertheless, need to have enough investment into this area.

What best is to be able to buy with current yield reaching 4.9%. Price can get lower and recession might comes knocking. USA side there is speculation that we are in recession already. Currently preference is to go in slowly.

Competing against budget for Bank is the need to also buy Reits on the cheap which produces good yield. Need to constant inject in this area too.

Singapore Saving Bond, Multipliers, Pension and Private Bond

Have not been utilizing fully the CPF scheme. Only did top up in recent years with the elimination of company bonds. This money tied down long term so we can't touch it till later or 65 mainly for FRS amount.

With Rising Rate, the interest rates of CPF is falling behind. Decided to try some Astrea bond which is becoming more attractive as the price falls. There is capital risk so starting small. Nothing is permanent I guess.

SSB is also getting more interesting. Multipliers can be switched out any time. The idea is that as the equity portfolio grows bigger, the reserve in SSB and Multiplier can be managed down. Rich get richer rings here ?

Property Investment

Unlike Reit, property investment requires large sum of money even with leverage. The potential rental income is quite attractive. However one has to make sure the rental income keeps coming in which can be easily 50% of equity dividends received. For long term diversification, property is nice to have. Have to watch the loan payment consistently and making sure there is cash reserve in SSB for sufficient run way if one get retrenched and out of market permanently.

In Summary

Returns excluding salary works out to cover a big portion of Life Style Creep expenses. There is still a gap to close. Need to look around on making remaining cash works harder while smothering down the expenses (cost).

Cory

2022-0705

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Telegram CoryLogics <= Link to Telegram

Articles in this Blog is personal take and sharing purposes only. Reader should seek their own professional help when making financial decision and be responsible for their decision.

Jun 19, 2022

Cory Diary : Life Style Creep

Coming to end of 1H'22. Long time since last tracked my expenses. With the global economy in gloomy atmosphere and stock market in tatter, it maybe prudent to increase one's saving when the inflation is high and hopefully able to channel it to cash generative assets to negate the rising prices.

Computation Logic

To make the review more meaningful, Income tax, home loan and saving type of insurance removed to focus what's matter. This is more applicable to myself.

Hopefully will give a good perspective of more realistic expenses to focus on. The expenses work out to about S$113 k for rolling 12 months period or 9.4 k monthly expenses.

What Is Lifestyle Creep?

In Investopedia, Lifestyle creep occurs when an individual's standard of living improves as their discretionary income rises and former luxuries become new necessities. The rise in discretionary income can happen either through an increase in income or decrease in costs.

It isn't entirely a bad thing but a progress but it can become a Monster when one's income falls or disappears. And this is my primary concern if one plans to retire.

Review

Most of the withdrawals are easily tracked in this saving account. Purchases via credit card is also paid out from the same account. So the data capture is quite robust.

Due to tiredness, we have get accustomed to taking car with our toddlers. Used to take a long walk instead when we have our first child. This item is now a good chunk in transport costs.

Food wise we have seen a spike as we stay at home mostly with delivery foods and going for more dishes. There is one time medical cost which will not repeat. A special Apple gift. A Hotel family expenses. And some misc items from oversea internet purchases.

Belt Tightening Operation

Despite there are items which are one-off it is not going to skew the total too much. In life there are likely many one-off of different events. Ignoring them is to our own financial perils which is why buffers are needed. After some discussion we decided to focus on list for the remaining 2H'22 expenses.

First Category

The first category of items are on myself is to reduce my breakfast expenditure. Something which I can control easily without much sacrifice. Takeaway simplified and consume home-made kopi. This cut down expense some. Next is night snack. Instead of bread plus others, it will be biscuits. Both cuts are much easier to handle.

Second Category

Second category related to children expenses. After consultation with wife, we decide to cut down on transport expenses to nanny's place. This may not be possible always such as raining days else we will take long walk with strollers more often. My knee feels tearing from the long walk so is not roller coaster walk. Long run I think is good for health. There is always temptation to take car so we shall see.

Next is nappy which is quite sizeable expense. The elder one is now three and toilet trained. There will be focus to reduce nappy use other than sleep. She has reached nursery age but we plan to have her spend a few hours after school to be taken care of by nanny. Expecting some ball park saving range. Sometimes out of tiredness, we will ask our nanny to help out on Sat. or holiday. This cannot go one. For two toddlers the cost could work out some saving.

Third Category

Our meals for our dinner is the next focus point. We often have food delivery service due to work and timing to fetch our children. The potential saving can be sizeable. Will target saving per meal for both of us.

In Summary

This works out to about below table. Looks like there is still some ways to go about in improving my financial situation. Will be vigilant in any non-essential costs to put some controls in place. However I have to admit, there is limit on what I can do when we have a family with kids other than raising income. To be realistic, at current measure we are not there yet of below 6 digits expense.

Cory

2022-06019

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Telegram CoryLogics <= Link to Telegram

Articles in this Blog is personal take and sharing purposes only. Reader should seek their own professional help when making financial decision and be responsible for their decision.

Jun 16, 2021

Cory Diary : Changing Expectation

I have faint memories of my first home, a one-room HDB flat in Toa Payoh more than 45 years ago. As a child, I rarely ventured beyond our block and spent most of my time in the long, dark common corridor that was flanked by units on both sides. The building itself was a long block with a central area connecting two blocks. In those days, chewing gum was abundant and unsightly patches of gum stuck to the cement floors.

Our entire floor, which had more than 20 units, had no lift. It only stopped on specific floors, so we had to climb the stairs for the rest. Once or twice, someone urinated in the lift, and the smell was unbearable. Often, one of the corridor or stairway lights would be spoiled, and if we were lucky, it would be dark for that segment of the corridor, otherwise, the flickering lights would blur my vision. Thin railings fenced off both ends of the corridor, and from our end, we could see the open space carpark below. Owning a car was a luxury in those days.

One interesting social behavior was that neighbors would leave their doors open, and there were no gates then. A small hump on the entrance prevented water from flowing in or out of the unit when the cleaner washed the corridor. I would often visit my Malay neighbors across the walkway just to explore, and they were always welcoming to a three-year-old Chinese boy's "intrusion" visits.

It was also the first and last place where I witnessed my father and his friends praying in the direction of Mecca. I loved the carpeted area where my elder sister and I would lie down and watch TV. Our black-and-white TV was large, almost like a table, and watching it too much probably resulted in my having to wear glasses at an early age. I still remember the cartoon with the song "Gu Gua Gu Gua Xiao Qin Wa...", about the story of a frog. The entire unit size was probably the size of a living room space of a 4-room flat, so there was no separation between the bed and the living room.

There was a narrow pathway connecting the kitchen to the backyard, and the narrow side was fenced with a railing at the bottom, so I could see what was happening on the ground floor. Once, I was naughty and dropped an eaten apple stem a few floors above, hitting a young girl's arm on the ground floor. She shrugged it off and walked away.

Right at the back of the backyard, we needed to make a U-turn to get into the toilet. The door was made of flimsy metal sheet, and it made a cranking sound every time we used it. We had to squat to get our business done, and I never really understood which direction I should face, but squatting was easy then. It would be a feat for me to try today. Back then, you could slip and have your feet stuck inside the shit hole if you were not careful. There was also a rubbish chute in our backyard, but it smelled.

Doing laundry used to be a strenuous task for housewives, involving rubbing clothes on a washboard in the toilet. It seemed like my mother did this all day. However, I found the process interesting. The long bamboo pole used to hang the clothes was heavy and angled, making it a challenge to handle when it was loaded with wet clothing. It required a certain level of skill to hang them out to dry under the hot sun. I still recall the practice of our neighbor, who lived one floor above us, slamming the bamboo pole against the outside wall to notify us that she planned to hang wet clothes. My mother would then quickly collect the dried clothes.

Our home was simple, lacking a table, with only a master bed neatly tucked against the inner wall. The floor was polished cement. Across from the bed was a window where my mother placed her vintage sewing machine.

Surprisingly, our home did not have a fan or air conditioner, but I hardly ever felt hot. Perhaps we were conditioned to the climate in those days, or the room temperature was much lower. Life was simple back then because we did not have mobile phones, computers, or washing machines. However, we did have a charcoal oven in the backyard for cooking Chinese medicine for hours. It was also the place where my mother would slaughter chickens, which was quite gross, with blood dripping down.

I just remembered that we did not have a water heater, but I never felt very cold while taking a shower. In the kitchen, we had a medium-sized fridge, which was already common and invented by the 1970s. Other than that, I can only recall the washing basin next to it. We hardly ever ate outside, as my mother would cook all our meals, visiting the wet market, which was within walking distance. Supermarkets and coffee shops were unheard of, and our expenses were very low.

Living like we did back then would make it much easier to raise a family with less money, even after adjusting for inflation. However, I could never live like that today unless I had no other choice.

Cory

2021-0616 - First Pass

Articles in this Blog is personal take and educational purposes only. Reader should seek their own professional help when making financial decision and be responsible for their decision.

Dec 16, 2020

Cory Diary : Expenses Year 2020

As the year come to a close soon, is a good time to estimate my expenses for the year. Previously I blogged about my expenses in Year 2019 which is kind of "shocking".

This year the expense is quite bewildering for Year 2020 too recording more than $140k for me alone excluding my wife credit card and cash expenses. There is a large portion due to Housing instalment. Maybe near to 40% which is smaller this year due to higher total expense. Even then this is quite huge considering the average local income for the remainder of expense size.

However interestingly, my Net Worth continues to keep up despite the spending. One of the key component that manage to help support it is due to stock market dividends or net gains supplementing my income. The other will be the principal of the home loan is counted towards my Net worth. And finally year end bonus if any. So it doesn't look like I will feel completely safe without a job. And to acknowledge help given, Baby Bonus do chip in some.

Major Expenses

Year 2020 is larger due to 2nd baby. Even though we buy fewer items as she can use the leftover from our first, there are items we cannot forego. One of the key item will be month long confinement period ($12k) which I reward my wife for her labor in delivering our second child ($6k). And then we have additional nappies and more expensive ones for my elder as she grows. My wife is very particular that it has to be made in japan to avoid allergy for their sensitive skins.

The other major expenses are taxes which I help to cover for is my wife income as well. Our combined taxes are "frightening" LOL for an average couple like us.

As usual, I take it as a responsibility to provide my parent allowances. It is a big ticket item which I would not reduce as my family grows as their expenses will not change significantly due to them.

As said earlier, housing expense is the largest and that is because it consists of two components. One is the interest expense and the other the down payment of the principal. I am still deliberating should I include both but they do hit my cash flow. So read my expenses with context as we included both. To be frank I am not perfectly consistent here as we do not include insurance expenses and it does has returns. I also do Not include CPF Housing Refund which is excluded from expense else it will be another balloon.

Finally this is followed by Food/Fruits Expenses which easily take-up more than $20k. This works out about minimum $55 per day for the family.

Cheers

Cory

2020-1216

Aug 22, 2020

Cory Diary : Net Worth - Fighting Mode

Generally Year 2020 has been quite trying for people who try to increase their net worth.

I would expect many people pay reduced, on unpaid leave, retrenched, mute property and likely poor equity investment returns,

This is particularly true for me because we have added expenses for additional member in the team. In Year 2019 I have estimated at least 140K expense which includes Home Loan that is well supported by investment returns.

For Year 2020 I don't think we deviate much expense wise however I am glad that she has chip in to help support baby clothing, shoes, Nappies, Toys, books, baby powders and food supplies. Dual income is so cool in bad times.

Here's the Net Worth chart. I won't go through the details.

Looks like the expense has not damaged the lines and able to hold-off so far. Rumor has it that we may not have increment and bonus this year so if that's the case we won't see a slight spike later on. Frankly speaking 2nd half could see better market condition.

There are a few new expenses this year.

The hot weather did add one addiction which is ice dessert. And I am getting a kick out of it recently. Hopefully this aren't permanent .... ... ... before the sweetness get my health.

Have been using hotspot for a long time. With WFH in great play this year, Home Internet connection will be better serve but nevertheless an added expense.

Cory

2020-0822

Dec 20, 2019

Cory Diary : Income and Expense 2019

Year 2019 is special because Cory becomes a father to a baby girl. Unlike most parents, financially Cory is much more ready. The thing lacking is experience which Wife will always take care or be ready to remind Uncle Cory ..... . Nevertheless, raising baby is really not easy. The good thing is we have Baby Bonus supports and this do help some. Fortunately, company is also supportive and provide as much work from home time and leaves as needed.

Expenses wise, as previously blogged ( link ), kind of exploded and will not come down significantly for years. Good problem to have. How to fix it is to ensure that we have higher saving prior, predictable income, investments or saving to mitigate which the last option is not a viable plan for wife 😂.

For 2019 Income, Cory has a good bonus. This helps to pay for Income Tax and Parents Allowances. A nice surprise is that some of the Company Stock has also come into vesting period and this help to add into the year end 2nd Bonus. Hmm, why has this becomes a so look forward thing ...

For 2019 Expenses, the value expects to cross $140, 000. This is inclusive of home loan which is a major ticket item. However, Net worth and Income Returns looks able to match the increase in spending ( above chart ).

As Cory has stake in lower levels investment returns such as SSB and FDs, all additional savings could go into higher equity returns in Year 2020 to build higher dividend income plan. Investment returns wise, returns has been quite significant which will be blogged later once year ended. Touch-wood it will not change negatively by then.

Before signing off. Two wishes from Birthday Boy.

1. To do : Things that we could change. ie. Continue working.

2. Not to do : Focus on things that we could not change. Negative thoughts.

Cory

2019-1220

Mar 23, 2019

Cory Diary : Baby Expenses - Overview

I have been pondering to write this post because expenses on my baby is not as closely tracked. One thing is I am often oversea and there is some currency exchange, and receipts lost. Some of the the expenses are covered by my wife and relatives. Do note that my baby is born oversea. I will be in the process to make baby bonus claim later but for tax deduction probably I don't benefit much from it locally. Nevertheless, is about out not in.

One thing to note is that over time I will come back and update this post with newer information as it occurs.

Before Deliver Expense - this excludes travelling and leave costs. Mainly pre-checks, scanning, medical packages in delivery clinic.

Baby Preparation Items - such as bottles, clothing, nappy etc. There are some wastage here and there but I won't elaborate for now.

After Deliver Expense - items such as delivery cost, suite and confinement stays. Do note i maybe able to claim some delivery expenses so I would like to come back and update later after.

Baby Aftercare - I do not want 24 hr care as I like to see her grow up. So we decide just day care will do. Has been great help even though need to negotiate and talk with nanny of her usual.

Interim Cost : S$22,437

Cheers

Cory

2019-0323 First Initial Update

One thing to note is that over time I will come back and update this post with newer information as it occurs.

Before Deliver Expense - this excludes travelling and leave costs. Mainly pre-checks, scanning, medical packages in delivery clinic.

Baby Preparation Items - such as bottles, clothing, nappy etc. There are some wastage here and there but I won't elaborate for now.

After Deliver Expense - items such as delivery cost, suite and confinement stays. Do note i maybe able to claim some delivery expenses so I would like to come back and update later after.

Baby Aftercare - I do not want 24 hr care as I like to see her grow up. So we decide just day care will do. Has been great help even though need to negotiate and talk with nanny of her usual.

Cheers

Cory

2019-0323 First Initial Update

Subscribe to:

Comments (Atom)