CoryLogics Invest Chat - No Coin, No Porn, No Penny

Jan 26, 2025

Cory Diary : Post-Retirement ROI (On) or ROI (Of)

Dec 16, 2024

Cory Diary : Retirement Funds - Retire Series

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Sep 28, 2024

Cory Diary : Retirement Reflections: A New Chapter

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Sep 14, 2024

Cory Diary : De-Cluttering our lifes

So I've been doing a thorough decluttering across multiple aspects of my life, from blog articles to personal belongings and hobbies. Streamlining everything can be quite refreshing!

Here's a summary of what I've achieved:

Blog Articles: Cleaned up my blog by deleting outdated dividend tracking posts, making room for more relevant updates.

Aquarium: After years as a corydoras enthusiast, I decided to put aquarium hobby on hold to focus more on family and other responsibilities.

Office Cube: Cleared out a significant amount of accumulated items, like outdated technology and office supplies, creating a more organized and minimalist workspace.

Large Baby Stroller: Letting go of a bulky stroller that’s no longer needed with our children growing up.

Pictures: A big effort to organize decades of photos across various storage devices, though I am leaving the rest for a future project.

I am clearly making space in both physical and digital life, leaving more room for what matters to me, especially investing. Keep up the momentum!

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Aug 5, 2024

Cory Diary : Retirement Equity Portfolio Size

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Apr 10, 2023

Cory Diary : You only young once

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Jul 22, 2022

Cory Diary : F.I.R.E - Financial Independence Retire Early

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Jul 5, 2022

Cory Diary : Building Up Passive Returns - Income Streams

One of the weakness in the portfolio is the persistent under representation of Finance stocks. Therefore, has been buying into DBS stock which provide good dividends. Size wise still not there yet due to concern with digital banking competition. Nevertheless, need to have enough investment into this area.

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Jun 26, 2022

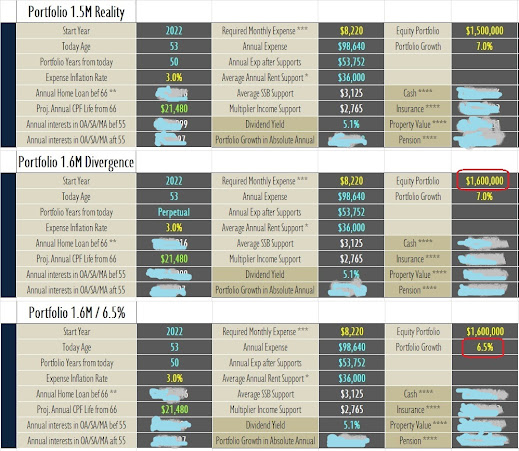

Cory Diary : Realization of Key Financial Variables and Sensitivity to Retirement Wellness

|

| Click to see sharper picture |

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Sep 17, 2021

Cory Diary : What I have been doing lately ( ... calculating my way to FI )

For one to retire young with kids, the first chart maybe more applicable. A situation where we still tap fully to life engagements. Expenses will be high and where we have dependents especially for sandwiched class. Even if we have no plan to fully retire, we know where we are financially.

Jun 30, 2021

Cory Diary : Perpetual Portfolio - Legacy

Apr 3, 2021

Cory Diary : Retirement Income Sources

Jul 11, 2020

Cory Diary : Retirement Calculator and a Miracle find !

|

| Table 1 : Retirement Math |

|

| Table 2 : Retirement Math |

|

| Table 3 - Retirement Math |

Jul 4, 2020

Cory Diary : Medical Bills

I take the time to ponder this morning questions. I am sure there are many scenarios.

1. If we have 2M dollar, do we spend all in order to prolong our lives say for another 6 months ?

2. What-if we survive and need life long care and a burden to family after ?

3. What-if we are young and recover completely ?

4. What-if bed ridden for rest of my life ?

This are real hard questions. No good answer but something to think about.

One key insurance I am happy to pay is hospitalization bills. The cost is not high and reasonable. CPF wise I can max whatever inside complement with Medi-save.

Anything beyond that, maybe I would define certain percentage of my net worth for it. That could an answer. I dunno. Simply Medical condition can be Wills of God. Meantime we try to stay healthy by living healthy. But we are limited by genes and external factors.

Health is important to enjoy the fruits which people tends to neglect. I got a scare a year ago and realize life can be short. Too short. ( "Wife, I want to retire ... really ... 😗 )

Cory

2020-0704

Apr 5, 2020

Cory Diary : Preparation of a life time

With this move, I will also be taking some new learning of another group of colleagues who recently lose their manager through attrition. This is in-addition with multi-tasking to help the new manager. I need to spend time to convince her that there is nothing to worry because I will support her as long I could. And it is better for everyone that she has time to take on the role while I am still around collecting money happily. Why I say that is because if the business get whacked or there is business rationalization, I could be on the chopping board, and the team could be impacted.

However, to myself every time I think about such possibilities there is a little unease as well. The sense of suddenly losing monthly income and bonuses. The beautiful constantly increasing Net Worth. The insecurity. This reminds me of why people chasing to buy toilet paper. We cannot change others easily but we can change ourselves. So when the time come, if I am to fall into desperation, I have no one to blame but myself but I aren't going to compete with others to buy toilet paper !

Daughters teach me that life is more than money. I probably bought 10 boxes of Pampers for the elder alone in case the market starts chasing for supply. This are non-perishable items and my thinking is that this is something which I could control and not spoiling the market if I get them before there is any crunch. There aren't so far and unlikely will. But as a father cannot do without Pampers and Milk Powders, I do not want to take the risk fighting over it with others. Neither do I want to be behind the horde just to get a pamper home. So this is the only two items I technically "hoarded" for my kids. Frankly, they use up pretty quick to my surprise. And maybe this also help to send signals early down the supply chain on the needs for greater supply buffers. Talking about vested interests.... that's how we push for more supplies.

So how is my dividend investment plan going ? Last year achieved almost $53k annual dividends. This higher figure is unplanned. Some amount due to the mergers and cash-out from rights issue. For current portfolio, to-date theoretical max $56k. The DPU compute is before Covid-19 so there will be cut however the believe is when this is over the DPU may returns in time. About 70% warchest left to play with which potentially due to this crisis to allow higher target than original allowed by another 30% to 45% more with current market condition. This will still leaves me with ample cash for loan payment for 6 to 7 years parked in SSB and FD mainly. I could reduce this amount but prefer not as it can also be used to pay down loan if needed. We never knows how the markets will move as time goes.

One thing for sure, every month I worked, the better my buffer. If I could hit year end bonus, that will be awesome. I know is annual event. I always appreciate that. Never takes good things for granted.

Cory

2020-0405

Oct 3, 2019

Cory Diary : Expenses 2019

There are many other one-off items such as Renovation, Alter, Cremation Niches, Medical Surgery, Hospitalization, Medical checks, Confinement ... this are debatable. Nevertheless they can be big ticket items or summation in total. Ignore them at your perils.

And we have the regular ones like Taxes, Nanny, Parent Allowances, Installments, Holidays, Baby Misc ...

If one plans to retire, make sure we plan them into our annual expense plan with good buffers. Don't simply jump into FIRE through hard core saving. You will be surprise like I do this year on how bad it can goes on how expenses blow up. After totaling up major items that i could find, the expenses YTD is S$117 K... ( ouch ).

The fortunate thing is that my Liquid asset and Net worth are still trending up. The first is due to Stock Market and Regular Job, and the later with added Property Valuation Growth (Cashless by the way).

Anyone like to retire now ?

Cheers

Cory

2019-1003

Jan 11, 2019

Cory Diary : My retirement just got pushed back

39 weeks and more to come but is all worth it, and I have done my part for my country. ;)

Welcome to the family ! My best investment returns. Priceless !

Cory

2019-0111

Aug 19, 2018

Cory Diary : Managing Risk and Goal update 2018-0819

|

| Cory Analysis |

To draw this further, I could ask for 1% growth in underlying portfolio.This will retard investment capital reduction. Now, for $1.35M investment size, returns can be lowered to 5.2%. The next question will be what investments will allow me to support the draw down and to secure $5K monthly expense ? One thing for sure, I do not need to take too high risk to achieve financial freedom but how to protect my investment to obtain desires.

Jul 14, 2018

Cory Diary : Financial Literacy

There were quite a few who are dead against institutions aka government in the chat group. So whatever PAP do, there is motives. Mistrusts ran high. One of them use to be my close buddy. Lost touch with him as we go on separate way after our "O" levels. In those days there aren't smartphone. Let me describe his life now from my perception that I have formed. We were one of the pioneer batch of normal stream education. As I could remember, his family appears to be below average as they have problem paying utility bills some time. We often go for mini-hike in the afternoon after school. And would comb the forest hill on our way home. It is as close to nature as we could get in developing Singapore. There were a lot of adventures. He went on to technical institutes whereas I am fortunate enough to excel in my study and manage to get a place in a Junior College.

My impression is that he do not have good jobs for past decades and he has in-depth frustration with the government. And in recent time probably for 5 years found a stable job that he is good at. A manager and has some work across the causeway. His salary about S$4k appears to be below average considerating his level of technical soundness and knowledge. There were some considerable stress and sometimes appear to need to work till late into the night. Married and has a son who just finished his primary with average score. He owned a car and stays in HDB.

Here's his financial status I think. In his late 40s, he do not have much saving. And probably about 5k to 10k in stocks the most at any one time. Mindset for him is that this are "vice trade". He would also like to take out as much money out from CPF as soon as regulation allowed as he do not trust them at all. And the money will be use for his son education. Singapore Saving Bond is just another outlet for the government to tune up their national Ponzi scheme. Inflation grumbling is always from water hikes to hawker meals. Every time where is a bad news by Temesek or GLC investments, they will point out that the funds are losing nation money which could have reserved to help the poor and needy. There is a believe tax is too high locally.

With such mindset, there is no way I could advise him to even go for safe investment like SSB which technically safer than saving account or fixed deposits. How nice if he could sell his SSB allocation which I would gladly take up to increase my limit. At least there is some use for him. I think we finally agree to disagree. At late 40s, trying to change each other mindset is next to impossible. He is still a good friend that I cherish over political divide. I view myself nationalistic and wish to keep the game going with the right formula to succeed. I wish him well.

Cory

20180714