CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Dec 31, 2023

Cory Diary : Year 2023 Equity Performance

Dec 21, 2023

Cory Diary : Year 2023 Dividends

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Dec 12, 2023

Cory Diary : Investment Plan for 2024, Navigating Through High Inflation

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Nov 13, 2023

Cory Diary : Putting in a case for Reit today

Currently Rate is Peaking in this high rate environment. While rental contract such as Mall Reit could takes 3 years to cover all tenants. This will mean Reit investors will have to absorb the cost of funding differences even with Reit with strong moat. The good news are most Reits are still profitable. We are in interesting time because the irony is those reits with very short term contract will be able to raise their rental cost quickly and are much more nimble to react to rate hike.

The benefits will be we could see significant rise in reits earning as contract takes time to unwind too and economy could be boosted in lower yield environment again. This is the upper optimism of hope. The fear could be diving deeper into lower dpu such as the high rate causes recession to the broader economy hence nothing is riskless due to the other spectrum of negativity.

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Nov 3, 2023

Cory Diary : Netlink BNB Trust H1 FY24 Review

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Oct 25, 2023

Cory Diary : Mapletree Log Trust 2Q FY23 Report

Have sold 1/3 of my position just recently before the major sell down and today report. Looks like I will be holding the remainder for quite a while. Quite happy with the Reit performance so will Hold and monitor due to many transaction of their properties.

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Oct 11, 2023

Cory Diary : Q3 Dividend Updates

YTD 58K dividend from Equity. On Total Returns after recent day sell down due to another rate hike fear, XIRR is around 8% plus. Still expecting to finish strong this year despite war erupting between Isreal and Hamas. It may have impact if the escalation hits Iran.

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Oct 6, 2023

Cory Diary : Review of Current Reits Position in the Portfolio

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Sep 26, 2023

Cory Diary : Expensive Ventures

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Sep 2, 2023

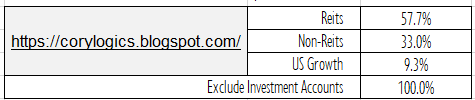

Cory Diary : Portfolio of Mainly Reits and Banks YTD Performance '23

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Aug 28, 2023

Cory Diary : Net Worth Tracking 2023-08

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Aug 11, 2023

Cory Diary : Compounding with Dividend Investing

SECRET Revealed! Sisters Turn $16,000 to $65,000 in Stocks! Millionaire Family's Money Talk Exposed!

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Jul 31, 2023

Cory Diary : Mapletree Log Trust Review

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Jul 24, 2023

Cory Diary : Reflections on the US Market and Singapore Investments

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Jul 17, 2023

Cory Diary : Managing Volatility Emotion

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Jul 1, 2023

Cory Diary : 1st Half 2023 Dividend

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Jun 14, 2023

Cory Diary : Quick Snap on YTD Equity Returns 2023

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Jun 7, 2023

Cory Diary : Portfolio Updates

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

May 19, 2023

Cory Diary : Navigating Crisis - Net Worth

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )