CoryLogics Invest Chat - No Coin, No Porn, No Penny

May 4, 2025

Cory Diary : FCT Review - 1H25

Feb 11, 2025

Cory Diary : DBS Investment thoughts

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Dec 5, 2024

Cory Diary : Straits Times Index (STI)

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Dec 4, 2024

Cory Diary : Recent Trades

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Nov 2, 2024

Cory Diary : Review Sheng Siong Business Update

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Oct 31, 2024

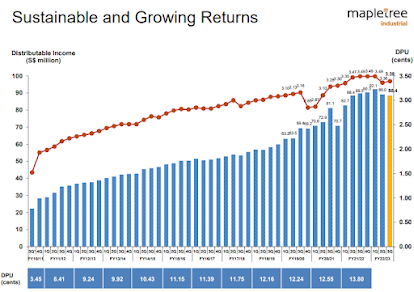

Cory Diary : Review Mapletree Industrial Reit

|

| Picture 1 :DPU Checks |

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Sep 7, 2024

Cory Diary : Rising Tide Lifts All Boats

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Jul 26, 2024

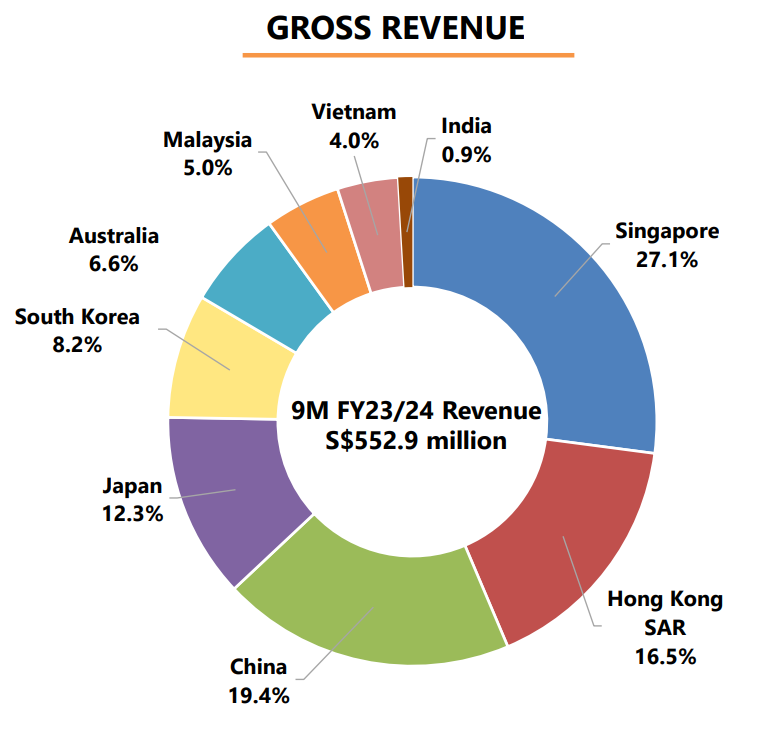

Cory Diary : Ascott Trust Investment Review

Ascott Trust just released their result. The DPU reduced about 8% YoY but is only 1% if we exclude forex. The table to explain as follow. Base case 5.4% yield. Include other gains 5.7% yield at price 0.895. Price did not drop much after result which likely priced in somewhat currently.

CoryLogics Invest Chat - No Coin, No Porn, No Penny

May 3, 2024

Cory Diary : MLT Result Review

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

May 1, 2024

Cory Diary : Sheng Siong Result Review

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Nov 3, 2023

Cory Diary : Netlink BNB Trust H1 FY24 Review

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Oct 25, 2023

Cory Diary : Mapletree Log Trust 2Q FY23 Report

Have sold 1/3 of my position just recently before the major sell down and today report. Looks like I will be holding the remainder for quite a while. Quite happy with the Reit performance so will Hold and monitor due to many transaction of their properties.

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Jul 31, 2023

Cory Diary : Mapletree Log Trust Review

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

May 13, 2023

Cory Diary : iReit Review

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Feb 25, 2023

Cory Diary : iReit Review of Annual Report

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Jan 28, 2023

Cory Diary : Mapletree Industrial Reit Info

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Aug 3, 2022

Cory Diary : Ascendas 1H22 Report

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Oct 20, 2021

Cory Diary : Ascendas 3Q'2021 Details

Completed development of Grab HQ : S$184.6M