Investing in property in Singapore has been a popular choice for retirement planning due to the rental income and capital appreciation it can provide over the long term. However, it's important to recognize that past trends and government policies do not necessarily guarantee future performance.

An analogy that can be used is that of a kettle whistle. When the pressure in the kettle gets too high, the whistle sounds, and the heat is lowered to prevent the water from boiling over. However, over time, more energy is added to the kettle, and it will boil again. This is similar to how government cooling measures can temporarily slow down the real estate market, but economic conditions, population growth, and consumer preferences can impact the market over the long term.

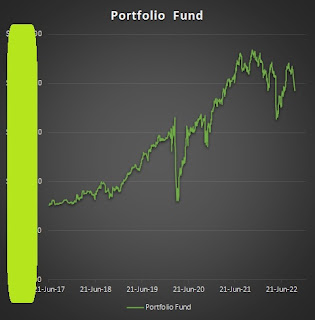

Personal experiences with property investment can vary. For instance, I have an investment property that I purchased more than a decade ago when the government introduced curbs. In addition to the possible rental income, the capital appreciation of my property has probably resulted in strong 6 digits in capital gain excluding costs.

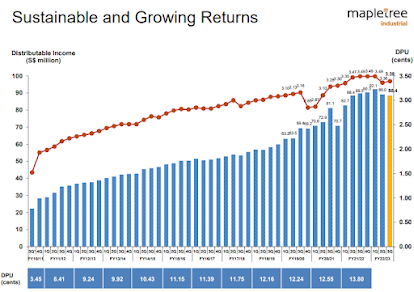

However, it's worth noting that the current state of the market may not be ideal for investment. The Singapore Property Index, which tracks the performance of the residential, commercial, and industrial sectors of the real estate market, has risen significantly in recent years. While past performance does not guarantee future success, the high market prices suggest that property investment in Singapore may be more challenging than in previous years.

While property investment can provide benefits, it's important to consider the risks involved. There are costs involved in maintaining and managing a property, and rental income and capital appreciation are not guaranteed. Additionally, factors such as location, property type, and market trends can impact the performance of an investment.

In conclusion, property investment can be a viable option for retirement planning in Singapore, but it's important to approach it with a clear understanding of the risks and considerations involved. The kettle whistle analogy highlights the temporary nature of government cooling measures, but it's important to research the market, consider the risks, and make informed decisions based on your individual circumstances and experiences. While past performance and personal experiences can provide valuable insight, it's also important to consider the current state of the market and whether it may be too high to invest in.

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )