Equity

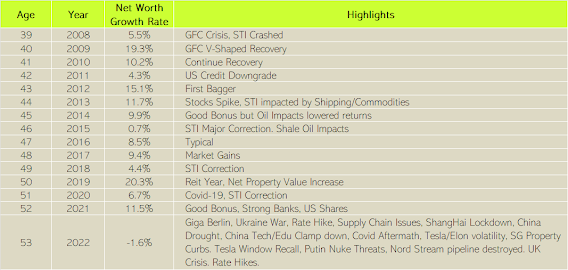

As I remember during GFC, Portfolio were down more than 50%. However, for the year 2022 Cory XIRR is down -12.8%. This is the 2nd worst after Year 2008 GFC. In absolute, today portfolio size is far greater than the one during 2008. It has been 15 years.

More than 50% drawdown is mainly due to Singapore stocks which are mainly in Reits. This are generally neutral mentally as from investment and cash flow perspective, we are getting more shares cheaper as their fundamental is good despite rising rate environment. This form bulk of cash flow dividend play strategy. To mitigate rights issue at this bad time, any new cash injection will be on Reits that is less likely not to give heavy discount if it does any. Theoretically it does not make sense as spiking rate environment is not conducive to shareholder returns to do rights issue as the loan will be expensive.

The other losses are mainly due to Tesla and some aspect Msft in the US Market. This are growth stocks which I embarked for long term. So far I am still quite bullish on them despite dramatic price falls of Tesla.

As in any investment, profit and losses are part and parcel of the investing game. Is how we size them such that we can sleep well. As we can see from this experience, even with less than 10% exposure in US market, we can see them taking sizeable loss onto the portfolio. A humbling experience even though the amount invested in this segment is sized with Year 2021 profits.

Net Worth

This year bonus is smaller than last. When totaled up, -1.6% reduction in asset. This is the first time we see reduction due in large part to Equity, and Personal Expenses which I plan to blog later.

There is another plus that mitigate the fall which is property value has gone up slightly in Year 2022.

Assets Allocation

Another view of the asset. There is some focus on fixed returns due to strong interest rates. They act as reserve for emergency and opportunity. Decided not to do CPF top up for now to allow more flexibility and higher rate income.

Cory

2023-01-16

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Telegram CoryLogics <= Link to Telegram Channel

Articles in this Blog is personal take and sharing purposes only. Reader should seek their own professional help when making financial decision and be responsible for their decision.

No comments:

Post a Comment