DPU and DRP

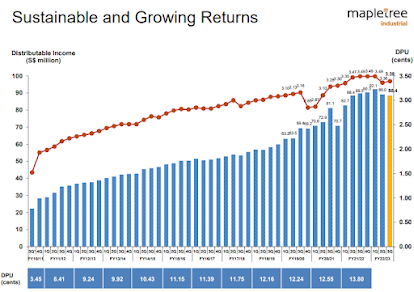

Mapletree Industrial Trust Announces Distribution per Unit of 3.39 Cents for 3QFY22/23. Annualized yield of 5.5% from this week price.

There will be DRP however with 1% discount I do no plan to consider at all. However with rising market, this maybe attractive for some.

Result

Comparison with 2Q, there appears to be some cost cutting measures as expenses are reduced with reducing revenue however dpu is up slightly due to capital gain and release of some cash withheld earlier.

Completion

Completion of the first block of the new high-tech industrial redevelopment project at Kallang Way in November 2022

Summary

Can see the management working to continue alignment with shareholders. Despite rising rate, the rising cost is contained. The coming Fed report expects to see another round of rate increase though smaller. This Reit is 3rd largest allocation in my portfolio. Not going to see much surprises and upside is limited in result performance perspective.

Decided to only reduce my allocation from the recent increase back to previous size to reserve more cash for other opportunity as the Reit stock price rebounded this week. May reduce further just a little more if the Reit continues to run up. Continue to be on the high side of the portfolio allocation forming a stable base for some core dividend. The main down side is possible macro environment.

Cory

2023-0128

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Telegram CoryLogics <= Link to Telegram

Articles in this Blog is personal take and sharing purposes only. Reader should seek their own professional help when making financial decision and be responsible for their decision.

No comments:

Post a Comment