CoryLogics Invest Chat - No Coin, No Porn, No Penny

Jun 5, 2022

Cory Diary : Interest Rate v Reit Prices

Jun 3, 2022

Cory Diary : 20-year annualized returns by Asset class

2022-0603

CoryLogics Invest Chat - No Coin, No Porn, No Penny

May 28, 2022

Cory Diary : Pricing Power

2022-0528

CoryLogics Invest Chat - No Coin, No Porn, No Penny

May 25, 2022

Cory Diary : Funding to buy during this market downturn

The Stock Market has been under correction mode for some period. For STI Index, it has came down to early Jan level. The NADAQ (-27% YTD - updated) seen more severe down level to last year 2021 Feb period similar to Dow Jones. Unfortunately, investment cash account has been depleting as stock gets cheaper.

Cory

2022-0525

CoryLogics Invest Chat - No Coin, No Porn, No Penny

May 13, 2022

Cory Diary : Market Fear

Market Opportunity Timing

Nasdaq has crashed about 25% from ATH. STI has corrected about 8.5% roughly from recent high. Many growth stocks already hit Pre-Covid level bursting the bubbles created from WFH atmosphere. No doubt Market is in Fear. As usual when market is in blood bath there is opportunity to be made. The problem is will it go lower. If we are to measure against Mar 2020 crash, we still have 1000 point to go for STI Index ! Something to think about with current high inflation. No model answer here.

Funding

The recent crash comes at a time after my fear of volatility with growth stocks, my path into multiplier and SSB hitting 2.5% for new issue. In a way, incidentally build up a reserve to tap.

Coincidentally with high SSB rate, refunded back some issues for higher rate plan and a Bond matured this month. However, I still prefer to retain most of SSB for housing loan emergency at higher rates. And I plan to reserve some fund for CPF top from the bond matured.

At max in Net, the reserve can still provide a sizeable amount if we are to deploy them into warchest other than those investment cash account which already quite depleted from recent DCAs during the sell down.

Deployment

Firstly, where should we deploy.

We can go for Strong Reit which are coming near to 6% yield as Option 1.

How about be a little greedy and go for High Yield Reit hitting 7% if we take into buffer consideration of exchange rate risk. Possibility mix with some other stocks. This will be Option 2.

Option 3 into S&P500 which corrected roughly 18%. Required exchanging for USD at expensive rate that tend to fall in good times as my assumption.

Option 4 into Growth stocks with strong balance sheet and again required USD and larger volatility/Risk which blogged in earlier article.

Secondly, how much each time to deploy, the pace and amount. So far I can hardly smell any course change with current high inflation medicine. Maybe will try bits investment each time during this market sell down each day spread across a period. Once Fed makes a deliberate control to slow down the rate hike, or some major market change, we can adjust after for the next batch. So maybe 30% before and 30% after. And remaining 40% for buffer. This plan likely varies as time progress.

What a time to have Covid Buffet at Home !

Cory

2022-0513

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Apr 30, 2022

Cory Diary : Market Drawdown Logic

Apr 22, 2022

Cory Diary : Trading log 2022-0422

Apr 10, 2022

Cory Diary : DBS Multiplier Experience Sharing

Following 4/5 criteria is met. So we hit 2% for the $50k and 3% for the next $50k as long eligible transactions meet $30k. This can come from salary, dividends, share transactions, credit card etc. Obviously I will not increase my credit card spending to meet the condition.

Apr 2, 2022

Cory Diary : Alignment of Net Worth Tracker

Apr 1, 2022

Cory Diary : Performance Q1'2022

Mar 31, 2022

Cory Diary : Tracking a counter trading information

Mar 24, 2022

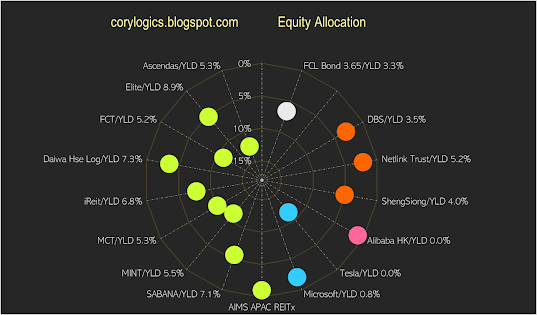

Cory Diary : Equity Allocation 2022-0324

Mar 18, 2022

Cory Diary : Asset Allocation Update 2022-0318

Mar 13, 2022

Cory Diary : How long will Ukraine War last ?

Mar 2, 2022

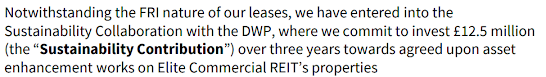

Cory Diary : Russian invasion of Ukraine - Elite Comm Reit

The only risk left which I am personally concern is exchange rate risk on DPU nevertheless is a good deal overall.

Feb 18, 2022

Cory Diary : Making Sense the Risks and Multiples

Feb 14, 2022

Cory Diary : Equity Allocation Feb'22

Note : Chart is for reference and yield computation is updated per my best knowledge and personal computation method.