In the background fighting for attention is Putin who has been devising a possible invasion into Ukraine. Interestingly Russian soldiers have been there since "Day 1" when the eastern provinces rebelled many years ago. Battle ground info has consistently shown Russian Soldiers in disguise as rebels. The Black Swan will be occupying the entire country. Steep sanction faces Russian people for many years to come if Putin decided to do this. Seems unlikely they can take out Ukraine with 100k troops.

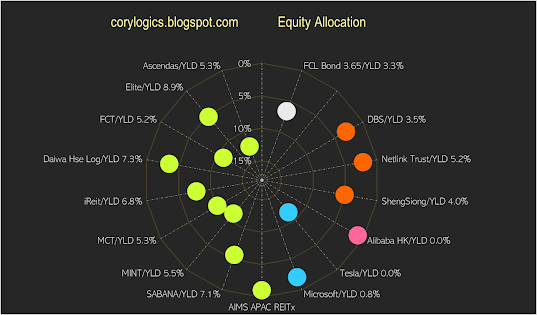

Note : Chart is for reference and yield computation is updated per my best knowledge and personal computation method.

PORTFOLIO

At this time, Potential dividend for Year 2022 will hit $65k. Investment fund reduced to around 7%. Has been doing small purchases as the market goes down. Concurrently, started a new stream of income from Multipliers. Expects to hit 2% for whole year based on current rules. Working to get to Max 3%. The good thing about this new account is that it can double up as emergency fund while providing higher returns than fixed deposits and same time reducing need for ready cash as it can be move around the accounts if really needed.

DBS

Will DBS continue their rise when digital banking started ? My guess is dependent on CEO. And therefore bet is still on DBS despite my reducing position. DBS ability to maintain margin unsure considering we have many fintech starts-up which will compete with traditional banking. Holding my remaining shares tightly for now in recognition of the coming disruptions.

TESLA

Some weakness has been going on with Tech stocks including Tesla. I guess investors still waiting for Giga Berlin to happen which is hampered by Germany Bureaucracy. Is smart for Tesla to expand Giga Shanghai and getting Giga Texas to roll up to support the needed capacity for Year 2022. However the growth is so large that Tesla will likely need newer sites to support increasing demands beyond.

On risk exposure front, 11.6% of Equity Portfolio and much smaller on Net worth around 5%. This is a calculated bet that it will support future asset growth for next couple of years considering the multiple S-Curve potentials.

MICROSOFT

Make it to return to the portfolio from recent weakness. The stock has strong moat and consistently profitable returns under the current CEO. The acquisition of Blizzard Activation in my personal opinion is a good synergy and cut short the lead time needed into "Metaverse". Gaming environment already has such features for many years which has it's own trading currency, mailing systems and groups chat communications in-addition to voice chat capability. The world within such games are enormous and beautiful with enchanting Music. The last leg will be enabling linkages to real world, bandwidth and 3D Visualization capability.

DAIWA HOUSE LOGISITIC

The latest report increase in valuation of their properties. Their gearing reduced significantly allying my fear on the reit gearing. Currently allocation is 7.3% of Equity Portfolio.

Cory

2022-0214

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Telegram CoryLogics <= Link to Telegram Chat

Channel Telegram Link <= Link to Telegram Channel

Articles in this Blog is personal take and sharing purposes only. Reader should seek their own professional help when making financial decision and be responsible for their decision.

No comments:

Post a Comment