As an investor, I recently made some changes to my portfolio that I'd like to discuss. Firstly, I decided to sell all my shares in Mapletree PanAsia Com Tr. Although I had a net positive return after 5 years of investing, I wasn't happy with the company's recent merger and management's actions. Additionally, the mall asset in Hong Kong is performing poorly, which doesn't bode well for the company. Given the current macroeconomic situation in Hong Kong, I felt it was time to move on and raise some cash.

On the other hand, I've decided to build a new position in Mapletree Log Tr. Although the macroeconomic headwinds make me unsure about investing in logistics, this company has a strong track record and is likely to do better than its peers. The investible REITs market in Singapore is also quite limited, especially with the recent high-interest-rate environment. As a result, I'm prioritizing debt management for any new investments I make.

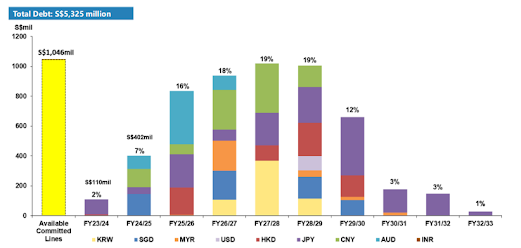

Mapletree Log Tr's total debt as of March 31, 2023, is S$4,877 million, which is slightly lower than the previous year. Although the weighted average annualized interest rate has increased slightly from 2.2% to 2.7% over the past year, the company's interest cover ratio of 4.0 times is still relatively healthy, indicating it has sufficient operating income to cover its interest expense. However, the adjusted interest cover ratio has decreased from 4.2 times in the previous year to 3.5 times in 2023. Overall, the company's debt level and leverage ratio seem manageable.

The company has taken steps to manage interest rate risk, with 84% of its total debt hedged or drawn in fixed rates. Every potential 25 bps increase in base rates1 may result in ~S$0.49m decrease in distributable income or -0.01 cents in DPU per quarter. Additionally, about 77% of the amount distributable in the next 12 months is hedged into or derived in SGD, mitigating forex risk.

Moving on to my stock holdings, I've added to my stake in Microsoft incrementally. While I used to think that we couldn't do without Google search, I've recently been impressed with ChatGPT and have reduced my usage of Google search. The recent acquisition of Blizzard further boosted the stock price, although it remains to be seen if this will help Microsoft. Nonetheless, I've learned that it pays to wait when investing in growth stocks, given their volatility.

I've also secured a position in OCBC to balance my portfolio's REITs exposure, as my portfolio currently has DBS as its top position. While UOB is also an option, I found OCBC's yield more attractive. All three banks are currently in a strong position, but we have to be mindful that their P/B ratios aren't cheap. Thus, I don't plan to add a significant stake immediately to rival the top 5 positions of my portfolio. As I focus annually on building up my dividend size, I'll be diligent in my investment choices. Currently, OCBC's management is flexible on future dividends, which means that the recent dividend may be volatile depending on the business.

Next, Sabana Reit has been performing well under the current management, delivering good returns. However, given its small size, it may be prone to volatility. The latest report shows that the Reit's returns may be negatively affected by a spike in interest rates. Therefore, a significant portion of the portfolio position was sold. If the high rates persist and the impact is not fully reflected, the next report could be negative too. As a result, the decision was made to take profits when good opportunities arose.

|

| Capitaland Ascott Trust |

Finally, I've initiated a position in Capitaland Ascott Trust, which appears to be a well-managed REIT with a diversified portfolio of properties across multiple geographies and solid capital management position. As with my other investments, I'm prioritizing debt management in this position as well.

I've also made some adjustments to my stock holdings by trimming the top positions of Ascendas and FCT to achieve adequate diversification at the current portfolio size.

Please note that this is not financial advice, and I encourage you to do your own research before making any investment decisions.