Interestingly, the invasion also resulted in 10 Yr bond yield crushing back to Jan level as people rush for safe assets. Reits started to rebound despite Inflation reeling hard. USD creeping up too. The bank prices that have been spiking past months have already entered discount modes. This allow me to kickstart collection but seems I am a little too eager as my position has increased to more than 5% of the Equity Portfolio. I need to hold my gun tighter when the probability or rate increase likely to be strong ?

So how is Europe Properties impacted or mitigated ?

Elite Commercial Trust

Regearing announced. There is some rent reduction in 11 of the 100 properties. A huge relieve to shareholders as they are now extended to year 2028.

"Together with the 31.6% of the total portfolio by GRI currently with straight leases through to 2028 with no lease break options, this means that 78.6% of the leases by total portfolio by GRI(1) will run straight to 2028 without any lease break options"

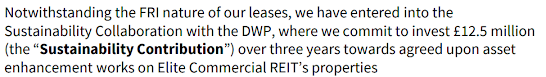

However there is also some investment required as follow. This could improve the valuation of the properties such that dividend will not take significant hit over the 3 years period if they go via additional loan.

The only risk left which I am personally concern is exchange rate risk on DPU nevertheless is a good deal overall.

Cheers,

Cory

2022-0302

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Telegram CoryLogics <= Link to Telegram Chat

Channel Telegram Link <= Link to Telegram Channel

Articles in this Blog is personal take and sharing purposes only. Reader should seek their own professional help when making financial decision and be responsible for their decision.

No comments:

Post a Comment