The trend continues on polynomial curve upwards on an average rate of 9.8% for the past 14 years compounded. This is despite a large portion of the asset resides in lower returns instruments which implies the needs for annual salary income plus equity returns to supplement. The hope is for property value to match along which just got dashed in the wake of new property curbs. However, is a matter of time inflation has to be reflected into them.

For Year 2021 continued growth, this is happening due to mainly Job Bonus income and better Equity Investment returns. Company also benefited from the Covid situation and we have a better adjustment too. The liquidity curve is slowing down which reflects increasing expense ( daily and housing loan repayment ), allocation of cash into CPF and voluntary housing fund into CPF done last year. The gap will be widen further when we top-up CPF this month.

The Security/MMF ( Orange line ) is on the uptrend due to increasing efficiency of investment. Therefore the space gap makes with Liquidity ( Red line ) is the idle cash and fixed deposits. This are getting smaller till 55 as CPF is top up till Age 55. The known retardation is the coming FCL bond maturing which will release cash and provides some widening.

Last year property value is flat however the blue line is on consistent rise due to the monthly loan repayment. Insurance surrender value has went up a little. Representation between the blue and red lines. Likely the blue path trend will remain so for years to come.

To maintain the current Net Worth trajectory, Job and Equity investment will continue to be depended. As equity returns can continue way beyond retirement, the hope is that we divert sufficient fund over time to reduce salary income dependency. Interestingly, the company do a good job to ensure this do not happen easily by continuing to increase the compensations such that it looks like they will be always the main driver from income unless we have significant contribution from equity investment returns.

Asset Allocation

Introduce CDA for Child Development Account. A segment which did more than enough required top-up last year to match the baby bonus. The scheme is good but CDA can be better if is well supported throughout the growing up period till they are in workforce or army. This will further help relieve the cost of parents and allow the child to have additional safety net on education and living expenses.

Saving Cash at 6.5% seems still quite large especially when there are additional 3.3% FD. Probably 5% will be sufficient for cash level. Inflation will be high but the market likely weak so maybe wise to achieve a balance between them. If there are alternative to overcome both this could be interesting. For now looks like nothing much else to act further.

Plan for 2022

The current macro condition on tapering execution is a done deal. The talk now is on interest rate hikes after. Even with those rolling in, the rate is still low and do not see sufficient interest rate returns in saving banks. Housing loan rate will remain affordable for years to come. And in time, Reits will be back thriving in inflationary world till the the rate overshot which will take a long time to happen unless the Fed trigger happy.

For now, Fed actions could put an end to mindless investment injection into unprofitable growth stocks that do not have good degree of success. The recent years on SPAC deals are symptoms of this happening. A lot of shareholders value is destroyed and this will be reflected when results are materialized. The impact could overflow to other segment of the economy however degree of impact is expect to be much smaller.

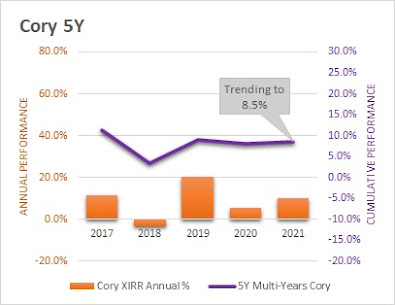

For three years in a row the portfolio has robust returns from equity. This year will be good to be flat if not better. However if there is a loss, need to be quick in mitigating them. Growth stock achieved 14% allocation in Equity Chart. Not shown here.

Primary Tasks1. CPF Top-Up to Max ( VC3AC )2. Increase Investment in Growth Stocks. Need to explore how much.3. Dividend Target 60k4. Sell Vested Stock allocation5. Put a portion of the emergency cash into Fixed Deposits6. Use more stroller instead of cab

7. Trip to Tainan for Holiday

8. 8% minimum warchest allocation

9. 5% - 5.5% cash allocation

10. No major adventure. Look for mitigation investment strategy.

11. Annual Parent allowances - completed

Secondary Tasks

1. Children CPF Top Up / CDA Top Up

2. Personal MA Top Up3. Try S&P500 if there are enough correction

PS. 3 yr old daughter starts to learn to sing on herself today

Cory

2022-0108

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Telegram CoryLogics <= Link to Telegram

Articles in this Blog is personal take and sharing purposes only. Reader should seek their own professional help when making financial decision and be responsible for their decision.