CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

May 19, 2023

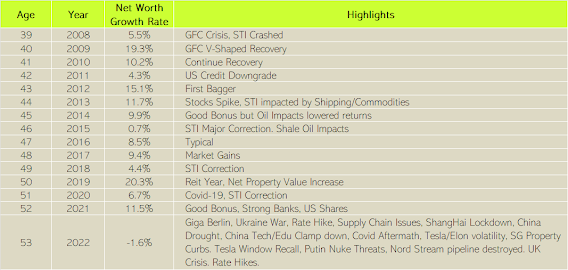

Cory Diary : Navigating Crisis - Net Worth

May 13, 2023

Cory Diary : iReit Review

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

May 6, 2023

Cory Diary : Property Curbs

Investing in property in Singapore has been a popular choice for retirement planning due to the rental income and capital appreciation it can provide over the long term. However, it's important to recognize that past trends and government policies do not necessarily guarantee future performance.

An analogy that can be used is that of a kettle whistle. When the pressure in the kettle gets too high, the whistle sounds, and the heat is lowered to prevent the water from boiling over. However, over time, more energy is added to the kettle, and it will boil again. This is similar to how government cooling measures can temporarily slow down the real estate market, but economic conditions, population growth, and consumer preferences can impact the market over the long term.

Personal experiences with property investment can vary. For instance, I have an investment property that I purchased more than a decade ago when the government introduced curbs. In addition to the possible rental income, the capital appreciation of my property has probably resulted in strong 6 digits in capital gain excluding costs.

However, it's worth noting that the current state of the market may not be ideal for investment. The Singapore Property Index, which tracks the performance of the residential, commercial, and industrial sectors of the real estate market, has risen significantly in recent years. While past performance does not guarantee future success, the high market prices suggest that property investment in Singapore may be more challenging than in previous years.

While property investment can provide benefits, it's important to consider the risks involved. There are costs involved in maintaining and managing a property, and rental income and capital appreciation are not guaranteed. Additionally, factors such as location, property type, and market trends can impact the performance of an investment.

In conclusion, property investment can be a viable option for retirement planning in Singapore, but it's important to approach it with a clear understanding of the risks and considerations involved. The kettle whistle analogy highlights the temporary nature of government cooling measures, but it's important to research the market, consider the risks, and make informed decisions based on your individual circumstances and experiences. While past performance and personal experiences can provide valuable insight, it's also important to consider the current state of the market and whether it may be too high to invest in.

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

May 2, 2023

Cory Diary : Equity Portfolio - Rate Spike Readiness

Apr 21, 2023

Cory Diary : Family Income Stress Test

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Apr 10, 2023

Cory Diary : You only young once

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Mar 29, 2023

Cory Diary : Net Worth Allocation

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Mar 25, 2023

Cory Diary : Navigating Risks in a Volatile Market - Equity Portfolio

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Feb 25, 2023

Cory Diary : iReit Review of Annual Report

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Feb 15, 2023

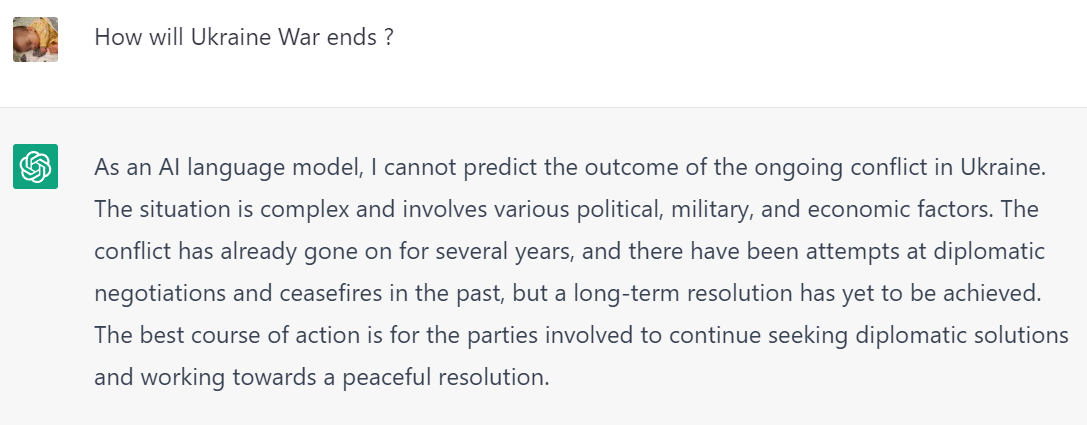

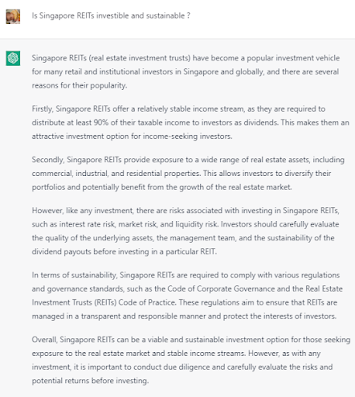

Cory Diary : Investment Questions to ChatGPT

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Feb 5, 2023

Cory Diary : Net Worth 2023 Feb

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Jan 28, 2023

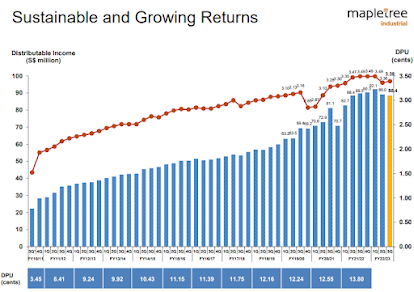

Cory Diary : Mapletree Industrial Reit Info

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Jan 23, 2023

Cory Diary : Life Style Creep Part 2

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Jan 16, 2023

Cory Diary : Year 2022 Performance

There is another plus that mitigate the fall which is property value has gone up slightly in Year 2022.

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Dec 29, 2022

Cory Diary : Financial Investment Updates

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Nov 20, 2022

Cory Diary : Stagflation - Net Worth

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Nov 14, 2022

Cory Diary : This is the One !

Nov 10, 2022

Cory Diary : Hedge of Cory Portfolio

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Oct 15, 2022

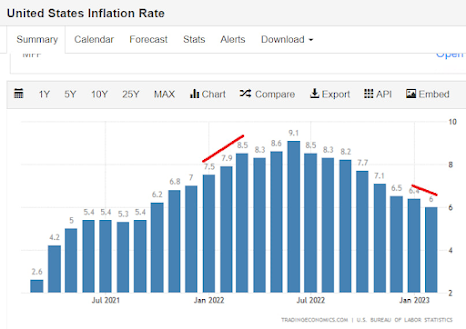

Cory Diary : US Sept Inflation Rate

there is about another 40 pts to go to hit that bottom. That's after more than 28% drop from all time high in 2020 excluding dividends. Assuming DPU not significantly impacted and with serious correction already happened that will be a solid entry point. Personally I don't think it will happen as explained on inflation projection but we should never say never as is just projection coupled with market reactions can varies.

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Oct 7, 2022

Cory Diary : How do SG reit performs ?

CoryLogics Invest Chat - No Coin, No Porn, No Penny