Recently I do a survey on investing communities in Singapore in IN. Thought it will be fun to share out to the blog community as well.

Is only a 3 days period that captured moments of month long rise where market heads north for Reits investors.

Glad to see so many retail investors benefited for the past few years that dabble less in speculation or day trading. Maybe is a new emerging class of DIY investors and profitable ones too.

Cheers

Cory

2019-0706

Jul 6, 2019

Jul 5, 2019

Cory Diary : Returns Rationalization

Since last blogged, the market continues to surge for yield stocks which portfolio benefited from Reits/Trusts exposure with low growth of the world. This is despite being peppered with bonds, preference, blue chips and SMEs. In the ever lowering yield quest which I have doing for past years, people like me will chase for whatever they feel safe hence lowering yield of stable instruments. Of-course unstable ones tag along as well to help build up the next crisis as and when it rolls. On and off we may have "Hyflux" or "Swiber" moments. Sorry folks. Not my intention to gloat over such but to constant remind that I could fall as well and is important not to be too carried away.

Currently achieved Xirr hits 37.2% if annualized for the year.

Xirr using year end date hits 18%. ( Roughly Profit Yield )

It has been a long time since we hit this higher level of returns. Those were the days ! In the past my portfolio was much smaller though. However at this moment this year profits in % term has been quite stunting considering portfolio has grown considerably. The absolute profit size is easily 4 years of my typical saving rate from my salary income.

Naturally my plan will be more and more conservative as the market goes higher to protect my gains. Dividend investors are more towards unrealised gains " to milk the cows"as dividends are as ... Music Lyrics "Always on my mind .... "

Using target of 50k annual dividends, profits for the 6 months+ is well over 3 years of dividends. Can it get better ? Sure just smaller increment as we compress the yield. Will the risk go higher ? Likely if the barrier to entry becomes so low that businesses starts to undercut each other.

With low growth in the world, the next cherish commodity is growth after "maturing" yield. In the extension of current stable yield concept, we hope for stronger stable growth iced with good dividends. Searching around maybe left the banks which I do have. Again buffered it up this week. Then we have digi-bank to worry ... life is like that. Don't complain.

One thing for sure, Portfolio has to grow over time. How to do it is the question.

Cheers

Cory

2019-0705

One thing for sure, Portfolio has to grow over time. How to do it is the question.

Cheers

Cory

2019-0705

Jun 30, 2019

Cory Diary : Record Profit Diversified Portfolio 2019-0630

As I get older, one key realization I have is about money in relation to other assets class. Moving from stock to cash is just from one asset class to another. From one risk to another. Cash has risks of inflation, low returns and country risk. Nevertheless is not easy for many to move past this point even for myself.

What this mean is that taking profit is meaningless strictly to dividend investors when fundamental remains unchanged if we are looking for safety harbor and out-of-market. Timing the market is tough. Often we miss big time when we realised or gains. I am still learning therefore prefer to do on stages for some counters.

The market has been on bull for some time. Even sell in MAY and GO AWAY is misguided as the market recovered. At this point of time, trying to inject huge amount of money into stocks seem lack margin of safety as the low point of Index has passed for this period. Hence, when I decided to max my SSB.

With market in exact halfway point this year, and the largest profit I have seen, I am still well invested in the market. During this period I did some amount of consolidations to reduce the counters I have to manage. One of the key reduction is Reits/Trusts. As we all know, we have one of the best this year so far. In the report, I have them added as a small dot to show their returns previously before I sold them for review purpose ( see chart ).

Those I have sold namely.

Parkway Life Reit,

Frasers CPT,

Frasers L&I TR,

Mapletree Com Tr and

Netlink NBN Tr

and again as reflected in the chart with small dots. I did not include First Reit as it was few days trade with slight loss in speculation. I think the only regret is Mapletree Com Tr which blew pass my sell price significantly. Netlink NBN Tr is recent sale so time will tell.

As mentioned before I tend to do some trading and CMT is a little smaller today as I recently took some profit off the table at $2.64. I hope to buy back. Really ..... ... ... Even with that, I still have 40% exposure in Reits. Frankly, is very hard to buy back in this rising market to my dismay. Fortunately, I play with a small percentage of my portfolio and most remains intact to enjoy the ride.

With the higher cash level, I have decided to complement it with SIA Bond and Astrea Bond for a more balance portfolio to buffer it up to 22%.

Namely,

Frasers Bond 3.65%

CMT Bond 3.08%

SIA bond 3%

AstreaIV Bond 4.35%

Equity investments to me needs to be RISK MANAGED to MY LEVEL. At 19 counters, this is quite manageable for me considering bonds/pref do not need much time to monitor so this leaves me with 15 to watch. At Portfolio size of $1.1 M excluding Gov securities I think is good enough for me right now.

Cory

2019-0630

What this mean is that taking profit is meaningless strictly to dividend investors when fundamental remains unchanged if we are looking for safety harbor and out-of-market. Timing the market is tough. Often we miss big time when we realised or gains. I am still learning therefore prefer to do on stages for some counters.

The market has been on bull for some time. Even sell in MAY and GO AWAY is misguided as the market recovered. At this point of time, trying to inject huge amount of money into stocks seem lack margin of safety as the low point of Index has passed for this period. Hence, when I decided to max my SSB.

With market in exact halfway point this year, and the largest profit I have seen, I am still well invested in the market. During this period I did some amount of consolidations to reduce the counters I have to manage. One of the key reduction is Reits/Trusts. As we all know, we have one of the best this year so far. In the report, I have them added as a small dot to show their returns previously before I sold them for review purpose ( see chart ).

Parkway Life Reit,

Frasers CPT,

Frasers L&I TR,

Mapletree Com Tr and

Netlink NBN Tr

and again as reflected in the chart with small dots. I did not include First Reit as it was few days trade with slight loss in speculation. I think the only regret is Mapletree Com Tr which blew pass my sell price significantly. Netlink NBN Tr is recent sale so time will tell.

As mentioned before I tend to do some trading and CMT is a little smaller today as I recently took some profit off the table at $2.64. I hope to buy back. Really ..... ... ... Even with that, I still have 40% exposure in Reits. Frankly, is very hard to buy back in this rising market to my dismay. Fortunately, I play with a small percentage of my portfolio and most remains intact to enjoy the ride.

With the higher cash level, I have decided to complement it with SIA Bond and Astrea Bond for a more balance portfolio to buffer it up to 22%.

Namely,

Frasers Bond 3.65%

CMT Bond 3.08%

SIA bond 3%

AstreaIV Bond 4.35%

Equity investments to me needs to be RISK MANAGED to MY LEVEL. At 19 counters, this is quite manageable for me considering bonds/pref do not need much time to monitor so this leaves me with 15 to watch. At Portfolio size of $1.1 M excluding Gov securities I think is good enough for me right now.

Cory

2019-0630

Jun 28, 2019

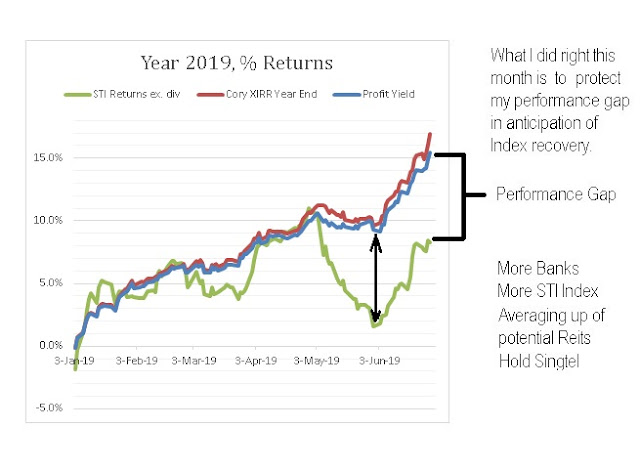

Cory Diary : Securing lead in Performance 2019-0628

Month of June has been incredible. A recovery of Index with continuous upward price swing on selected Reits and Trusts. The final return will be known tonight after the US market ends(updated). This post is about how I ensure the gap continues. Here's links on my goal to ensure the performance is maintained.

https://corylogics.blogspot.com/2019/06/cory-diary-mexico-tariffs-cory.html

https://corylogics.blogspot.com/2019/05/cory-diary-volatile-sti.html

Despite high number of Reits/Trusts in my portfolio, achieved 100% strike for 5 digits gain on each. Having enlarged Banks investment as blogged earlier to help me catch up with the rising Index works well. Singtel seems bottomed but I do not want to average up yet as I like to reserve my funds for opportunity.

Result: XIRR YTD: 17% (slightly higher due to some realised gains), Profit Yield: 15.4%, Total Profit 1st Half YTD : $147,723 (Realised/unrealised including dividends), Expense Ratio 0.35%, XIRR Non-Fixed YTD: 20.6% (Removing Bond/PS elements). Despite that, I am happy with them as they gives me confidence to map out my investment strategy as my investment needs to be risk managed.

Personally I have a bit of fear on Iran conflict to be worsen other than on-going trade war. This will affect Oil price which will have implications on my equity investment. Therefore, in the last weeks, took some defensive moves after achieving my aims of preserving my performance with rising STI Index. I will blog later on them when I go through the bubble chart.

I do not have fresh injection into the portfolio this year. Instead I have tapped some of my saving fund into SSB to max it out which mean continue with no fresh fund injection probably for rest of year. July will be interesting as my portfolio has been moving towards more defensive postures.

Cheers

Cory

2019-0628

https://corylogics.blogspot.com/2019/06/cory-diary-mexico-tariffs-cory.html

https://corylogics.blogspot.com/2019/05/cory-diary-volatile-sti.html

Despite high number of Reits/Trusts in my portfolio, achieved 100% strike for 5 digits gain on each. Having enlarged Banks investment as blogged earlier to help me catch up with the rising Index works well. Singtel seems bottomed but I do not want to average up yet as I like to reserve my funds for opportunity.

Result: XIRR YTD: 17% (slightly higher due to some realised gains), Profit Yield: 15.4%, Total Profit 1st Half YTD : $147,723 (Realised/unrealised including dividends), Expense Ratio 0.35%, XIRR Non-Fixed YTD: 20.6% (Removing Bond/PS elements). Despite that, I am happy with them as they gives me confidence to map out my investment strategy as my investment needs to be risk managed.

Personally I have a bit of fear on Iran conflict to be worsen other than on-going trade war. This will affect Oil price which will have implications on my equity investment. Therefore, in the last weeks, took some defensive moves after achieving my aims of preserving my performance with rising STI Index. I will blog later on them when I go through the bubble chart.

I do not have fresh injection into the portfolio this year. Instead I have tapped some of my saving fund into SSB to max it out which mean continue with no fresh fund injection probably for rest of year. July will be interesting as my portfolio has been moving towards more defensive postures.

Cheers

Cory

2019-0628

Jun 27, 2019

Cory Diary : Ever Lowering Yield ...

As I mentioned early on the logic of ever lower yield, this is spot on and have benefited from it. Check the links on earlier articles. Entering big on Reit/Tr since last year. Is a strong ride for my portfolio within 6 months.

https://corylogics.blogspot.com/2019/06/cory-diary-bitching-my-favorite-again.html

https://corylogics.blogspot.com/2019/05/cory-diary-yield-anchoring.html

So with another shot on Reits to another record level this week ... when is this going to end ?

That's an interesting question. The answer maybe is to do a spectrum of different instruments (see below charts). Bear with me the rough accuracy as I do this on a quick pace while my baby is still sleeping.

As I can see, the gaps are not very big between them right now. Have we reach a platter ?

We need growths. Sure there are still some hidden gems out there on Reits. As a rough guide for me, if there is exchange in positions among them we may have Euphoria ? We can price them relatively to aga aga risk consideration.

Cory

2019-0627

https://corylogics.blogspot.com/2019/06/cory-diary-bitching-my-favorite-again.html

https://corylogics.blogspot.com/2019/05/cory-diary-yield-anchoring.html

So with another shot on Reits to another record level this week ... when is this going to end ?

That's an interesting question. The answer maybe is to do a spectrum of different instruments (see below charts). Bear with me the rough accuracy as I do this on a quick pace while my baby is still sleeping.

As I can see, the gaps are not very big between them right now. Have we reach a platter ?

We need growths. Sure there are still some hidden gems out there on Reits. As a rough guide for me, if there is exchange in positions among them we may have Euphoria ? We can price them relatively to aga aga risk consideration.

Cory

2019-0627

Jun 22, 2019

Cory Diary : HRnetGroup 2019-0622

HRnetGroup

Today price is $0.675. Is a gap down together with quite a number of counters last Friday. Probably the market get winds of Trump eventual strikes on Iran. Fortunately, it didn't. Personally, I feel it could ignite a war as Iran is not like Libya or Syria who are just the receiving ends.

I have been monitoring this counter for some time after I sold my positions. Reason as following Link. However, a number of local investors swore to it.

Initiated (update: informed) a small position in 2017-1214. Sold informed 2019-0226. Transactions as below table.

Did a collection for the 3 years record. Applied XIRR. Results as above.

Kopi money. So far I make the right decision for myself and also reducing a counter to manage for my limited bandwidth.

Cory

2019-0622

Today price is $0.675. Is a gap down together with quite a number of counters last Friday. Probably the market get winds of Trump eventual strikes on Iran. Fortunately, it didn't. Personally, I feel it could ignite a war as Iran is not like Libya or Syria who are just the receiving ends.

I have been monitoring this counter for some time after I sold my positions. Reason as following Link. However, a number of local investors swore to it.

Initiated (update: informed) a small position in 2017-1214. Sold informed 2019-0226. Transactions as below table.

Did a collection for the 3 years record. Applied XIRR. Results as above.

Kopi money. So far I make the right decision for myself and also reducing a counter to manage for my limited bandwidth.

Cory

2019-0622

Jun 19, 2019

Cory Diary : STI Rebounded 2019 June

STI has been quite volatile. This week it starts rebounding. If one has invested near end of last year, today one would still has nice returns of about 300 points ahead.

As we can see from long term resistance support, averaged down more on STI earlier and is now benefiting from the rebound. Recent low is a test of one resolve. The turmoil of the market doing their sum on our thinking. However, being portfolio buffered, this bring calmness for us to try.

Everyone waiting for FED now. Trump complained last time and likely more this time as he needs more ammunition to fight trade battle with China and EU especially we could see currency war entering the game. Will FED supports ?

Expecting the rate to hold. Chance is 60%. Cut 30% However, if Powell tries to be funny and raise the interest rates instead, the market could well #$^$%&%^$*%4&*)&. Maybe he will try other options instead. However, should policy be reactive based on data coming in or anticipation in today world. Maybe we need to change with time.

Cory

2019-0619

Jun 16, 2019

Cory Diary : Asset allocation 2019 Jun

In my plan for retirement, if it happens, there could be draw-down in my net worth. Next question will be how fast. So I decided to do a rough update estimate based on what I have today.

Roughly, I could see return generation of 113 K annually. This could be generous on the property. Never mind. Just ignore me on that one. However, to meet short-medium term needs, FCF is more important. Which left me with 51.5K annually after removing Insurance, Property and Pension. And this is assuming I have surrendered my Insurance policy. I still have loan to pay up, which implied even with my net worth today, I could not afford to retire for the lifestyle I want to maintain after, without draw-down.

First thing to do is to tackle my most unproductive asset which is Saving. With Gov securities that can double up as Emergency and Housing loan support, there is no need to have such a high saving % allocation which has been my constant issue with saving rate from salary and bonus. This needs to cut down by a third of which I would have my SSB max. and then remainder to war chest. This saving category includes cash management account which is giving reasonable interests.

Secondly, my backup plan is to sell my property after 7 years and would switch to further OCR region to increase the psf when I retired for at least same amount. This is not impractical from current caveats logged. However, my wish is to have another property instead and this will required environment to be conducive enough such as removal of ABSD, and my saving rate and investment are reasonable to generate growing dividends.

In a not so good scenario, where I decided to retire immediate, and my investment returns turn sour. I would estimate 5% draw down after paying up all my loans from the start, will last me for at least 17 years. After which, I am left with Pension and Property. Then the option is to down-grade .... to finance more reasonable lifestyle and my daughter education. At 67 then, maybe is still ok. Still cannot tahan, then I will ask my wife to chip in (my last buffer of buffer which is to clean tables lol ... ) . ha.

Someone said : What about legacy ?

Uncle Cory : Simi lah. Down grade liao still want legacy. You only have one life to live.

... Legacy is for the rich. Don't act rich if you are not.

Cheers

Cory

2019-0616

Roughly, I could see return generation of 113 K annually. This could be generous on the property. Never mind. Just ignore me on that one. However, to meet short-medium term needs, FCF is more important. Which left me with 51.5K annually after removing Insurance, Property and Pension. And this is assuming I have surrendered my Insurance policy. I still have loan to pay up, which implied even with my net worth today, I could not afford to retire for the lifestyle I want to maintain after, without draw-down.

First thing to do is to tackle my most unproductive asset which is Saving. With Gov securities that can double up as Emergency and Housing loan support, there is no need to have such a high saving % allocation which has been my constant issue with saving rate from salary and bonus. This needs to cut down by a third of which I would have my SSB max. and then remainder to war chest. This saving category includes cash management account which is giving reasonable interests.

Secondly, my backup plan is to sell my property after 7 years and would switch to further OCR region to increase the psf when I retired for at least same amount. This is not impractical from current caveats logged. However, my wish is to have another property instead and this will required environment to be conducive enough such as removal of ABSD, and my saving rate and investment are reasonable to generate growing dividends.

In a not so good scenario, where I decided to retire immediate, and my investment returns turn sour. I would estimate 5% draw down after paying up all my loans from the start, will last me for at least 17 years. After which, I am left with Pension and Property. Then the option is to down-grade .... to finance more reasonable lifestyle and my daughter education. At 67 then, maybe is still ok. Still cannot tahan, then I will ask my wife to chip in (my last buffer of buffer which is to clean tables lol ... ) . ha.

Someone said : What about legacy ?

Uncle Cory : Simi lah. Down grade liao still want legacy. You only have one life to live.

... Legacy is for the rich. Don't act rich if you are not.

Cheers

Cory

2019-0616

Jun 15, 2019

Cory Diary : Value-Add in Trade War

“If he shows up, good, if he doesn’t – in the meantime, we’re taking in billions of dollars a month [in tariffs] from China,” Trump tells “Fox & Friends.”

Sounds familiar ? Yup is from President Trump. Interestingly to say it so openly could imply many things ...

1. He is threatening President Xi

2. He purposely want to make sure President Xi lose face

3. He is trying to make sure President Xi won't attend G20

4. He is trying to stall the talk purposely

5. He is not thinking at all

6. He is not interested for trade talk at all. Is all a ruse

7. He is stupid

Let's sit back and think when the 25% tariffs kick-in. First is final export to America cannot be China as the tariffs are too high unless we are prepared to pass the cost to consumer which are specifically American Consumers. This won't happen due to competition for market shares therefore even Chinese companies will have to change their supply chain model.

Secondly, to classify as not China produce there have to be sufficient value-add through the supply chain. Value-Add could be the next level that Trump administration will focus on if Trade War gets deeper. For now, if one need to avoid tariffs is to have the key assembly done in another country say Mexico but there must be enough value-add to the product. Adding packaging or labeling which are cosmetic and naming won't be enough and US will still consider it as Made in China.

What will happen is manufacturers will likely do the minimum to meet the cut-off. This will mean China will still produce the basic raw lower level assemblies. Some jobs will be loss. There will be a slight delta in product cost due to additional touches in Mexico. Consumers probably won't feel much impact.

If this model continues long enough, soon manufacturers will find cheaper eco-system outside china. This could be expedited and permanent if they decided to adjust the value-add criteria higher such that it may not make sense to even do basic assemblies in China. When this happen, product cost will soon come down to norm or even cheaper. This could take a few years to happen though.

The final stage will be when the new eco-system is so establish, Mexico can be a manufacturer not only for America market but also the other parts of the world. At this time, China will start their own protectionist measures requiring their own local value-add to sell in China.

Replace Mexico with few other like countries. Countries that benefits from this trade war will be Vietnam, Taiwan, Mexico, Thailand, Cambodia, South Korea, Japan, Singapore etc. Maybe even India if they open up their market fast enough. Remote choice could be North Korea if they have settled their difference with America.

From what I see, trade war is just a pre-text for bigger things to come. Is about ensuring US stay much ahead. So from this read, who will pays for the tariffs ? Where should we focus our investments ? How the world will be after ? Food for thoughts.

2019-0614

Jun 13, 2019

Cory Diary : Market Euphoria on Reits ?

Market today continues to plough into Reits euphoria. This pushes Portfolio to new high. The story seems to continue. However 2 things need to be cautious. G20 and Fed. Hopefully none will break this rising rhythm as I previously mentioned the gap between risk free rates such as SSB and stable returns of strong Reits. This is still hold true so far.

With money sitting in cash management account coupled with saving banks, opting to max out SSB is a growing option. But this could slow down my portfolio growth for years to come due to compounding effect. This logic holds true for people who sell most and took profits. Once we do that, coming back is aren't easy.

Investment is a long game. Portfolio growth is a priority. Unless we see cliff right in front of us, derailing may not be wise so one would prefer to stay invested. Right now earning is still coming in, continue monitoring. Wish me luck.

Cory

2019-0613

With money sitting in cash management account coupled with saving banks, opting to max out SSB is a growing option. But this could slow down my portfolio growth for years to come due to compounding effect. This logic holds true for people who sell most and took profits. Once we do that, coming back is aren't easy.

Investment is a long game. Portfolio growth is a priority. Unless we see cliff right in front of us, derailing may not be wise so one would prefer to stay invested. Right now earning is still coming in, continue monitoring. Wish me luck.

Cory

2019-0613

Jun 12, 2019

Cory Diary : Bubble Report 2019-0611

Straits Time Index has come down by 5.5% since my last bubble chart report on 5/2. That's -186 points. So investing in ETF is not that straight forward. Timing helps as previously mentioned.

With the recent correction, I have increased my stake in STI ETF. With corresponding profit taking in some of my REIT counters, ETF is now the largest counter. This can be easily observed from the bubble size.

Let's do a review of the Bubble Chart.

First the bad news.

1. Unlike past bubble chart, there aren't need t do Axis adjustment to fit higher earning. ( Due to risk adjusted )

2. Banks are still in doldrums .... . ( Trying to bottom fish )

3. STI ETF has come down due to large swing on the straits time index within a month. ( Average down )

Here's the good news

1. Reits / Trust profits have generally been moving upwards eclipsing STI ETF downward moves. Looks like it has stabilised.

2. Portfolio is generally performing which can be seen for the relatively lower profitability of bonds in the chart.

My Plan as mentioned earlier is to preserve the leading gap of my portfolio. Is working so far. Will continue to monitor. What's next. Something I need to figure out.

Here's the link for those who are interested in the progress of the Bubble chart for this year so far.

Cory

2019-0611

With the recent correction, I have increased my stake in STI ETF. With corresponding profit taking in some of my REIT counters, ETF is now the largest counter. This can be easily observed from the bubble size.

Let's do a review of the Bubble Chart.

First the bad news.

1. Unlike past bubble chart, there aren't need t do Axis adjustment to fit higher earning. ( Due to risk adjusted )

2. Banks are still in doldrums .... . ( Trying to bottom fish )

3. STI ETF has come down due to large swing on the straits time index within a month. ( Average down )

Here's the good news

1. Reits / Trust profits have generally been moving upwards eclipsing STI ETF downward moves. Looks like it has stabilised.

2. Portfolio is generally performing which can be seen for the relatively lower profitability of bonds in the chart.

My Plan as mentioned earlier is to preserve the leading gap of my portfolio. Is working so far. Will continue to monitor. What's next. Something I need to figure out.

Here's the link for those who are interested in the progress of the Bubble chart for this year so far.

Cory

2019-0611

Jun 8, 2019

Cory Diary : New Heights with Low Risk Portfolio Balance

This is one of the interesting year where we have obvious divergence in the performance of a portfolio high in Reits (~50%) vs STI returns which has fallen to-date to 3.18%. With the much less possibility of Rates increase, the sentiment of Reits have been quite exciting this past week.

Clearly staying invested and believing in the positiveness of Reit so far, dividend investors have benefited a lot from the upwards move if we walk the talk. Nevertheless, we need to stay nimble and monitor the market. Trump has stated Mexico Tariffs is off. That's a relief.

As previous mentioned, I moved some funds to ensure portfolio higher returns gap "Be maintained" relative to STI Index such as with DBS and STI Index. So far they have stay relatively stagnant. I also raised fund when I close my FCT position. Again this is more opportunity base due to the spike and my speculative blood in me to try for capital gains. Don't do this unless you have 7 other Reits and Trusts like me. Grrrrrr....

Xirr hits higher to 11.6% partially helped by realised gains in FCT. The Actual profit is roughly 10.8% which gives me more (updated for privacy) profit this year. Overall the Portfolio is balanced in such a way that I can sleep better at night. With some spare cash, I am again looking for opportunity. I may decide to max my Singapore Saving Bond. We shall see.

Cheers

Cory

2019-0608

Clearly staying invested and believing in the positiveness of Reit so far, dividend investors have benefited a lot from the upwards move if we walk the talk. Nevertheless, we need to stay nimble and monitor the market. Trump has stated Mexico Tariffs is off. That's a relief.

As previous mentioned, I moved some funds to ensure portfolio higher returns gap "Be maintained" relative to STI Index such as with DBS and STI Index. So far they have stay relatively stagnant. I also raised fund when I close my FCT position. Again this is more opportunity base due to the spike and my speculative blood in me to try for capital gains. Don't do this unless you have 7 other Reits and Trusts like me. Grrrrrr....

Xirr hits higher to 11.6% partially helped by realised gains in FCT. The Actual profit is roughly 10.8% which gives me more (updated for privacy) profit this year. Overall the Portfolio is balanced in such a way that I can sleep better at night. With some spare cash, I am again looking for opportunity. I may decide to max my Singapore Saving Bond. We shall see.

Cheers

Cory

2019-0608

Jun 6, 2019

Cory Diary : Bitching my favorite again

Why the article today ? Well, CMT has a large spike of 11 cent today hitting $2.57. FCT has a good day too. This quickly bring CMT yield to-date to roughly 4.5%. If one could remember when I blogged about Yield Anchoring this could be what I am expecting of ever lower yield. Will the price go higher to the unknown since is at all time high or it will crash soon?

Took a look on the DPU and compute the yield from it. To hit $2.80 (arbitrary), CMT yield would drops to near 4%. Is this enough for "kiasi" me ? I will be happy compared to SSB or Bank Interests surely.

What is the chance that it will crash from $2.57 ? Well, DPU has to fall. Which mean Malls Business have to fall largely. Make sense to you now ? Will you buy more instead ?

Cory

2019-0606

Jun 3, 2019

Cory Diary : Leapfrog your wealth

There are ways to leapfrog our wealth. Coming from below middle income family, and choosing a down-to-earth wife ( hee hee ), marriage do helps but inheritance from our families are out. Neither do our families have business acumen. So I would say today my siblings and we are above middle income. Hey, that's what makes Singapore incredible isn't it ? As long we work hard and smart, with a little luck and opportunity, we are contented.

As previously blogged, I am a "Value Saver" but I aren't frugal. I can spurt a dinner that cost few hundreds, and renovation in good 5 digits. As a value/dividend stock investor, this bring me quite a good sum to my net-worth. Of-course this won't happen fast enough if I do not have monthly salary and saving, and then equity investment.

Now, I can add that Property Investment as another option to propel. See chart below. With the mark-to-market valuation based on recent residential transactions of surrounding properties on the same development. Of-course some friends would say as long I don't sell, is only paper gain. This actually applies to my dividend stocks too. Nevertheless, Net-worth is the market value you have.

My thinking is whether we sell it or not is subjective. Holding cash in an inflationary environment is losing money too so I rather put my money to work continuously. Unless we are doing short term speculative trade, taking profit to realize the gain is cutting our game short as a good hedge against inflation.

Property provides a strong underlying asset base so I am in the mentality of "Never Sell". It can be also be an insurance that if needed, I could use it for downgrade therefore the more I would like to hold it for long term appreciation to be meaningful.

What I find amazing from this experience is how fast the pace of property appreciation and loan leverage can do to one's net-worth. No wonder our government needs to introduce curbs to rein them in to ensure more stable market. As for another sharing based on my limited experience, I realised the surrounding properties about few hundred meters away do not appreciate much at all for the same period. A real example of location of property matters in value appreciation.

In summary, the list of Wealth Accumulation.

1. Monthly Salary - Yes

2. Property Investment - Yes

3. Stock Investment - Yes

4. Marriage

5. Saving - Yes

6. Inheritance

7. Business

Cory

2019-0602

Jun 1, 2019

Cory Diary : Mexico tariffs - Cory Performance 2019 May

This can be viewed as a continuation of STI Volatility article here. This update unfortunately faced Mexico Tariffs on the last trading day of the month and we see adverse dip in ST Index. This also marked Sell-in-May and go away complete.

Had a few conference calls with my colleagues in preparation for China Tariffs and now have to absorb the impact of Mexico Tariffs. Trump is keeping my brain busy. We know from day one that there will be some exodus of manufacturing out-of-China however how much and how long it takes still to be determine.

This basically boils down to what level of manufacturing is considered Not made in China. And everyone probably trying to do the minimum cut-off and finish the final product somewhere else. Asean, Taiwan, Korea, Japan and Mexico probably benefits the most from this trade war in term of job creation. This may means well for Singapore as regional HQ. Hong Kong may lose out.

We do know that if we are kept long enough outside China and if deep enough, we probably won't be moving back to China. For America market, naturally Mexico will be an ideal site due to abundance labors and lands. However for supply chain eco-system to work more smoothly, proximity to China will be better.

What will be the end game will be interesting to find out. The world may never be the same again.

Bye ... baby awakes now.

Cory

2019-0601

May 31, 2019

Cory Diary : Housing Leverage

Just want to share something from my personal experience on housing.

Used to own HDB Maisonette years ago and sold it for slightly more than 100K profit only to see it go for another after. As I am often based overseas, decided to acquire a Private home later if I decide to return for good.

Here's my previous thoughts. How my thinking change over time and steps I took.

1. Link on My Home in Year 2014

This basically say how I felt about rising property prices is not helping us socially. Rising price.

2. Link on Shrinking and Integrated Property in Year 2015

With prices running above income, shrinking property size. Value of integrated property thoughts. The situation.

3. Link on Money in Gaming in Year 2015

Money is continuously shrinking. The inflation.

4. Link on Million Dollar home in Year 2017

In Year 2013 I blogged about $1M home goal which post I have moved to draft to clean up.

However my 2017 article basically summaries. Acted.

With that, I realised that it does not make sense for me to hold Gold as property can be a good hedge against inflation. In Year 2019 today, my value of my home has increased by 25% approximately. This is based on current similar property price on location and estate. As is only 20% down with roughly 5% expenses. Maybe I can do a similar XIRR on the returns and it works out about 21% annually. Kind of surprise.

This explain the power of housing leverage unlike typical stock investment. The other benefit is the diversification from stock market.

Cory

2019-0531

Used to own HDB Maisonette years ago and sold it for slightly more than 100K profit only to see it go for another after. As I am often based overseas, decided to acquire a Private home later if I decide to return for good.

Here's my previous thoughts. How my thinking change over time and steps I took.

1. Link on My Home in Year 2014

This basically say how I felt about rising property prices is not helping us socially. Rising price.

2. Link on Shrinking and Integrated Property in Year 2015

With prices running above income, shrinking property size. Value of integrated property thoughts. The situation.

3. Link on Money in Gaming in Year 2015

Money is continuously shrinking. The inflation.

4. Link on Million Dollar home in Year 2017

In Year 2013 I blogged about $1M home goal which post I have moved to draft to clean up.

However my 2017 article basically summaries. Acted.

With that, I realised that it does not make sense for me to hold Gold as property can be a good hedge against inflation. In Year 2019 today, my value of my home has increased by 25% approximately. This is based on current similar property price on location and estate. As is only 20% down with roughly 5% expenses. Maybe I can do a similar XIRR on the returns and it works out about 21% annually. Kind of surprise.

This explain the power of housing leverage unlike typical stock investment. The other benefit is the diversification from stock market.

Cory

2019-0531

May 28, 2019

Cory Diary : Golden Era of Reits

Throughout history when something reaches it's peak, downhill is the way to go. From Tang Dynasty to Mongol Empire. Roman to British Empire. Even in science, Quote by Isaac Newton: “What goes up must come down.”

So question in our minds ... Have Reits reached it peaks ?

The question will be on the questioner on why the question. When it comes, it will come.

Till it comes. Meantime .... enjoy our Golden Era. It has been 10 years already since last GFC. Whatever has been gained, easily doubled. Buffer not enough ?

Something to cheer your Tuesday.

Cory

2019-0528

So question in our minds ... Have Reits reached it peaks ?

The question will be on the questioner on why the question. When it comes, it will come.

Till it comes. Meantime .... enjoy our Golden Era. It has been 10 years already since last GFC. Whatever has been gained, easily doubled. Buffer not enough ?

Something to cheer your Tuesday.

Cory

2019-0528

May 25, 2019

Cory Diary : Dividend Hat

Reits have ex-dividend just recently. And interestingly at today prices, the dividend gap has mostly closed. What ! Since when they becomes a gem... well not exactly like those miraculous speculative counters that spiked more than 20% in a day but if we are to track the trend across multi-years, Reits are like turtle but they will reach and beyond.

A few examples on just this year returns for me will be Ascendas Reit closes $2.95 (Xirr 27%), CapitaMall Trust $2.44 (Xirr 11%) and Mapletree Ind Tr $2.10 (Xirr 10%). Instead of going lower, many Reits have went up in this Trade War.

Quote from Warren Buffett :

“Many investors get this one wrong. Even though they are going to be net buyers of stocks for many years to come, they are elated when stock prices rise and depressed when they fall. In effect, they rejoice because prices have risen for the ‘hamburgers’ they will soon be buying."

“This reaction makes no sense. Only those who will be sellers of equities in the near future should be happy at seeing stocks rise. Prospective purchasers should much prefer sinking prices.”

This is easily applied to Stable Return Equities. Investing in Strong Reits are simple. DPU and Growth. If the price go lower, is cheaper ! This is so true for investment that has stable returns. Problem is too many people has "master the art". Reits are at ever lowering yield. Does that mean is no good ? Maybe is just the Hat you want to wear. All in the mind.

Cory

2019-0525

May 23, 2019

Cory Diary : Volatile STI

Volatility

The picture has changed so much for STI. Banks were hammered down. In addition to the Trade War the new concern is the virtual bank licensing. The Reits / Trusts generally do much better that even the weaker ones make the Banks look bad.

I did a bottom fishing on STI ETF to support the gap in performance between the ETF and me. However, it seems STI ETF still has some distance to go further down as the next tariffs of US$300 B is going to be major. Companies should be making preparation for this as this could hit China manufacturing with more substance whereas previously maybe just on finishing touch of products.

I think War Chest is more essential today than few days ago as the market trend seems getting a little nervous. While I hold the view that stable Reits are like "Fixed Deposits", this is based on the opinion that DPU remains stable and Investor ignore Capital Gain/Loss. So any significant market changes, if any, to hit this class of asset, this may even present good opportunity for the fund to expand. Question is how deep ?

Feeling bored and thinking.

Cory

2019-0523

May 19, 2019

Cory Diary : Net Worth 20190519

Last previous blog here.

The key change after 3.5 months are my Net Property Asset. Definition is the value of my property minus outstanding loan. This is then added to my Net Worth. The way to obtain value of my property is to access URA website for recent transacted values in $psf. And then do a conservative estimate of what my property value be if I have to sell it today.

Other changes includes increase in Singapore Saving Bond holdings (SSB) and increase in equity valuation due to capital gains. Both % figures hold well but SSB still reduces slightly in % wise. More cash today in my investment account and the unrealised gains from stocks outweighs the net sales. Dividends are straight into cash.

Despite that, saving reduced in % wise. Mainly because I have just paid my tax. Proportionate decrease due to significant increase in property net value. Slightly higher spending due to new cost for nanny.

Cheers

Cory

2019-0519

The key change after 3.5 months are my Net Property Asset. Definition is the value of my property minus outstanding loan. This is then added to my Net Worth. The way to obtain value of my property is to access URA website for recent transacted values in $psf. And then do a conservative estimate of what my property value be if I have to sell it today.

Other changes includes increase in Singapore Saving Bond holdings (SSB) and increase in equity valuation due to capital gains. Both % figures hold well but SSB still reduces slightly in % wise. More cash today in my investment account and the unrealised gains from stocks outweighs the net sales. Dividends are straight into cash.

Despite that, saving reduced in % wise. Mainly because I have just paid my tax. Proportionate decrease due to significant increase in property net value. Slightly higher spending due to new cost for nanny.

Cheers

Cory

2019-0519

Subscribe to:

Posts (Atom)