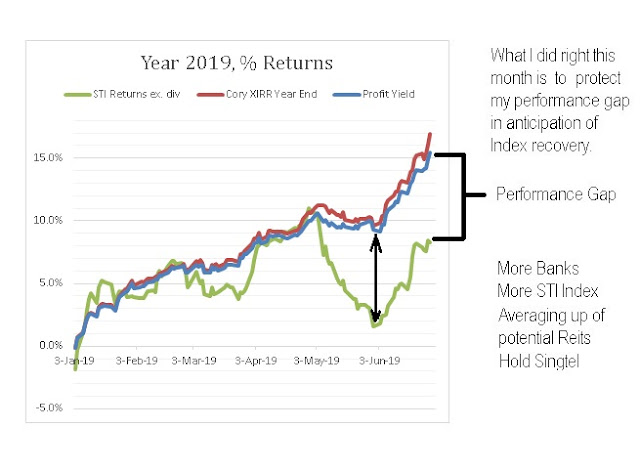

Month of June has been incredible. A recovery of Index with continuous upward price swing on selected Reits and Trusts. The final return will be known tonight after the US market ends(updated). This post is about how I ensure the gap continues. Here's links on my goal to ensure the performance is maintained.

https://corylogics.blogspot.com/2019/06/cory-diary-mexico-tariffs-cory.html

https://corylogics.blogspot.com/2019/05/cory-diary-volatile-sti.html

Despite high number of Reits/Trusts in my portfolio, achieved 100% strike for 5 digits gain on each. Having enlarged Banks investment as blogged earlier to help me catch up with the rising Index works well. Singtel seems bottomed but I do not want to average up yet as I like to reserve my funds for opportunity.

Result: XIRR YTD: 17% (slightly higher due to some realised gains), Profit Yield: 15.4%, Total Profit 1st Half YTD : $147,723 (Realised/unrealised including dividends), Expense Ratio 0.35%, XIRR Non-Fixed YTD: 20.6% (Removing Bond/PS elements). Despite that, I am happy with them as they gives me confidence to map out my investment strategy as my investment needs to be risk managed.

Personally I have a bit of fear on Iran conflict to be worsen other than on-going trade war. This will affect Oil price which will have implications on my equity investment. Therefore, in the last weeks, took some defensive moves after achieving my aims of preserving my performance with rising STI Index. I will blog later on them when I go through the bubble chart.

I do not have fresh injection into the portfolio this year. Instead I have tapped some of my saving fund into SSB to max it out which mean continue with no fresh fund injection probably for rest of year. July will be interesting as my portfolio has been moving towards more defensive postures.

Cheers

Cory

2019-0628

No comments:

Post a Comment