Is like weeks since my last posting. After registering strong return in the month of January 2020, Wuhan Virus finally get into my nerve. For the past few weeks I have sold enough shares that i have never done before that I hit my elevated selling limit set by my brokerage for a day. So moving forward I will be on buying mode since what has left behind will be the baseline that I would want to hold vested.

Today Tracker is the latest I got after the market closed today. Currently there is about 2% gap between Cory and STI Index.There is some roller-coaster ride since the Wuhan saga comes into play. How this ends will be interesting.

From the chart, one key learning is I did not manage to catch the rebound up-swing of STI Index and Bank enough. As you know they took a step back today. This is something I like to digest on how to read them correctly and take decisive action.

Another action I took is I have kick-started my the other trading account which has lower fees. There will be some saving mitigated. The other advantage is that I will have two burners when needed.

Finally, one stock I like to mention is Ascott Reit from Ascendas-h tr shares. Last year I sold about half of Ascendas-h Tr shares. And decided to clear my remaining shares that was converted to Ascott Reit. Nothing against this Reit except that I did not choose this previously and market condition do not suit me to continue holding something that I am not in tune to it.

Little Daughter keeps me fun and busy. 😉

Cheers

Cory

2020-0207

Showing posts with label Performance. Show all posts

Showing posts with label Performance. Show all posts

Feb 7, 2020

Jan 15, 2020

Cory Diary : Resetting Performance Tracker 2020

The year 2020 starts with robust gain though not like the burst we see in start of 2019. Cory portfolio is also not well position to benefit significantly from it. Nevertheless relatively to STI, Cory Portfolio still edge a little bit higher.

The purpose of this post today is not about the gains but the reset feature of recognizing past realised and unreleased gains in 2019 as one's Year 2020 asset. This is done by resetting the Cory portfolio tracker to zero as above along with STI.

This is important concept in Cory Portfolio Strategy management that is not to subject oneself to have a mindset of plenty and that what profited in prior years are not dispensable money.

Cory

2020-0115

The purpose of this post today is not about the gains but the reset feature of recognizing past realised and unreleased gains in 2019 as one's Year 2020 asset. This is done by resetting the Cory portfolio tracker to zero as above along with STI.

This is important concept in Cory Portfolio Strategy management that is not to subject oneself to have a mindset of plenty and that what profited in prior years are not dispensable money.

Cory

2020-0115

Jan 7, 2020

Cory Diary: Short Coming of Cumulative XIRR of Lifetime Result

Has been in market for more than 15 years. Over the years strategy changed with ones experience and learning. Sometime change for the better, sometimes worst. One indication is using Cumulative XIRR across all trades through the years.

For Cory, due to strong performance in 2019, the Cumulative XIRR since 2007 is now 7.2% as above. However this is from 2007 when Cory is still young man with all sort of ideas.

How good is it to measure progress over time. Logically the cumulative will have to go up. But is this assumption right ? Let's try another table by injecting additional 10k profit into 2 scenarios. First scenario in Year 2007 and the second scenario in Year 2019 below.

From the above table, there are much larger improvement in the score in 2007 ( 7.54% ) which is much more than Year 2019 ( 7.36% ) can provides. This is probably due to portfolio size and compounding over the years. What this mean is that it will be harder to push up the cumulative value even with good performance in later year. It will have take few more good years to see recovery.

To overcome this issue, we may have to use rolling years to accommodate this limitation. Here's the table. So you can see at 13th, 10th and 7th Years period ... is down trend.

Now, if we have a major strategy change 7 years ago, we could see the progress at 5 years, 3 years and 1 year ago. This way "very past" performance do not cloud the future view.

What I am still deliberating is.... if a Guru has fantastic performance in his early years of investment life, will his performance stick with him for later years using cumulative metrics ?

Cory

2020-0107

For Cory, due to strong performance in 2019, the Cumulative XIRR since 2007 is now 7.2% as above. However this is from 2007 when Cory is still young man with all sort of ideas.

How good is it to measure progress over time. Logically the cumulative will have to go up. But is this assumption right ? Let's try another table by injecting additional 10k profit into 2 scenarios. First scenario in Year 2007 and the second scenario in Year 2019 below.

From the above table, there are much larger improvement in the score in 2007 ( 7.54% ) which is much more than Year 2019 ( 7.36% ) can provides. This is probably due to portfolio size and compounding over the years. What this mean is that it will be harder to push up the cumulative value even with good performance in later year. It will have take few more good years to see recovery.

To overcome this issue, we may have to use rolling years to accommodate this limitation. Here's the table. So you can see at 13th, 10th and 7th Years period ... is down trend.

What I am still deliberating is.... if a Guru has fantastic performance in his early years of investment life, will his performance stick with him for later years using cumulative metrics ?

Cory

2020-0107

Dec 1, 2019

Cory Diary : Performance Nov'19

The month ended with one of the most actions seen on Reits in Cory Portfolio this year.

1. Ascendas Reit Rights Issue

2. FCOT Halts

3. Accordia Golf Tr Potential buyer

4. SPH Reit Private Placements

5. MINT acquisitions of DCs

6. Aims Apac Reit books building exercise

Performance Tracker

STI Index continues to reel from Trade War falls out which means well for yield assets. Interestingly, DJIA hits new 28K records with strong jobs report despite on-going trade tariffs. Cory Portfolio has to work harder to keep up with the score with increasing exposure to banking.

Cory

2019-1201

Nov 17, 2019

Cory Diary : Wake-up Call - Performance Mid-Nov'19

When China mentioned that they are close to a trade deal, this send a shocker to the market used to flip-flop sending investors to good safe haven equities of good dividend returns. A strong recipe for good quality REITs locally. The good news send a little cooling of sizable reduction in share prices not seen for some period of time on surprisingly strong quality counters. Is market finally feels is real ?

This is a wake-up call to Cory who just got his portfolio ready for 2020 and now has to do another re-balance. Took some rather drastic and decisive actions to re-balance the portfolio by profit level as the previous assumption were always defensive is good except how to is a big question. The learning is we see FCT, CMT, Ascendas Reit, MCT, MINT etc driven down much lower than other REITs of lower quality is humbling. The rationale is interesting but something to explore with on other time.

This is a wake-up call to Cory who just got his portfolio ready for 2020 and now has to do another re-balance. Took some rather drastic and decisive actions to re-balance the portfolio by profit level as the previous assumption were always defensive is good except how to is a big question. The learning is we see FCT, CMT, Ascendas Reit, MCT, MINT etc driven down much lower than other REITs of lower quality is humbling. The rationale is interesting but something to explore with on other time.

In another front, if we could remember, Ascendas Reit has quite a large discount in it's Rights. After Ex-rights and Ex-dividend, price was driven much lower in subsequent days. At 5.7% yield, this is attractive, and Cory took the opportunity to expand more at $2.88. Yes, Cory still loves good quality Reits especially at cheaper price.

Today, DJIA broke 28,004 and STI Index is at higher 3228 level. Cory XIRR 22.6% YTD. Profit Yield ( Profits / [Total Portfolio + Investment Cash] ) at 18%. Just another reminder that strategy has to be nimble to accept change to counter the unexpected and assumption.

(updated for privacy) - Cory aren't complaining as is better to sleep well with some profit buffers. Yes, Cory has a bazooka right now. A good problem to have for Year 2020.

Cory

2019-1116

Labels:

ASCENDAS REIT,

Performance,

Portfolio

Oct 26, 2019

Cory Diary : Performance Oct'19

Oei ! Too early lah. Still got a week leh. What's the hurry uncle ?

Next week uncle no feel good leh. Don't be so rigid can ? ( Uncle Cory cheated the time to report good result cannot meh.... )

Seriously why today ? ... All Time High ( ATH ) lah. Next week not sure can maintain or not. I don't want to miss the mountain ... so report first. Shiok right. Lucky Cory Portfolio is not listed else sure kenna ....

Why Cory worry ? Let's look at STI first ....

Based on CoryLogics, STI approaching a resistance after bouncing off from multi-year support as expected else it will be major correction at minimum. See link on last reasoning in Aug. i think which is basically a broad strategy this year on STI Performance in earlier articles as well. And well I am comfortable to have large stake in STI Index as a buffer for Reits profitability protection.

Finally cleared Facebook. Portfolio now all Singapore team. YTD Cory Xirr 19.1%. (updated for privacy). If we remove Bonds/Preference holdings, Portfolio would have been 23.1%. STI Index 3.81% (excluding dividend).

What's next ? Lack of ideas now. Thinking how should I further protect my profits but need to stay vested for rest of year and ensuring enough dividends for next year. So many asks. So little ideas.

On top of this I have different ideas coming up for next year.

1. Re-Balance some part of my portfolio to lower cost fees

2. Holding back purchases maybe to later part of next year

3. Key deliberation on Bank Stocks, Bonds and Preference Shares Strategy

Cory

2019-1025

Next week uncle no feel good leh. Don't be so rigid can ? ( Uncle Cory cheated the time to report good result cannot meh.... )

Seriously why today ? ... All Time High ( ATH ) lah. Next week not sure can maintain or not. I don't want to miss the mountain ... so report first. Shiok right. Lucky Cory Portfolio is not listed else sure kenna ....

Why Cory worry ? Let's look at STI first ....

|

| STI Long Term Bull, Short Term Dunno ! |

Based on CoryLogics, STI approaching a resistance after bouncing off from multi-year support as expected else it will be major correction at minimum. See link on last reasoning in Aug. i think which is basically a broad strategy this year on STI Performance in earlier articles as well. And well I am comfortable to have large stake in STI Index as a buffer for Reits profitability protection.

Finally cleared Facebook. Portfolio now all Singapore team. YTD Cory Xirr 19.1%. (updated for privacy). If we remove Bonds/Preference holdings, Portfolio would have been 23.1%. STI Index 3.81% (excluding dividend).

What's next ? Lack of ideas now. Thinking how should I further protect my profits but need to stay vested for rest of year and ensuring enough dividends for next year. So many asks. So little ideas.

On top of this I have different ideas coming up for next year.

1. Re-Balance some part of my portfolio to lower cost fees

2. Holding back purchases maybe to later part of next year

3. Key deliberation on Bank Stocks, Bonds and Preference Shares Strategy

Cory

2019-1025

Oct 9, 2019

Cory Diary : All in Our Minds

There are many times I am asked to take profits. Reason being people has the conception that cash is the safe harbor. A rest point before we venture out again. This mindset is not wrong when one trades for a living especially speculative short trade.

Post today is I hope to share how Cory thinks from another perspective. Often we hear people make so and so $Xx,xxx but then lose it all or worst in negative. The angle I do is to treat profit earned as part of base capital in every new year.

Post today is I hope to share how Cory thinks from another perspective. Often we hear people make so and so $Xx,xxx but then lose it all or worst in negative. The angle I do is to treat profit earned as part of base capital in every new year.

Let's say I started with $500k in 2018 and ended with $580k. That's 80k profits. In Year 2019, I will treat $580k as my new cost structure (or base capital) thereby zero-out my profit. Why we do this is to overcome the human weakness of "Feeling Rich" and lose them back to the market.

When we do this long enough, for some reason cutting loss is more a mechanic nature rather than a pain-in-the-heart. Interestingly, we could also sell a stock at say $1.50 near end of Year 2018 but buy them back in Jan 2019 at much higher price sold earlier. Is like hyped on a Jan market trend trading mechanism. Fortunately, I do't this often ! Cory aren't crazy but it does happen sometimes .... ... ...

Since Cory Portfolio is ignited on every first day of new year, safe harbor has no meaning from previous year trades. Therefore, Cory result is often Year-to-date (YTD) meaning is the measure of Profit or Loss from 1st Jan base to current date figure. This keeps Cory on toes and not feeling rich. Historical past year trades are just for "Glorification" use only, nothing else.

If Cory feels the market going to crash like 2008 GFC, he can relieve all his counters as he wanted but that's not because he has make enough profits. There is no relevancy between getting out-of-market and having make or loss enough.

Is all in our minds.

Cory

2019-1008

Post today is I hope to share how Cory thinks from another perspective. Often we hear people make so and so $Xx,xxx but then lose it all or worst in negative. The angle I do is to treat profit earned as part of base capital in every new year.

Post today is I hope to share how Cory thinks from another perspective. Often we hear people make so and so $Xx,xxx but then lose it all or worst in negative. The angle I do is to treat profit earned as part of base capital in every new year.Let's say I started with $500k in 2018 and ended with $580k. That's 80k profits. In Year 2019, I will treat $580k as my new cost structure (or base capital) thereby zero-out my profit. Why we do this is to overcome the human weakness of "Feeling Rich" and lose them back to the market.

When we do this long enough, for some reason cutting loss is more a mechanic nature rather than a pain-in-the-heart. Interestingly, we could also sell a stock at say $1.50 near end of Year 2018 but buy them back in Jan 2019 at much higher price sold earlier. Is like hyped on a Jan market trend trading mechanism. Fortunately, I do't this often ! Cory aren't crazy but it does happen sometimes .... ... ...

Since Cory Portfolio is ignited on every first day of new year, safe harbor has no meaning from previous year trades. Therefore, Cory result is often Year-to-date (YTD) meaning is the measure of Profit or Loss from 1st Jan base to current date figure. This keeps Cory on toes and not feeling rich. Historical past year trades are just for "Glorification" use only, nothing else.

If Cory feels the market going to crash like 2008 GFC, he can relieve all his counters as he wanted but that's not because he has make enough profits. There is no relevancy between getting out-of-market and having make or loss enough.

Is all in our minds.

Cory

2019-1008

Labels:

Dividend Investing,

Maths,

Performance

Oct 5, 2019

Cory Diary: Importance of staying invested 2019-1005

Importance of staying invested to beat inflation is a psychological battle after GFC 2008. People tend to wait for the next major crisis or at least a correction. This is especially so when we have many headline news or risks and worries.

While the concept is possible in theory, the timing or execution is not easy reason being because of the opportunity costs. Reits yield over the years have climbs down from double digits to 5% range. However, the cumulative capital gains and dividends are of considerable size. (See table)

The Gratification comes in when we go beyond inflation beating to actually profiteering from our investment. And to see our portfolio continuously growing in good years while mute in down. Overall, we just need to see more ups than downs to win the game.

Recession Fear as we are on our 11 years of economic growths since Year 2008. 2020 could be mute or small increase in profitability. What I could do is to continuously apportion my portfolio to more "Fixed returns" by percentage while in absolute number can still be larger in non-fixed investment. This could protect my down side while continuously to have larger growth in portfolio size through re-balancing. That's the strategy.

Cory

2019-1005

Oct 1, 2019

Cory Diary : Portfolio Sector Allocation Report

Has been away for a week long family holiday .... ( Fretting ). Expenses are like shooting star right now. Original plan today is to write something on expenses but 10/1 comes up and probably is more exciting to update how is Cory Portfolio so far first.

Cory Top 7 Equity Investments

1. STI ETF

2. Ascendas Reit

3. Frasers Bond

4. Frasers Com Trust

5. Ascendas-h Trust

6. VICOM

7. Mapletree Ind Trust

Cory Portfolio has Bond/Pref to calm his porcelain heart. He can't take much stress. The index do their numbers too which totaled with Fixed investment hits 33.7% allocation. To calm further, Cory has SSB outside Equity Portfolio which is use to support Housing Loan (Emergency). This damped investment returns but is done deliberately.

Telco allocation is actually Netlink BNB Trust. The position is relatively small after taking profits. Telco stocks are struggling a little so is better to avoid for now. Of similar size is the Banks which provide a little upside volatility.

Particularly excited about Ascendas Reit because as previously reported scope more on higher low. Managed to buy some MINT back as well though is net negative. VICOM has been a cool winner considering Cory is late in the game on this one. Is better to be late than never. Key is to size our position appropriately so that we can average down nicely or enjoy the ride up.

Cheers

Cory

2019-1001

Labels:

Performance,

Portfolio,

Sector Distribution

Aug 30, 2019

Cory Diary : Portfolio Resilience August Report

STI Index has major roller coaster rides this year. The most recent one is just this month when it erases all it this year winning and then creep back up a little to end at +1.23% YTD. After dividends, probably +4% range.

How did Cory Portfolio performs ? If we are to use the relative perform chart against STI, End Jun report is Here and Early Aug in Here. Iran conflict did not happen. I was trying to secure the widened gap. Let's look how it goes.

Year-to-Date

(updated for privacy)

Cory Portfolio : 15.8% which came down from 18.x% range

excluding fixed instruments (ie bond) : 19.2%. This is mainly due to weakness in Banks, STI ETF and lastly Mapletree NAC Tr (Black-swan - HK Riots/RMB Depreciation).

(updated for privacy)

Overall portfolio outperforms STI by 11.x% so far this year. There are some changes in portfolio mix which I will elaborate in later blogging.

Cory

2019-0830

How did Cory Portfolio performs ? If we are to use the relative perform chart against STI, End Jun report is Here and Early Aug in Here. Iran conflict did not happen. I was trying to secure the widened gap. Let's look how it goes.

Year-to-Date

(updated for privacy)

Cory Portfolio : 15.8% which came down from 18.x% range

excluding fixed instruments (ie bond) : 19.2%. This is mainly due to weakness in Banks, STI ETF and lastly Mapletree NAC Tr (Black-swan - HK Riots/RMB Depreciation).

(updated for privacy)

Overall portfolio outperforms STI by 11.x% so far this year. There are some changes in portfolio mix which I will elaborate in later blogging.

Cory

2019-0830

Labels:

MAPLETREE NAC TR,

Performance,

STI ETF,

STI Index

Aug 7, 2019

Cory Diary : laparoscopic cholecystectomy

If anyone wondering what the hell it is, I went for ER more than a week ago and end up for laparoscopic cholecystectomy surgery on the same day. Basically to remove my gall bladder and to solve other complication. I would say this is one of the unpleasant surprises I have this year.

Mood swing from positive to delight to negative to very negative .... and then mood came back positive day by day ... all within the span of one week. Sounds like stock market huh ? My wife needs to cheer me up during this period. Think I did more than 10 X-rays ....as well. Fortunately I did not fall into depression from my medical conditions. However, I did loose significant interests to trade considering I am bedridden literally for a week and 5kg lesser.

To be frank, during this "Horrific Period", I took a couple of seconds to glance on my counters despite my mood swings. Today I am back on my desk, to tally up my dividends and portfolio value. What a change for STI gaping down (data points as and when I update my data) to 3170. That's put it just 3.3 % gains this year before dividends.

As for Cory Portfolio I am kind of surprise that XIRR still hold a good 15% YTD or Portfolio yield of 14% range. Do a double check for errors which seems good. The only explanation is that Reits again held up very well as we are compensated by dividends during current turbulent period which also probably gives the impression that the Reit market is sliding more than it was.

I am not sure is time for shopping. I do have some fund in cash management account to boost my portfolio yield (updated for privacy) . My timing on Reits do not have good track record so to speak.... but if I could find something stable for 6% I would grab. That's leave "little" candidates .... to speak of.

Cory

2019-0807

Mood swing from positive to delight to negative to very negative .... and then mood came back positive day by day ... all within the span of one week. Sounds like stock market huh ? My wife needs to cheer me up during this period. Think I did more than 10 X-rays ....as well. Fortunately I did not fall into depression from my medical conditions. However, I did loose significant interests to trade considering I am bedridden literally for a week and 5kg lesser.

To be frank, during this "Horrific Period", I took a couple of seconds to glance on my counters despite my mood swings. Today I am back on my desk, to tally up my dividends and portfolio value. What a change for STI gaping down (data points as and when I update my data) to 3170. That's put it just 3.3 % gains this year before dividends.

As for Cory Portfolio I am kind of surprise that XIRR still hold a good 15% YTD or Portfolio yield of 14% range. Do a double check for errors which seems good. The only explanation is that Reits again held up very well as we are compensated by dividends during current turbulent period which also probably gives the impression that the Reit market is sliding more than it was.

I am not sure is time for shopping. I do have some fund in cash management account to boost my portfolio yield (updated for privacy) . My timing on Reits do not have good track record so to speak.... but if I could find something stable for 6% I would grab. That's leave "little" candidates .... to speak of.

Cory

2019-0807

Jul 8, 2019

Cory Diary : Cumulative Returns

In stock investment, one can "strike lottery" once in a while but to truly and really make sustainable returns, the logical way is to track it through Cumulative XIRR to reflect long term returns.

What this mean is to annualized all your years of investment returns and have them compounded into a return figure. Only then we can truly understand where we stand on our ego memory or actual returns. This will also give us a view on sustainability or a "2008 GFC" can wipes out all our "career gains".

The tracker started on 2007 of sizable portfolio therefore STI Index of that year. For STI Index, the condition is no fresh injection and no re-investment for simplification. At the end of 12.5 years, STI Index returns is 0.5% annualized excluding dividends. Cory Portfolio hits 7.4% annualized and same period across 12.5 years.

Cory

2019-0708

Cory

2019-0708

Jun 28, 2019

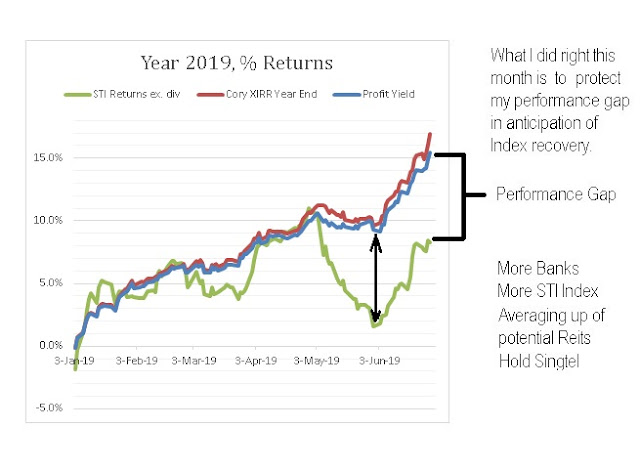

Cory Diary : Securing lead in Performance 2019-0628

Month of June has been incredible. A recovery of Index with continuous upward price swing on selected Reits and Trusts. The final return will be known tonight after the US market ends(updated). This post is about how I ensure the gap continues. Here's links on my goal to ensure the performance is maintained.

https://corylogics.blogspot.com/2019/06/cory-diary-mexico-tariffs-cory.html

https://corylogics.blogspot.com/2019/05/cory-diary-volatile-sti.html

Despite high number of Reits/Trusts in my portfolio, achieved 100% strike for 5 digits gain on each. Having enlarged Banks investment as blogged earlier to help me catch up with the rising Index works well. Singtel seems bottomed but I do not want to average up yet as I like to reserve my funds for opportunity.

Result: XIRR YTD: 17% (slightly higher due to some realised gains), Profit Yield: 15.4%, Total Profit 1st Half YTD : $147,723 (Realised/unrealised including dividends), Expense Ratio 0.35%, XIRR Non-Fixed YTD: 20.6% (Removing Bond/PS elements). Despite that, I am happy with them as they gives me confidence to map out my investment strategy as my investment needs to be risk managed.

Personally I have a bit of fear on Iran conflict to be worsen other than on-going trade war. This will affect Oil price which will have implications on my equity investment. Therefore, in the last weeks, took some defensive moves after achieving my aims of preserving my performance with rising STI Index. I will blog later on them when I go through the bubble chart.

I do not have fresh injection into the portfolio this year. Instead I have tapped some of my saving fund into SSB to max it out which mean continue with no fresh fund injection probably for rest of year. July will be interesting as my portfolio has been moving towards more defensive postures.

Cheers

Cory

2019-0628

https://corylogics.blogspot.com/2019/06/cory-diary-mexico-tariffs-cory.html

https://corylogics.blogspot.com/2019/05/cory-diary-volatile-sti.html

Despite high number of Reits/Trusts in my portfolio, achieved 100% strike for 5 digits gain on each. Having enlarged Banks investment as blogged earlier to help me catch up with the rising Index works well. Singtel seems bottomed but I do not want to average up yet as I like to reserve my funds for opportunity.

Result: XIRR YTD: 17% (slightly higher due to some realised gains), Profit Yield: 15.4%, Total Profit 1st Half YTD : $147,723 (Realised/unrealised including dividends), Expense Ratio 0.35%, XIRR Non-Fixed YTD: 20.6% (Removing Bond/PS elements). Despite that, I am happy with them as they gives me confidence to map out my investment strategy as my investment needs to be risk managed.

Personally I have a bit of fear on Iran conflict to be worsen other than on-going trade war. This will affect Oil price which will have implications on my equity investment. Therefore, in the last weeks, took some defensive moves after achieving my aims of preserving my performance with rising STI Index. I will blog later on them when I go through the bubble chart.

I do not have fresh injection into the portfolio this year. Instead I have tapped some of my saving fund into SSB to max it out which mean continue with no fresh fund injection probably for rest of year. July will be interesting as my portfolio has been moving towards more defensive postures.

Cheers

Cory

2019-0628

Jun 1, 2019

Cory Diary : Mexico tariffs - Cory Performance 2019 May

This can be viewed as a continuation of STI Volatility article here. This update unfortunately faced Mexico Tariffs on the last trading day of the month and we see adverse dip in ST Index. This also marked Sell-in-May and go away complete.

Had a few conference calls with my colleagues in preparation for China Tariffs and now have to absorb the impact of Mexico Tariffs. Trump is keeping my brain busy. We know from day one that there will be some exodus of manufacturing out-of-China however how much and how long it takes still to be determine.

This basically boils down to what level of manufacturing is considered Not made in China. And everyone probably trying to do the minimum cut-off and finish the final product somewhere else. Asean, Taiwan, Korea, Japan and Mexico probably benefits the most from this trade war in term of job creation. This may means well for Singapore as regional HQ. Hong Kong may lose out.

We do know that if we are kept long enough outside China and if deep enough, we probably won't be moving back to China. For America market, naturally Mexico will be an ideal site due to abundance labors and lands. However for supply chain eco-system to work more smoothly, proximity to China will be better.

What will be the end game will be interesting to find out. The world may never be the same again.

Bye ... baby awakes now.

Cory

2019-0601

May 26, 2019

Cory Diary : Dividend Report Card 2019-0526

Cory Dividend Report tracks Cumulative and Annual Dividends.

Cumulative (Right Axis) has reached $294,000. With the rate we are going, it will only takes 3 to 4 more years to hit $500K mark and probably another 5 years to accumulate to $1M theoretically. This comes with Dividend Strategy.

For Annual Dividend perspective, accumulated $22K in 5 months. This amount only include counter that has ex-dividends in 2019. If my annual salary saving is also $22K, my saving has speed up by 100% by now isn't it ? That's the power.

However, all this is meaningless if over time which I mean portfolio value (realized and Unrealized) has decreased. So is important we track them as well as in below chart from SG Equity mainly.

One thing I did that helps with increasing portfolio size is to minimize the draw down. This provide a good boost. To manage risk, the portfolio which are mainly SG Equity is one of my future Retirement support. In addition to Pension, I also have Cash, Property, Gov securities and Fixed deposits which are growing in tandem. One thing which I agree, that we have to watch carefully is Insurance as well.

Cory

2019-0526

Cumulative (Right Axis) has reached $294,000. With the rate we are going, it will only takes 3 to 4 more years to hit $500K mark and probably another 5 years to accumulate to $1M theoretically. This comes with Dividend Strategy.

For Annual Dividend perspective, accumulated $22K in 5 months. This amount only include counter that has ex-dividends in 2019. If my annual salary saving is also $22K, my saving has speed up by 100% by now isn't it ? That's the power.

However, all this is meaningless if over time which I mean portfolio value (realized and Unrealized) has decreased. So is important we track them as well as in below chart from SG Equity mainly.

One thing I did that helps with increasing portfolio size is to minimize the draw down. This provide a good boost. To manage risk, the portfolio which are mainly SG Equity is one of my future Retirement support. In addition to Pension, I also have Cash, Property, Gov securities and Fixed deposits which are growing in tandem. One thing which I agree, that we have to watch carefully is Insurance as well.

Cory

2019-0526

May 23, 2019

Cory Diary : Volatile STI

Volatility

The picture has changed so much for STI. Banks were hammered down. In addition to the Trade War the new concern is the virtual bank licensing. The Reits / Trusts generally do much better that even the weaker ones make the Banks look bad.

I did a bottom fishing on STI ETF to support the gap in performance between the ETF and me. However, it seems STI ETF still has some distance to go further down as the next tariffs of US$300 B is going to be major. Companies should be making preparation for this as this could hit China manufacturing with more substance whereas previously maybe just on finishing touch of products.

I think War Chest is more essential today than few days ago as the market trend seems getting a little nervous. While I hold the view that stable Reits are like "Fixed Deposits", this is based on the opinion that DPU remains stable and Investor ignore Capital Gain/Loss. So any significant market changes, if any, to hit this class of asset, this may even present good opportunity for the fund to expand. Question is how deep ?

Feeling bored and thinking.

Cory

2019-0523

May 13, 2019

Cory Diary : Shaky Shaky - Market on brink of ...

Relative Performance is like a bitch but I like it. Keeps me on my toes. There is also a deep secret which I have been studying for some time that is to use it to do re-balance between STI ETF against my portfolio. That way I could theoretically increase my odds to beat Strait Times Index.

Using Cory Barometer above, the gap is widening so maybe good time to plunge into STI ETF. However, Uncle scare scare. Almost try DBS but also scare scare. Okay okay. How about buying back Mapletree Ind Tr ? Also scare .... glad that I raised some cash.

In the end, Cory Gene Strategy : Freeze..... ( Think I am crazy ? Ignore me )

Cory

2019-0513

Apr 14, 2019

Cory Diary : Equity Performance 2019-0414

Not surprisingly my portfolio benefited from it as I continue to stay invested and more. Reits and Trusts did well during this time. Frankly, the broad market did good too..

If I do away with Fixed investment, Xirr hits 10.7% using end date at year end to account for annualized full year without further gains. Closely correlated to current 10% profit range.

Moving forward how ?

Assuming STI Index continues to climb which is my personal expectation (DYODD), Index level of 3600 appears to be potential. That's a 8% climb from here. Is that possible ? A check on CMT will reach 4.6% yield. Ascendas will be 5.1%. In a ever lowering yield world, investors could still be happy. So It can happen. Will it ?

Cory

2019-0414

Mar 3, 2019

Cory Diary : US Stocks enjoying nice rebound

Last year is bad for US stock investors. This year for the first 2 months have seen strong rebound. Hopefully it stays. Below table is the YTD returns of US stocks that I am tracking.

One thing realised is that if there is nothing fundamental change in the company, US stock can swing like crazy. Therefore, ability to hold seems key. On the other hand, if I have average down, returns would have been awesome. Indeed land of opportunity.

Cory

2019-0303

One thing realised is that if there is nothing fundamental change in the company, US stock can swing like crazy. Therefore, ability to hold seems key. On the other hand, if I have average down, returns would have been awesome. Indeed land of opportunity.

Cory

2019-0303

Mar 1, 2019

Subscribe to:

Posts (Atom)