CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Jan 23, 2024

Cory Diary : Cash Flow against Assets Investment

Jan 9, 2024

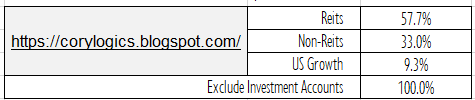

Cory Diary : Investment Ratios

The first ratio is how much liquidity on current assets that i can move easily. This give me an idea if I am to ramp up my equity portfolio to support war chest.

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Jan 4, 2024

Cory Diary : Year 2023 Equity Learning Part 2

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Dec 12, 2023

Cory Diary : Investment Plan for 2024, Navigating Through High Inflation

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Sep 26, 2023

Cory Diary : Expensive Ventures

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Aug 28, 2023

Cory Diary : Net Worth Tracking 2023-08

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Jul 24, 2023

Cory Diary : Reflections on the US Market and Singapore Investments

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Jul 17, 2023

Cory Diary : Managing Volatility Emotion

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Feb 15, 2023

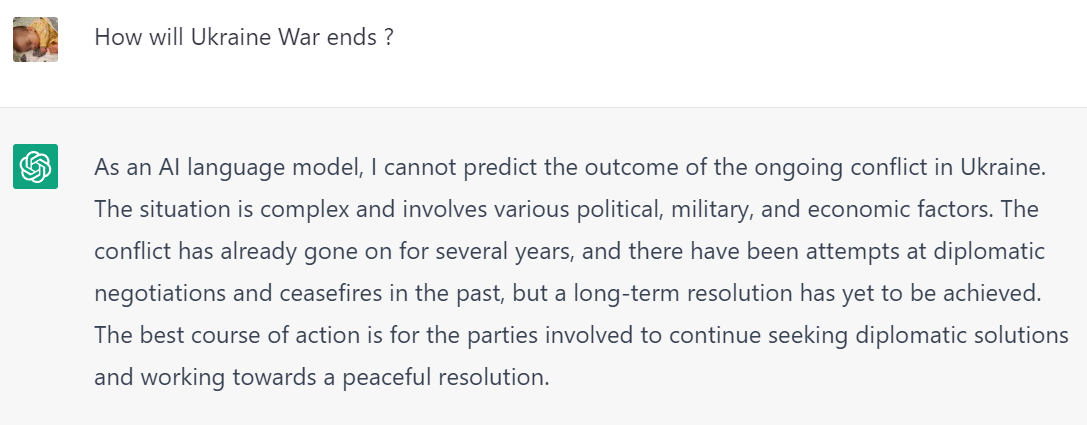

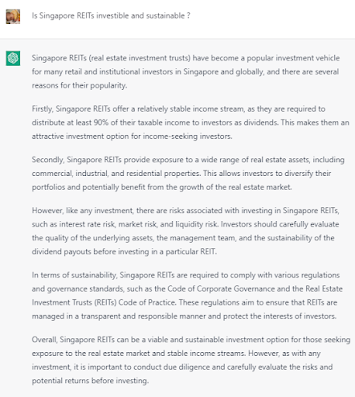

Cory Diary : Investment Questions to ChatGPT

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Feb 5, 2023

Cory Diary : Net Worth 2023 Feb

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Jan 16, 2023

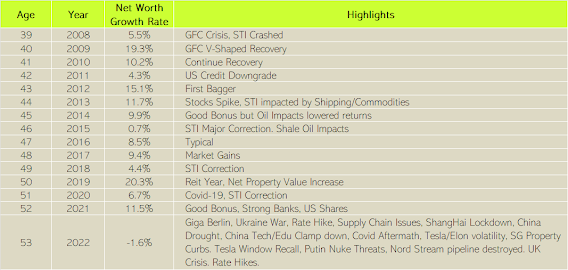

Cory Diary : Year 2022 Performance

There is another plus that mitigate the fall which is property value has gone up slightly in Year 2022.

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Dec 29, 2022

Cory Diary : Financial Investment Updates

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Nov 20, 2022

Cory Diary : Stagflation - Net Worth

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Nov 10, 2022

Cory Diary : Hedge of Cory Portfolio

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Aug 9, 2022

Cory Diary : Green SGS Bonds

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Jul 14, 2022

Cory Diary : How much is Enough in CPF ?

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Jun 11, 2022

Cory Diary : Time will Pass - Don't let the correction go to waste

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Jun 5, 2022

Cory Diary : Interest Rate v Reit Prices

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Jun 3, 2022

Cory Diary : 20-year annualized returns by Asset class

2022-0603

CoryLogics Invest Chat - No Coin, No Porn, No Penny

May 28, 2022

Cory Diary : Pricing Power

2022-0528

CoryLogics Invest Chat - No Coin, No Porn, No Penny