US Market ( Nasdaq )

In recent times, the US market, specifically Nasdaq, seems to have completed a significant run-up. Despite Tesla showing decent growth results, it experienced a correction on the second day. This reminds us that the market will always find a reason to sell. Microsoft also followed suit with lower volatility. Looking at the three-year performance of just these two US stocks, it appears that I am almost breakeven, with only a modest 15k gain if I were to consider all US shares held during the past three years. This experience has taught me that growing out of dividend plays in the SGX market is not as easy as it seems. Timing plays a crucial role in the US market, and its wild volatility can lead to valuation fluctuations with each reporting or news release. Consequently, it is wise to avoid chasing stocks, especially when there are no or little dividend gains for holding them long-term.

Singapore Market

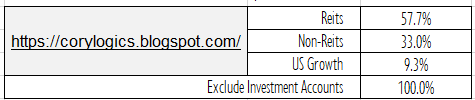

On the other hand, Singapore banks have experienced some revival due to recent Fed hawkishness, balancing out the hits on Reits. I have observed that the recent rights issue on iReit and Aims Apac Reit have been profitable, but the discounts are not as substantial as in previous years, resulting in less impressive gains. My current allocation is as shown above, with some USD cash remaining from earlier sales. Given the current lower US rate, I am undecided on whether to hold it until the next bottom cycle and park it in a high-interest rate account or convert it back to S$.

As I review my equity portfolio, it is becoming harder to rotate stocks, particularly since Fed rate hikes may have already peaked. The sell-off in Reits, however, presents a promising opportunity for investors as we could see significant capital gains alongside regular dividends in the future. I plan to maintain a cash reserve for the last one or two rate hikes or potential recession sell-offs, if any. This strategy could lead to another record-level annual dividend, and the opportunity is quite apparent.

Passive Income Reporting

Additionally, I've noticed a new trend in my financial planning that better suits me. I have shifted away from reporting Net Worth Pie Chart segment allocations to focus on Passive Returns ( Non-Salary based returns or other returns). This change comes from the realization that using asset methodology doesn't directly help me with my expenses. However tracking Passive Income gives me a gauge on income once I retire. Currently reporting excludes my partner.

Using the listed amount in the table, I have a good idea how they fit into my expenses. And how much I need to grow or control.

In the past three months, I have invested more into T-Bills, primarily adding an additional $2,350. There was also a slight increase in my CPF investments, though I am cautious about doing so since I am nearing 55 to fit my personal plan. I've learned to avoid this unless there is a significant boost in cash levels from an euphoric market. Please note that CPF is not tracked in this table and is currently treated as a bonus retirement amount at 65.

While there have been upticks in equity dividends from rights issues, I've sacrificed a significant amount of cash for safer investment allocations in the past three months. Currently, I am monitoring my cash levels carefully to ensure my T-Bills are adequately spread out to support property loans or meet any cash needs comfortably.

Overall, my experiences in the US market and the shifts in my investment approach have provided valuable lessons, which I hope will continue to guide my financial decisions moving forward

Cory

2023-0724

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Telegram CoryLogics <= Link to Telegram Chat

Disclaimer: The articles presented in this blog reflect personal opinions and are intended for informational and sharing purposes only. Readers are advised to seek professional guidance when making financial decisions and should take full responsibility for their choices.

No comments:

Post a Comment