When I last blogged about CMT in 28th Jan'17, the stock price on 31st Jan'17 was $1.94. For people who are interested can refer to earlier blog article on CMT 4Q16 HERE. Since then, what has happened ?

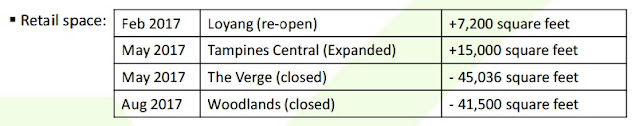

There were no distribution since we just Ex-div in 26th Jan'17. Stock price $2.01 as of today 20th Apr'17. Gain of 3.6%. CMT posts today 20th Apr'17 after trading hours, stable 1Q 2017 distribution per unit of 2.73 cents. Achieves higher distributable income despite closure of Funan for redevelopment. Result as below table. As at 31 March 2017, CMT’s average cost of debt and aggregate leverage were 3.2% and 35.3% respectively.

The next table is the comparison with other investment. I let the table speaks to you. If we are to invest in 12 month fixed Deposit in XXXX for 0.35% return, it will takes collective 16 years ! How many 16 years do we left ?

The last table is CMT properties. They are major name locally. As mentioned in my previous article, very hard to go wrong with this REIT. Stock Price will fluctuates with Market Sentiments no doubt but which direction will it goes long run ?

Further update - 20170421

CMT’s 40.0% interest in Raffles City Singapore and 30.0% interest in Westgate.

Cory

20170420

There were no distribution since we just Ex-div in 26th Jan'17. Stock price $2.01 as of today 20th Apr'17. Gain of 3.6%. CMT posts today 20th Apr'17 after trading hours, stable 1Q 2017 distribution per unit of 2.73 cents. Achieves higher distributable income despite closure of Funan for redevelopment. Result as below table. As at 31 March 2017, CMT’s average cost of debt and aggregate leverage were 3.2% and 35.3% respectively.

The last table is CMT properties. They are major name locally. As mentioned in my previous article, very hard to go wrong with this REIT. Stock Price will fluctuates with Market Sentiments no doubt but which direction will it goes long run ?

Further update - 20170421

CMT’s 40.0% interest in Raffles City Singapore and 30.0% interest in Westgate.

Cory

20170420