Is another profitable period for Sheng Siong. A growth and relative good dividend stock. The Rev/Profit growth is so persistent that every quarter seems like a norm. What I like most is it provides basic essentials therefore relatively recession proof. A mix of growth and yield stock, how much growth imo depends on how fast it can expands and idle cash available to support the expansion considering profit is mainly distributed out.

This is cut and paste Key Notes

Dividends

"Propose a final cash dividend of 1.85 cents per share, taking our total dividend for FY2016 to 3.75 cents per share, equivalent to about 89.9% payout on our net profit after tax." That's roughly 4% yield.

Growth

"The Group is still looking for suitable retail space particularly in areas where the Group does not have a presence. However, competition for retail space has not abated and looking for suitable retail outlets may be challenging." There is still enough cash to expand for growth.

Risk

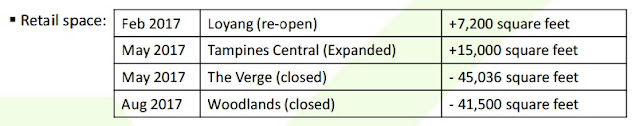

"The Verge and Woodlands Checkpoint supermarkets which were to close on 30 April

and 30 June 2017 respectively as the landlords will be re-developing the sites have now been extended to 31 May and 31 August 2017. These supermarkets contributed 8.6% to FY2016’s revenue."

Without looking into details, appears mitigated by staggered closure, continue store growth and existing sales growth.

Cory

20170223

|

| Sheng Siong 4Q'16 |

This is cut and paste Key Notes

Dividends

"Propose a final cash dividend of 1.85 cents per share, taking our total dividend for FY2016 to 3.75 cents per share, equivalent to about 89.9% payout on our net profit after tax." That's roughly 4% yield.

Growth

"The Group is still looking for suitable retail space particularly in areas where the Group does not have a presence. However, competition for retail space has not abated and looking for suitable retail outlets may be challenging." There is still enough cash to expand for growth.

Risk

"The Verge and Woodlands Checkpoint supermarkets which were to close on 30 April

and 30 June 2017 respectively as the landlords will be re-developing the sites have now been extended to 31 May and 31 August 2017. These supermarkets contributed 8.6% to FY2016’s revenue."

Without looking into details, appears mitigated by staggered closure, continue store growth and existing sales growth.

Cory

20170223

No comments:

Post a Comment