Trump twittered to increase taxes to 15% on $300B and remaining ... etc. This is in response to Chinese PRC increase tariffs on American products.

Frankly, the import of American goods to China is far lesser than China exports. Any increase in tariffs now is like whipping a dead horse after several rounds of retaliations. In all it's purpose, China latest response is for local consumption mainly FACE and probably upholding President Xi power base. Unfortunately, President Trump aren't the type who can lose face either. Furthermore this help America interests and his voting base to provide reason to further isolate China from America Economy to prevent a China near term rise to challenge America power presumption.

( LKY has said before as long China has peaceful development provided The PRC Chinese holds their horses they would reach their Super Power status. What a wise word said so long long ago. The key meaning therefore is "Provided" which appears no longer able to uphold Economically in Trade and Militarily in South China Sea)

With Tariffs card played out, China only left with mainly Currency or Financial instruments to continue the game. They have chosen currency which is the start of RMB weakening. This will be a down slope trend. So anyone holding to Forex exposure could be at risk. In reality, there could be upheaval in the market. And selling US treasuries to protect will likely to happen. This is a dual sword as it will weaken USD and further improve American business competitiveness that Trump has been begging Fed for.

Meantime, in any MNC industries, after such a long period of tariffs gestation, most are ready to switch to alternate countries on the go. There will be some pain but it would help to spread the wealth to regional countries rather than consolidate manufacturing base to a single country to benefit from. This will happen as is not just intellectual protection and fair trade. Is about containing China rise and ensuring America continues to be the only super power.

Maybe if China has cooperated early in the game, the extend of the damage to Chinese economy could be managed. I think we could be at a point of no return now and any compromise will likely requires China to give up a lot more such as FaceBook, Google, Twitter, U-Tube, Whats app market access in-additions to all the original complains. Meanwhile America still have more cards in play. HK Special status, more Tariffs, Supply Chain Value-add percentage and controls, debt limits and lastly if Fed is to cooperate, Interest rates.

The damage is clear based on current DJIA vs Shanghai Index comparison. And this is before expected coming Monday slide in Asia time. But the pill will be very hard to swallow. Finally, the argument of American consumers pay more is irrelevant as this will only reduce consumption slightly as the cost delta to operate outside China is likely to be around 5% increase. This could translate higher in the market but is not going to be out-of-the-world pricing.

This probably explains why Trump is so willing to proactively engage in the trade battle for Supremacy. Even if China can wait till Oct'20 which appears more remote now with the elevated crisis on the economic impact, Trump failure to be re-elected do not guaranteed any discontinuation in current policy for Trade War is probably the largest misnomer among the media today.

Cory

2019-0825

Aug 25, 2019

Aug 21, 2019

Cory Diary : Ever lowering Yield Reality

To Cory, every lowering yield has been a key phenomenon for decades as i blogged earlier. Looks at this chart 1. Federal Fund Rate has been going on since 1980s. That's almost 40 years of trend. Recessions precipitates whenever there is locality inflation (not shown in chart).

|

| Chart 1 : FFR, Treasury Yield and SP500 |

Let's look at another interesting chart 2. What happen with increasing effective federal fund rate. We probably have yields inversion.

|

| Chart 2: Effective FFR and Treasury Yields |

From read above, Interest rate is closely tied to managing inflation. With increasing rate, there is potential of recession. The overall trend for the past 40 years have been decreasing rate as long we keep inflation in checks. Ever lowering rates have been driving SP 500 direction up generally.

This could explain why there is no rational reason for Fed to raise rates unless we see high inflation. Low rate means money to fund cost of business is low therefore driving employment I think ! So who want to go against that ? Will we see even lower yield (meaning high reits prices is here to stay ? ). Why not ? I aren't going to bet against a 40 years trend.

What this mean is that the more we delay in investing yield income asset, the income we have will be lesser in the future. So do we still want to take profit or should we let our investments continue to fund us ? The only time I think is practical to get out is when we really have major recession like 2008. This is like lifetime event. However, even if we didn't sell, is still a small beep on the ever lower yield trend and high stock prices after.

Key takeaway from my read

1. Ever lowering yield is the trend. Meaning lesser dividend income if we invest later.

2. Inflation drives Interest rate

3. Low Interest rate drives economy

Let me know your thoughts

Cory

2019-0821

Aug 10, 2019

Cory Diary : Asset Allocation Review 2019-0810

Seems like it has been a while since last reviewed my asset allocations. Not that I do not like. I always have the curiosity on how they goes and prefer to check on them more often than not as I am a slow learner. Usually I will do a quick round of updates across my accounts and have them reflected. Thanks to excel, this is all done in minutes.

In this update, the computation is a lot more simple on a more conservative side of perspective angle. Saving allocation has been reduced to 10% but I think it can be further improve.

Liquid Cash Flows from Investments

Equity/Bond/Pref theoretical annual dividends : -

Gov Securities : - ( assume max 10 years )

Saving/FD : -

Investment Sub-Total : -

Maximizing Returns

Saving 10% allocation implied missing (updated for privacy) possible earning. So I think maybe opportunity to tap more here in the future

Sub-Total : $0

Pension/CPF/Insurance

This will be buffer. Another is because I would probably tap on them after 65 yr old.

Sub-Total : $0

Rental Providence ( update : instead from income)

(updated for privacy)

Cory Asset Annual Returns : (updated for privacy)

I do have salary income. And I am still paying Insurance. For simplicity, they are excluded. I hope this is a realistic and simplified as I could get for estimating returns from non-salary income perspective.

Happy to say this well cover my home loan today.

My next goal is to increase my returns further to (updated for privacy) annually from non-salary income with minimal risk.

Cory

2019-0810

Aug 9, 2019

Cory Diary : Trades - 2019-0809

I have been looking further into banks but find it not easy to buy more considering the interests rates are being talked down. Getting more Reits are a bit tricky. CMT and FCOT do have some lows past few weeks period but I do not have a chance to investigate further with my recent hospitalization. CMT yield is quite low so my keenness is limited and happy with what I have currently. Buying high yield with weak fundamental is risky. I rather leave my cash alone. They aren't the same league as Ascendas, Frasers, Mapletree or Capitaland breeds ...

STI Index

VICOM

As you may know, I have been ranting how small my exposure is in this counter. So I do some buying which boost my Portfolio Yield despite the price has run up this year. I feel there is sufficient positive to have a large stake in. I am more interested in their other businesses. So a bet there will be some growth while able to continue to support the dividend yield (excluding special dividends). This is quite an illiquid counter. You can't buy much and I suspect you can't do much shorts as the counter can spikes and you will be caught with pants down for a long time.

SIngtel

I have been holding from averaging down on Singtel till i see sufficient signs. The last one is the quarterly report which is kind of below expectation. This mean I need to wait for another quarter to review. Meantime, I reduce my stake further to lock in some gains YTD to buy more into Vicom. I almost decide to sell the remainder of Singtel to manage my counter numbers but decides otherwise as there could be rebound that I will hate to miss.

Netlink BNB Tr

As you may be aware . I am back on securing some from this counter. Frankly, the feeling is good as the price goes back up quicker than I expected. So is just a small moon in my bubble chart. Nevertheless, I am glad to be able to get some.

My family and I are very well vested in Singapore. We hope Singapore continues to prosper. So our wishes may this continues !

Happy National Day, Singapore !

Cory

2019-0809

Labels:

NetLink NBN Tr,

Singtel,

STI ETF,

Trading,

Vicom

Aug 7, 2019

Cory Diary : laparoscopic cholecystectomy

If anyone wondering what the hell it is, I went for ER more than a week ago and end up for laparoscopic cholecystectomy surgery on the same day. Basically to remove my gall bladder and to solve other complication. I would say this is one of the unpleasant surprises I have this year.

Mood swing from positive to delight to negative to very negative .... and then mood came back positive day by day ... all within the span of one week. Sounds like stock market huh ? My wife needs to cheer me up during this period. Think I did more than 10 X-rays ....as well. Fortunately I did not fall into depression from my medical conditions. However, I did loose significant interests to trade considering I am bedridden literally for a week and 5kg lesser.

To be frank, during this "Horrific Period", I took a couple of seconds to glance on my counters despite my mood swings. Today I am back on my desk, to tally up my dividends and portfolio value. What a change for STI gaping down (data points as and when I update my data) to 3170. That's put it just 3.3 % gains this year before dividends.

As for Cory Portfolio I am kind of surprise that XIRR still hold a good 15% YTD or Portfolio yield of 14% range. Do a double check for errors which seems good. The only explanation is that Reits again held up very well as we are compensated by dividends during current turbulent period which also probably gives the impression that the Reit market is sliding more than it was.

I am not sure is time for shopping. I do have some fund in cash management account to boost my portfolio yield (updated for privacy) . My timing on Reits do not have good track record so to speak.... but if I could find something stable for 6% I would grab. That's leave "little" candidates .... to speak of.

Cory

2019-0807

Mood swing from positive to delight to negative to very negative .... and then mood came back positive day by day ... all within the span of one week. Sounds like stock market huh ? My wife needs to cheer me up during this period. Think I did more than 10 X-rays ....as well. Fortunately I did not fall into depression from my medical conditions. However, I did loose significant interests to trade considering I am bedridden literally for a week and 5kg lesser.

To be frank, during this "Horrific Period", I took a couple of seconds to glance on my counters despite my mood swings. Today I am back on my desk, to tally up my dividends and portfolio value. What a change for STI gaping down (data points as and when I update my data) to 3170. That's put it just 3.3 % gains this year before dividends.

As for Cory Portfolio I am kind of surprise that XIRR still hold a good 15% YTD or Portfolio yield of 14% range. Do a double check for errors which seems good. The only explanation is that Reits again held up very well as we are compensated by dividends during current turbulent period which also probably gives the impression that the Reit market is sliding more than it was.

I am not sure is time for shopping. I do have some fund in cash management account to boost my portfolio yield (updated for privacy) . My timing on Reits do not have good track record so to speak.... but if I could find something stable for 6% I would grab. That's leave "little" candidates .... to speak of.

Cory

2019-0807

Jul 23, 2019

Cory Diary : Trades 2019 June/July

Been some time since I last blog on my trades. This beauty on the left has been getting quite an attention from me. Before I get suck in again, thought I could give an updates on what I can remember on my trades. Hopefully, I get a bigger picture on what I am doing from my silly moves.

Do note I am no expert and just sharing of what I have done. As is a re-collection, some details and trades will not be available and could have error. By no means should one based on my article to make your investment decisions. I could be well vested and be selling to you. haha. thanks for milk powder contribution if you did ! However, I am quite well vested in the market due to dividend play.

Here we go. I am back holding some Netlink BNB Tr on recent price weakness. Just small amount to improve my portfolio yields a little bit more but wouldn't want to get caught and lose back my gains on this counter. Is a far cry of what I have in the past.

Decided to let go ValueMax to balance my counters. There has been some movement and I am not surprise others may get a better price than me after. XIRR 8% which is about 4% kopi profits. With that I am left with 2 SMEs.

Manage to up my DBS some more and benefited from recent rise. The actual reason is more of lack of upside in Reits after the 1st half feat which I personally feel is late gratification. Due to relatively rich valuation, upside is harder but not impossible just lesser gains. However I do not think we can rate Reits like other stocks as the rise is due ever lowering yields which means the price can last a long time at this level while earning catches up.

There are a few stocks which I almost like to enter and decided not. Great Eastern, Frasers L&R Tr, Frasers CPT Tr ... due to variety of reasons. Maybe the Reits reporting season will give me a good hunch.

The mistake which I still feel the pain is Vicom. I have too little ... and I am not comfortable to average up. Kiasi me again ...

Cory

2019-0723

Do note I am no expert and just sharing of what I have done. As is a re-collection, some details and trades will not be available and could have error. By no means should one based on my article to make your investment decisions. I could be well vested and be selling to you. haha. thanks for milk powder contribution if you did ! However, I am quite well vested in the market due to dividend play.

Here we go. I am back holding some Netlink BNB Tr on recent price weakness. Just small amount to improve my portfolio yields a little bit more but wouldn't want to get caught and lose back my gains on this counter. Is a far cry of what I have in the past.

Decided to let go ValueMax to balance my counters. There has been some movement and I am not surprise others may get a better price than me after. XIRR 8% which is about 4% kopi profits. With that I am left with 2 SMEs.

Manage to up my DBS some more and benefited from recent rise. The actual reason is more of lack of upside in Reits after the 1st half feat which I personally feel is late gratification. Due to relatively rich valuation, upside is harder but not impossible just lesser gains. However I do not think we can rate Reits like other stocks as the rise is due ever lowering yields which means the price can last a long time at this level while earning catches up.

There are a few stocks which I almost like to enter and decided not. Great Eastern, Frasers L&R Tr, Frasers CPT Tr ... due to variety of reasons. Maybe the Reits reporting season will give me a good hunch.

The mistake which I still feel the pain is Vicom. I have too little ... and I am not comfortable to average up. Kiasi me again ...

Cory

2019-0723

Jul 21, 2019

Cory Diary : Funan Mall "Expedition"

Have been a long time since I took the MRT here. This is for the trip to the newly built Funan Mall by CMT. As I know there is some concept into the mall designs which I am eager to explore. Ideally I would like it to be connected to the MRT without walking under the hot-sun to get there and back. Fortunately, I have a little distance shaded by the capitol way, underground. Funan Mall main entrance doesn't seems grand or obvious. Maybe is just me as I am quite new to the revamp.

The most interesting will be rock climbing. I like it. Is good to see young folks trying them and get to have fun. There is a crowd on this.

This certainly fits the theme of trees ....

The central ground floor area has a cafe. Some open spaces which I suppose can be provided for future ad-hoc activities.

Behind the cam on the right has a broad stairway where we can see a numbers of people rest on it. Interesting though I do not think it was meant to design for that but I did not explore further. Not in picture.

Other than the escalators on the edge, there are inter-connection stairways at a distance off the edge between the floors where they have additional stores.

However I do not think it drives much revenue from it. The clothing store doesn't fit there as well.

The ceiling has glass right through illuminating the mall other than the purplish neon lighting. This are unique.

The ceiling has glass right through illuminating the mall other than the purplish neon lighting. This are unique.

There are B1 and B2 mainly food stores. Level 1, 2 and 3 are too. Not surprising in order to sustain the mall operations. I would think they also help to bring the crowds from surrounding to support the IT stores thereby feeding on each other attractions.

There are a number of establish IT stores. A cool bicycle shop. The modelling shop seems not ready. I find it out-of-place to find a furniture store. We can do well with a few pet shops, climbing/camping gears shops, boxing/gym, banking services and telcos. WeWork is kind of good fit. There is a cinema on the top floor but I think it can do well to have laser/combat/maze types of team building activities as well.

The metal stair case lead to the roof garden where you find some modern tech farming. There are some height, zig-zag and distance to cover so not that cool for a 49 year old man with a 7 kg load ... to travel up there. For those who still want to attempt, there is actually a lift .... darn.

I heard there is tennis court and barbecue pit but not in this section than I have climbed. It will be nice to have infinity swimming pool though.

Not everything is in-place yet and I think there will be further fine-tuning.

Overall, is a unique concept. However, there are room for improvements.

On my return journey in the MRT, all the seats are occupied. I could see those seats marked for the needy filled by the deserving. However I could not understand why no one please a baby-carrying dad for the normal seat. Ok, lazy me. Maybe I look muscular. haha. I do hope to receive some social grace out from the heart and not due to social pressure or laws. On the later part of the journey, a student alight and a young Indian man standing besides signal me to have the seat right in-front of him. And there's this 50s loving couple sitting beside me, the lady smiled at my baby ....

Vested though much smaller than previous.

Cory

2019-0721

Jul 8, 2019

Cory Diary : Cumulative Returns

In stock investment, one can "strike lottery" once in a while but to truly and really make sustainable returns, the logical way is to track it through Cumulative XIRR to reflect long term returns.

What this mean is to annualized all your years of investment returns and have them compounded into a return figure. Only then we can truly understand where we stand on our ego memory or actual returns. This will also give us a view on sustainability or a "2008 GFC" can wipes out all our "career gains".

The tracker started on 2007 of sizable portfolio therefore STI Index of that year. For STI Index, the condition is no fresh injection and no re-investment for simplification. At the end of 12.5 years, STI Index returns is 0.5% annualized excluding dividends. Cory Portfolio hits 7.4% annualized and same period across 12.5 years.

Cory

2019-0708

Cory

2019-0708

Jul 6, 2019

Cory Diary : Investing Style - Truly Singapore

Recently I do a survey on investing communities in Singapore in IN. Thought it will be fun to share out to the blog community as well.

Is only a 3 days period that captured moments of month long rise where market heads north for Reits investors.

Glad to see so many retail investors benefited for the past few years that dabble less in speculation or day trading. Maybe is a new emerging class of DIY investors and profitable ones too.

Cheers

Cory

2019-0706

Is only a 3 days period that captured moments of month long rise where market heads north for Reits investors.

Glad to see so many retail investors benefited for the past few years that dabble less in speculation or day trading. Maybe is a new emerging class of DIY investors and profitable ones too.

Cheers

Cory

2019-0706

Jul 5, 2019

Cory Diary : Returns Rationalization

Since last blogged, the market continues to surge for yield stocks which portfolio benefited from Reits/Trusts exposure with low growth of the world. This is despite being peppered with bonds, preference, blue chips and SMEs. In the ever lowering yield quest which I have doing for past years, people like me will chase for whatever they feel safe hence lowering yield of stable instruments. Of-course unstable ones tag along as well to help build up the next crisis as and when it rolls. On and off we may have "Hyflux" or "Swiber" moments. Sorry folks. Not my intention to gloat over such but to constant remind that I could fall as well and is important not to be too carried away.

Currently achieved Xirr hits 37.2% if annualized for the year.

Xirr using year end date hits 18%. ( Roughly Profit Yield )

It has been a long time since we hit this higher level of returns. Those were the days ! In the past my portfolio was much smaller though. However at this moment this year profits in % term has been quite stunting considering portfolio has grown considerably. The absolute profit size is easily 4 years of my typical saving rate from my salary income.

Naturally my plan will be more and more conservative as the market goes higher to protect my gains. Dividend investors are more towards unrealised gains " to milk the cows"as dividends are as ... Music Lyrics "Always on my mind .... "

Using target of 50k annual dividends, profits for the 6 months+ is well over 3 years of dividends. Can it get better ? Sure just smaller increment as we compress the yield. Will the risk go higher ? Likely if the barrier to entry becomes so low that businesses starts to undercut each other.

With low growth in the world, the next cherish commodity is growth after "maturing" yield. In the extension of current stable yield concept, we hope for stronger stable growth iced with good dividends. Searching around maybe left the banks which I do have. Again buffered it up this week. Then we have digi-bank to worry ... life is like that. Don't complain.

One thing for sure, Portfolio has to grow over time. How to do it is the question.

Cheers

Cory

2019-0705

One thing for sure, Portfolio has to grow over time. How to do it is the question.

Cheers

Cory

2019-0705

Jun 30, 2019

Cory Diary : Record Profit Diversified Portfolio 2019-0630

As I get older, one key realization I have is about money in relation to other assets class. Moving from stock to cash is just from one asset class to another. From one risk to another. Cash has risks of inflation, low returns and country risk. Nevertheless is not easy for many to move past this point even for myself.

What this mean is that taking profit is meaningless strictly to dividend investors when fundamental remains unchanged if we are looking for safety harbor and out-of-market. Timing the market is tough. Often we miss big time when we realised or gains. I am still learning therefore prefer to do on stages for some counters.

The market has been on bull for some time. Even sell in MAY and GO AWAY is misguided as the market recovered. At this point of time, trying to inject huge amount of money into stocks seem lack margin of safety as the low point of Index has passed for this period. Hence, when I decided to max my SSB.

With market in exact halfway point this year, and the largest profit I have seen, I am still well invested in the market. During this period I did some amount of consolidations to reduce the counters I have to manage. One of the key reduction is Reits/Trusts. As we all know, we have one of the best this year so far. In the report, I have them added as a small dot to show their returns previously before I sold them for review purpose ( see chart ).

Those I have sold namely.

Parkway Life Reit,

Frasers CPT,

Frasers L&I TR,

Mapletree Com Tr and

Netlink NBN Tr

and again as reflected in the chart with small dots. I did not include First Reit as it was few days trade with slight loss in speculation. I think the only regret is Mapletree Com Tr which blew pass my sell price significantly. Netlink NBN Tr is recent sale so time will tell.

As mentioned before I tend to do some trading and CMT is a little smaller today as I recently took some profit off the table at $2.64. I hope to buy back. Really ..... ... ... Even with that, I still have 40% exposure in Reits. Frankly, is very hard to buy back in this rising market to my dismay. Fortunately, I play with a small percentage of my portfolio and most remains intact to enjoy the ride.

With the higher cash level, I have decided to complement it with SIA Bond and Astrea Bond for a more balance portfolio to buffer it up to 22%.

Namely,

Frasers Bond 3.65%

CMT Bond 3.08%

SIA bond 3%

AstreaIV Bond 4.35%

Equity investments to me needs to be RISK MANAGED to MY LEVEL. At 19 counters, this is quite manageable for me considering bonds/pref do not need much time to monitor so this leaves me with 15 to watch. At Portfolio size of $1.1 M excluding Gov securities I think is good enough for me right now.

Cory

2019-0630

What this mean is that taking profit is meaningless strictly to dividend investors when fundamental remains unchanged if we are looking for safety harbor and out-of-market. Timing the market is tough. Often we miss big time when we realised or gains. I am still learning therefore prefer to do on stages for some counters.

The market has been on bull for some time. Even sell in MAY and GO AWAY is misguided as the market recovered. At this point of time, trying to inject huge amount of money into stocks seem lack margin of safety as the low point of Index has passed for this period. Hence, when I decided to max my SSB.

With market in exact halfway point this year, and the largest profit I have seen, I am still well invested in the market. During this period I did some amount of consolidations to reduce the counters I have to manage. One of the key reduction is Reits/Trusts. As we all know, we have one of the best this year so far. In the report, I have them added as a small dot to show their returns previously before I sold them for review purpose ( see chart ).

Parkway Life Reit,

Frasers CPT,

Frasers L&I TR,

Mapletree Com Tr and

Netlink NBN Tr

and again as reflected in the chart with small dots. I did not include First Reit as it was few days trade with slight loss in speculation. I think the only regret is Mapletree Com Tr which blew pass my sell price significantly. Netlink NBN Tr is recent sale so time will tell.

As mentioned before I tend to do some trading and CMT is a little smaller today as I recently took some profit off the table at $2.64. I hope to buy back. Really ..... ... ... Even with that, I still have 40% exposure in Reits. Frankly, is very hard to buy back in this rising market to my dismay. Fortunately, I play with a small percentage of my portfolio and most remains intact to enjoy the ride.

With the higher cash level, I have decided to complement it with SIA Bond and Astrea Bond for a more balance portfolio to buffer it up to 22%.

Namely,

Frasers Bond 3.65%

CMT Bond 3.08%

SIA bond 3%

AstreaIV Bond 4.35%

Equity investments to me needs to be RISK MANAGED to MY LEVEL. At 19 counters, this is quite manageable for me considering bonds/pref do not need much time to monitor so this leaves me with 15 to watch. At Portfolio size of $1.1 M excluding Gov securities I think is good enough for me right now.

Cory

2019-0630

Jun 28, 2019

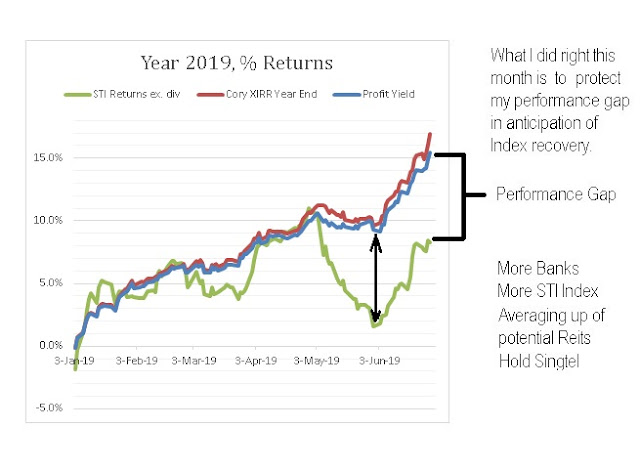

Cory Diary : Securing lead in Performance 2019-0628

Month of June has been incredible. A recovery of Index with continuous upward price swing on selected Reits and Trusts. The final return will be known tonight after the US market ends(updated). This post is about how I ensure the gap continues. Here's links on my goal to ensure the performance is maintained.

https://corylogics.blogspot.com/2019/06/cory-diary-mexico-tariffs-cory.html

https://corylogics.blogspot.com/2019/05/cory-diary-volatile-sti.html

Despite high number of Reits/Trusts in my portfolio, achieved 100% strike for 5 digits gain on each. Having enlarged Banks investment as blogged earlier to help me catch up with the rising Index works well. Singtel seems bottomed but I do not want to average up yet as I like to reserve my funds for opportunity.

Result: XIRR YTD: 17% (slightly higher due to some realised gains), Profit Yield: 15.4%, Total Profit 1st Half YTD : $147,723 (Realised/unrealised including dividends), Expense Ratio 0.35%, XIRR Non-Fixed YTD: 20.6% (Removing Bond/PS elements). Despite that, I am happy with them as they gives me confidence to map out my investment strategy as my investment needs to be risk managed.

Personally I have a bit of fear on Iran conflict to be worsen other than on-going trade war. This will affect Oil price which will have implications on my equity investment. Therefore, in the last weeks, took some defensive moves after achieving my aims of preserving my performance with rising STI Index. I will blog later on them when I go through the bubble chart.

I do not have fresh injection into the portfolio this year. Instead I have tapped some of my saving fund into SSB to max it out which mean continue with no fresh fund injection probably for rest of year. July will be interesting as my portfolio has been moving towards more defensive postures.

Cheers

Cory

2019-0628

https://corylogics.blogspot.com/2019/06/cory-diary-mexico-tariffs-cory.html

https://corylogics.blogspot.com/2019/05/cory-diary-volatile-sti.html

Despite high number of Reits/Trusts in my portfolio, achieved 100% strike for 5 digits gain on each. Having enlarged Banks investment as blogged earlier to help me catch up with the rising Index works well. Singtel seems bottomed but I do not want to average up yet as I like to reserve my funds for opportunity.

Result: XIRR YTD: 17% (slightly higher due to some realised gains), Profit Yield: 15.4%, Total Profit 1st Half YTD : $147,723 (Realised/unrealised including dividends), Expense Ratio 0.35%, XIRR Non-Fixed YTD: 20.6% (Removing Bond/PS elements). Despite that, I am happy with them as they gives me confidence to map out my investment strategy as my investment needs to be risk managed.

Personally I have a bit of fear on Iran conflict to be worsen other than on-going trade war. This will affect Oil price which will have implications on my equity investment. Therefore, in the last weeks, took some defensive moves after achieving my aims of preserving my performance with rising STI Index. I will blog later on them when I go through the bubble chart.

I do not have fresh injection into the portfolio this year. Instead I have tapped some of my saving fund into SSB to max it out which mean continue with no fresh fund injection probably for rest of year. July will be interesting as my portfolio has been moving towards more defensive postures.

Cheers

Cory

2019-0628

Jun 27, 2019

Cory Diary : Ever Lowering Yield ...

As I mentioned early on the logic of ever lower yield, this is spot on and have benefited from it. Check the links on earlier articles. Entering big on Reit/Tr since last year. Is a strong ride for my portfolio within 6 months.

https://corylogics.blogspot.com/2019/06/cory-diary-bitching-my-favorite-again.html

https://corylogics.blogspot.com/2019/05/cory-diary-yield-anchoring.html

So with another shot on Reits to another record level this week ... when is this going to end ?

That's an interesting question. The answer maybe is to do a spectrum of different instruments (see below charts). Bear with me the rough accuracy as I do this on a quick pace while my baby is still sleeping.

As I can see, the gaps are not very big between them right now. Have we reach a platter ?

We need growths. Sure there are still some hidden gems out there on Reits. As a rough guide for me, if there is exchange in positions among them we may have Euphoria ? We can price them relatively to aga aga risk consideration.

Cory

2019-0627

https://corylogics.blogspot.com/2019/06/cory-diary-bitching-my-favorite-again.html

https://corylogics.blogspot.com/2019/05/cory-diary-yield-anchoring.html

So with another shot on Reits to another record level this week ... when is this going to end ?

That's an interesting question. The answer maybe is to do a spectrum of different instruments (see below charts). Bear with me the rough accuracy as I do this on a quick pace while my baby is still sleeping.

As I can see, the gaps are not very big between them right now. Have we reach a platter ?

We need growths. Sure there are still some hidden gems out there on Reits. As a rough guide for me, if there is exchange in positions among them we may have Euphoria ? We can price them relatively to aga aga risk consideration.

Cory

2019-0627

Jun 22, 2019

Cory Diary : HRnetGroup 2019-0622

HRnetGroup

Today price is $0.675. Is a gap down together with quite a number of counters last Friday. Probably the market get winds of Trump eventual strikes on Iran. Fortunately, it didn't. Personally, I feel it could ignite a war as Iran is not like Libya or Syria who are just the receiving ends.

I have been monitoring this counter for some time after I sold my positions. Reason as following Link. However, a number of local investors swore to it.

Initiated (update: informed) a small position in 2017-1214. Sold informed 2019-0226. Transactions as below table.

Did a collection for the 3 years record. Applied XIRR. Results as above.

Kopi money. So far I make the right decision for myself and also reducing a counter to manage for my limited bandwidth.

Cory

2019-0622

Today price is $0.675. Is a gap down together with quite a number of counters last Friday. Probably the market get winds of Trump eventual strikes on Iran. Fortunately, it didn't. Personally, I feel it could ignite a war as Iran is not like Libya or Syria who are just the receiving ends.

I have been monitoring this counter for some time after I sold my positions. Reason as following Link. However, a number of local investors swore to it.

Initiated (update: informed) a small position in 2017-1214. Sold informed 2019-0226. Transactions as below table.

Did a collection for the 3 years record. Applied XIRR. Results as above.

Kopi money. So far I make the right decision for myself and also reducing a counter to manage for my limited bandwidth.

Cory

2019-0622

Jun 19, 2019

Cory Diary : STI Rebounded 2019 June

STI has been quite volatile. This week it starts rebounding. If one has invested near end of last year, today one would still has nice returns of about 300 points ahead.

As we can see from long term resistance support, averaged down more on STI earlier and is now benefiting from the rebound. Recent low is a test of one resolve. The turmoil of the market doing their sum on our thinking. However, being portfolio buffered, this bring calmness for us to try.

Everyone waiting for FED now. Trump complained last time and likely more this time as he needs more ammunition to fight trade battle with China and EU especially we could see currency war entering the game. Will FED supports ?

Expecting the rate to hold. Chance is 60%. Cut 30% However, if Powell tries to be funny and raise the interest rates instead, the market could well #$^$%&%^$*%4&*)&. Maybe he will try other options instead. However, should policy be reactive based on data coming in or anticipation in today world. Maybe we need to change with time.

Cory

2019-0619

Jun 16, 2019

Cory Diary : Asset allocation 2019 Jun

In my plan for retirement, if it happens, there could be draw-down in my net worth. Next question will be how fast. So I decided to do a rough update estimate based on what I have today.

Roughly, I could see return generation of 113 K annually. This could be generous on the property. Never mind. Just ignore me on that one. However, to meet short-medium term needs, FCF is more important. Which left me with 51.5K annually after removing Insurance, Property and Pension. And this is assuming I have surrendered my Insurance policy. I still have loan to pay up, which implied even with my net worth today, I could not afford to retire for the lifestyle I want to maintain after, without draw-down.

First thing to do is to tackle my most unproductive asset which is Saving. With Gov securities that can double up as Emergency and Housing loan support, there is no need to have such a high saving % allocation which has been my constant issue with saving rate from salary and bonus. This needs to cut down by a third of which I would have my SSB max. and then remainder to war chest. This saving category includes cash management account which is giving reasonable interests.

Secondly, my backup plan is to sell my property after 7 years and would switch to further OCR region to increase the psf when I retired for at least same amount. This is not impractical from current caveats logged. However, my wish is to have another property instead and this will required environment to be conducive enough such as removal of ABSD, and my saving rate and investment are reasonable to generate growing dividends.

In a not so good scenario, where I decided to retire immediate, and my investment returns turn sour. I would estimate 5% draw down after paying up all my loans from the start, will last me for at least 17 years. After which, I am left with Pension and Property. Then the option is to down-grade .... to finance more reasonable lifestyle and my daughter education. At 67 then, maybe is still ok. Still cannot tahan, then I will ask my wife to chip in (my last buffer of buffer which is to clean tables lol ... ) . ha.

Someone said : What about legacy ?

Uncle Cory : Simi lah. Down grade liao still want legacy. You only have one life to live.

... Legacy is for the rich. Don't act rich if you are not.

Cheers

Cory

2019-0616

Roughly, I could see return generation of 113 K annually. This could be generous on the property. Never mind. Just ignore me on that one. However, to meet short-medium term needs, FCF is more important. Which left me with 51.5K annually after removing Insurance, Property and Pension. And this is assuming I have surrendered my Insurance policy. I still have loan to pay up, which implied even with my net worth today, I could not afford to retire for the lifestyle I want to maintain after, without draw-down.

First thing to do is to tackle my most unproductive asset which is Saving. With Gov securities that can double up as Emergency and Housing loan support, there is no need to have such a high saving % allocation which has been my constant issue with saving rate from salary and bonus. This needs to cut down by a third of which I would have my SSB max. and then remainder to war chest. This saving category includes cash management account which is giving reasonable interests.

Secondly, my backup plan is to sell my property after 7 years and would switch to further OCR region to increase the psf when I retired for at least same amount. This is not impractical from current caveats logged. However, my wish is to have another property instead and this will required environment to be conducive enough such as removal of ABSD, and my saving rate and investment are reasonable to generate growing dividends.

In a not so good scenario, where I decided to retire immediate, and my investment returns turn sour. I would estimate 5% draw down after paying up all my loans from the start, will last me for at least 17 years. After which, I am left with Pension and Property. Then the option is to down-grade .... to finance more reasonable lifestyle and my daughter education. At 67 then, maybe is still ok. Still cannot tahan, then I will ask my wife to chip in (my last buffer of buffer which is to clean tables lol ... ) . ha.

Someone said : What about legacy ?

Uncle Cory : Simi lah. Down grade liao still want legacy. You only have one life to live.

... Legacy is for the rich. Don't act rich if you are not.

Cheers

Cory

2019-0616

Jun 15, 2019

Cory Diary : Value-Add in Trade War

“If he shows up, good, if he doesn’t – in the meantime, we’re taking in billions of dollars a month [in tariffs] from China,” Trump tells “Fox & Friends.”

Sounds familiar ? Yup is from President Trump. Interestingly to say it so openly could imply many things ...

1. He is threatening President Xi

2. He purposely want to make sure President Xi lose face

3. He is trying to make sure President Xi won't attend G20

4. He is trying to stall the talk purposely

5. He is not thinking at all

6. He is not interested for trade talk at all. Is all a ruse

7. He is stupid

Let's sit back and think when the 25% tariffs kick-in. First is final export to America cannot be China as the tariffs are too high unless we are prepared to pass the cost to consumer which are specifically American Consumers. This won't happen due to competition for market shares therefore even Chinese companies will have to change their supply chain model.

Secondly, to classify as not China produce there have to be sufficient value-add through the supply chain. Value-Add could be the next level that Trump administration will focus on if Trade War gets deeper. For now, if one need to avoid tariffs is to have the key assembly done in another country say Mexico but there must be enough value-add to the product. Adding packaging or labeling which are cosmetic and naming won't be enough and US will still consider it as Made in China.

What will happen is manufacturers will likely do the minimum to meet the cut-off. This will mean China will still produce the basic raw lower level assemblies. Some jobs will be loss. There will be a slight delta in product cost due to additional touches in Mexico. Consumers probably won't feel much impact.

If this model continues long enough, soon manufacturers will find cheaper eco-system outside china. This could be expedited and permanent if they decided to adjust the value-add criteria higher such that it may not make sense to even do basic assemblies in China. When this happen, product cost will soon come down to norm or even cheaper. This could take a few years to happen though.

The final stage will be when the new eco-system is so establish, Mexico can be a manufacturer not only for America market but also the other parts of the world. At this time, China will start their own protectionist measures requiring their own local value-add to sell in China.

Replace Mexico with few other like countries. Countries that benefits from this trade war will be Vietnam, Taiwan, Mexico, Thailand, Cambodia, South Korea, Japan, Singapore etc. Maybe even India if they open up their market fast enough. Remote choice could be North Korea if they have settled their difference with America.

From what I see, trade war is just a pre-text for bigger things to come. Is about ensuring US stay much ahead. So from this read, who will pays for the tariffs ? Where should we focus our investments ? How the world will be after ? Food for thoughts.

2019-0614

Subscribe to:

Posts (Atom)