REITs have been in SGX for long time. Despite that people still has concern whether they take more than they give. If I am to invest in REITs obviously the benchmark will not just be more than they take only. They need to give enough back in the form of capital gain or dividends that are way above inflation in total.

This concept is pretty simple.

REITs Investment Returns = Capital Gain/Loss + Dividends , and Annualized

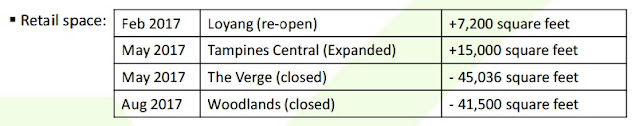

For the sake of a safer example, I will pick a stable REIT CMT. Yes, the one which I have blogged recently. CMT owns many Malls in Singapore whose tenant income are tied to tourist visits, impact of internet shopping and the local economy. And Funan Mall in the midst of AEI. I will take a peek on CMT for past 6 years performance starting from 1 May '11 ( after Ex-div ) till today.

During this period there are no retail rights issue which makes my calculation easier to compute. To make thing simple, I will use Yahoo monthly chart to calculate CMT annualized return on the stock price against today 1.97 closing. XIRR = -0.08.% which imply a capital loss. And then lookup on the total dividends distributed on the measured periods. Total : $0.6276. Combine both of them as table below.

So annualized returns for CMT for the past 6 years are 5.28%. What this mean is for every $10,000 dollar invested in CMT, you get $528 annually. A total of $3,168 or 31.7% for the total period.

So at least for CMT, is a Myth that REITs are not a good investment vehicle. Like any other stock, when to invest and sell is important. REITs are no exception. Will CMT continues to prosper ? That is for their current management to answer.

Please DYODD.

Cory

20170502

This concept is pretty simple.

REITs Investment Returns = Capital Gain/Loss + Dividends , and Annualized

For the sake of a safer example, I will pick a stable REIT CMT. Yes, the one which I have blogged recently. CMT owns many Malls in Singapore whose tenant income are tied to tourist visits, impact of internet shopping and the local economy. And Funan Mall in the midst of AEI. I will take a peek on CMT for past 6 years performance starting from 1 May '11 ( after Ex-div ) till today.

During this period there are no retail rights issue which makes my calculation easier to compute. To make thing simple, I will use Yahoo monthly chart to calculate CMT annualized return on the stock price against today 1.97 closing. XIRR = -0.08.% which imply a capital loss. And then lookup on the total dividends distributed on the measured periods. Total : $0.6276. Combine both of them as table below.

So annualized returns for CMT for the past 6 years are 5.28%. What this mean is for every $10,000 dollar invested in CMT, you get $528 annually. A total of $3,168 or 31.7% for the total period.

So at least for CMT, is a Myth that REITs are not a good investment vehicle. Like any other stock, when to invest and sell is important. REITs are no exception. Will CMT continues to prosper ? That is for their current management to answer.

Please DYODD.

Cory

20170502