Figure includes

- "Home Loan"

- A few one-off Medical Expenses - Therapy Sessions etc

- On/Off there maybe Bonus Company Share Sales

- Parental Allowances

Figure excludes

- Income Taxes. I help cover my partner too.

- Partner contributed to some expenses. Assume 15%. May Revisit later on this assumption.

Full Year Comparison

To set the right expectation, it maybe quite big-eyed to see saving jumped 65% for Year 2023 when income do not rise as much. 13% includes company shares sold. Saving is typically a small subset for me due to family, housing, transport, holiday etc. The important rationale is that if we able to keep our expense in check, all the income increase will be channeled to saving. Hence, we see large % increase in saving.

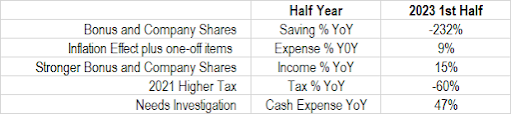

1st Half Year Comparison

Cash Expenses do increase significantly due to many reasons. However, what is interesting to know is that for 1st Half comparison YoY.

|

There is basically negative cashflow for 1st half of Y2023. Lumpy Tax. What to focus is the cash expenses YoY 47% Increase but overall expense only 9% up. Compared to Full Year chart, the expense 42% as is much more actively watched in 2nd Half of Y2023

Sharing on Expense Ways

Obviously this aren't a sharing of low expenses. Is not intended initially when I start to write this article but strikes me that i could share what efforts have been put in to slow down expense increase with family as this aren't easy ....

1. More instances of more simple home cook food and outside meals.

2. Tighter control on transports. We do more walking.

3. Reduced Fruits wastage and less expensive varieties.

I wish there could be more. There aren't. Is so easy to blow our budgets. What keeps the mood up is the Net Worth still on increasing path. Maybe this is the way to control expense in moderation while increase total assets. We still need to keep fighting the demon within.

Cory Diary

2024-02-19

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Telegram CoryLogics <= Link to Telegram Chat

Disclaimer: The articles presented in this blog reflect personal opinions and are intended for informational and sharing purposes only. Not responsible of errors. Readers are advised to seek professional guidance when making financial decisions and should take full responsibility for their choices.

No comments:

Post a Comment