Jun 11, 2021

Cory Diary : Sustainability of Dividend Income

Jun 7, 2021

Cory Diary : Weighted Average Cost of Capital ( WACC)

Jun 4, 2021

Cory Diary : Net Worth Updates

Seems a long time that I last did my Net Worth report. Some time ago I do some revamp on my Chart to make it even more easier to manage with lesser time. During this period I learned how to use macro in Excel to do VBA. Quite excited about it as this add a layer of automation to my learning. It is much simpler than I thought it would be. Maybe I can start to learn to do some tool for my colleagues as automation is sorely lacking even though we have some power tools using VBA, BI and Power BI.

I added a trend line in my chart just for fun. Though it might gives the impression of exponential type of feel into my net worth growth, seriously I doubt it can last. I am going 52 and looking forward to age 55 as a milestone which I could ask for retirement. Frankly I am not sure I would when time arrives. Nevertheless is something I look forward to in the aging process as an option which is favorable by then.

Back of my mind is I could be "retired" before 55 but this seems less likely for now as the company business is doing well. They even give a special bonus to boost Work-From-Home Morale. When you are at my age, we are earning a much higher salary that is near the peak of our career. The cost of retirement would be costly. So there is always the motivation or to some fear factor in play.

I am thinking should I do a comparison against my previous net worth report but is quite a hassle when I want to go sleep asap. I am nodding off.... . Instead I would focus on a particular highlight in the chart and talk about it which is the securities + MMF line in the chart. Is getting more steeper which basically is the result of my action to optimize wealth generation. Therefore channeling idle fund to more active use. There is still some gap to fill except that sizeable amounts allocated for War Chest needs. So the easy picking is reduced.

Cory

2021-0603

Articles in this Blog is personal take and educational purposes only. Reader should seek their own professional help when making financial decision and be responsible for their decision.

May 30, 2021

Cory Diary : Investment Evolutions

May 23, 2021

Cory Diary : Recent Trades - Portfolio

May 12, 2021

Cory Diary : Netlink NBN Trust : Bao Jiak Business ?

May 10, 2021

Cory Diary : Information familiarization work of SPH 2021-0510

May 8, 2021

Cory Diary : When Bad News come, it Pours

Apr 26, 2021

Cory Diary : Frasers Cpt 1H2021

Apr 22, 2021

Cory Diary : What keeps me worry at night

Apr 18, 2021

Cory Diary : Growing Kiddo Wealth

"To make baby millionaires, you first need quite a sum of money: S$64,350 to be exact for each baby at birth, to be contributed into their CPF SA."

Apr 16, 2021

Cory Diary : Where are we now on Reits ?

Apr 13, 2021

Cory Diary : Things I found out from Property Ownership

Apr 9, 2021

Cory Diary : Portfolio Fund Tracker 2021Q1

Apr 3, 2021

Cory Diary : Retirement Income Sources

Apr 2, 2021

Cory Diary : Equity Allocation April Review

Apr 1, 2021

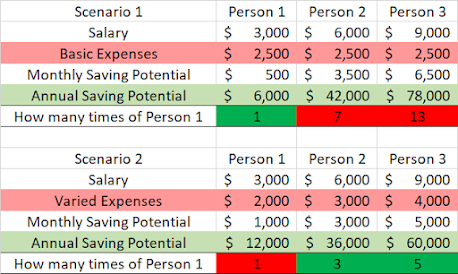

Cory Diary : Saving and Frugality

To sum up my idea using above table. Using Scenario 1 assuming varied income with same expenses. Person 3 saving is 13 times ! of person 1. This is a little extreme of higher earning but continue to maintain low expenses of one who only draw 3k years ago.