"Low-interest rates may also lead to NLT’s regulatory weighted average cost of capital (WACC) for the next review period (Jan 2023-Dec 2027) to be revised down from 7% currently, adversely impacting distributions potentially. In addition, there is no visibility on any acquisition by NLT which could be positive catalyst in the long term."

" A high weighted average cost of capital, or WACC, is typically a signal of the higher risk associated with a firm's operations. Investors tend to require an additional return to neutralize the additional risk. ... In theory, WACC represents the expense of raising one additional dollar of money. "

The WACC formula is as such

Basically is the weighted amount of Equity Cost and Debt Cost.

Cost of Debt

2.87% of 509,120k and 1.2% 155,587k

= Weighted will be (14,612k + 1,867k ) /664707k

= 2.48%

Cost of Debt Variables

Gross debt 666M

Market Cap 3683M

Tax rate 17%

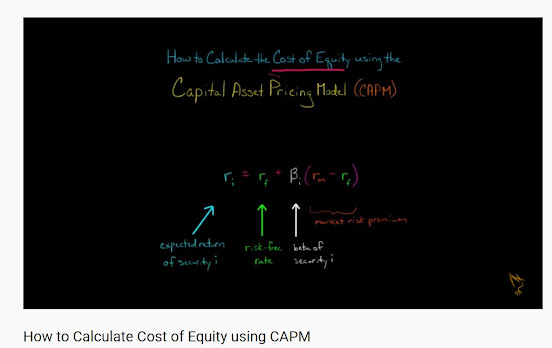

CAPM

CAPM model to estimate cost of equity.

Cost of Equity

Let's say Risk free rate 1.53% per Singapore Saving Bond

Expected Rate of return say 8.3%. ( 5.34% yield + 3% growth )

Cost of Equity = 1.53% + 0.3 x ( 8.34% - 1.53% ) = 3.573% ( 8.34% for Beta = 1 )

The calculation of Beta is tricky. Who should we use as reference for NLT ? Should we use STI Index ? Since NLT listed in Year 2017, their stock price has raised more than 21% compared to STI -1.3%. Yahoo put NLT beta as 0.3. Some other put 0.5. This one need another article to think about and compute !

If we assume Beta = 0.3, plug in all this data into the model, we have

WACC = Weighted ( Cost of Equity + Cost of Debt )

= 3683M x 3.573%/(666M+3683M) + 666M x 2.48% x (1 - 17%) / (666M + 3683M)

= 131.59M/4349M + 16.52M x 0.83/4349M

= 0.03 + 0.00315

= 0.03315 or 3.315% ( or 7.3% for Beta = 1 )

Below is NLT model. There are other moving wheels such as Depreciation and Opex for Rev determination.

Interesting Exercise. However this is my First pass. Please DYODD.

Cory

2021-0606

Articles in this Blog is personal take and educational purposes only. Reader should seek their own professional help when making financial decision and be responsible for their decision.

I'm far too lazy to do the exercise but I recommend you to reverse engineer the BETA implied by NLT Model previously (when they last determine the WACC with the authorities). I doubt the beta will be as low as 0.3 from such calculation.

ReplyDeleteNLT Beta can be very low depending what it is measured against. The key thing likely will be the depreciation and opex factors to influence the pricing model.

Delete