What this mean is that taking profit is meaningless strictly to dividend investors when fundamental remains unchanged if we are looking for safety harbor and out-of-market. Timing the market is tough. Often we miss big time when we realised or gains. I am still learning therefore prefer to do on stages for some counters.

The market has been on bull for some time. Even sell in MAY and GO AWAY is misguided as the market recovered. At this point of time, trying to inject huge amount of money into stocks seem lack margin of safety as the low point of Index has passed for this period. Hence, when I decided to max my SSB.

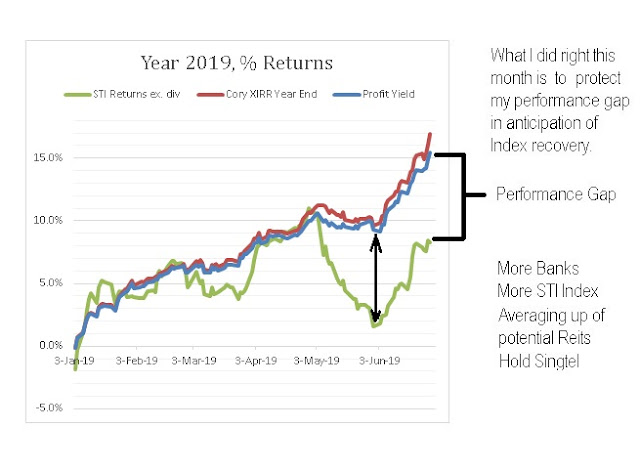

With market in exact halfway point this year, and the largest profit I have seen, I am still well invested in the market. During this period I did some amount of consolidations to reduce the counters I have to manage. One of the key reduction is Reits/Trusts. As we all know, we have one of the best this year so far. In the report, I have them added as a small dot to show their returns previously before I sold them for review purpose ( see chart ).

Parkway Life Reit,

Frasers CPT,

Frasers L&I TR,

Mapletree Com Tr and

Netlink NBN Tr

and again as reflected in the chart with small dots. I did not include First Reit as it was few days trade with slight loss in speculation. I think the only regret is Mapletree Com Tr which blew pass my sell price significantly. Netlink NBN Tr is recent sale so time will tell.

As mentioned before I tend to do some trading and CMT is a little smaller today as I recently took some profit off the table at $2.64. I hope to buy back. Really ..... ... ... Even with that, I still have 40% exposure in Reits. Frankly, is very hard to buy back in this rising market to my dismay. Fortunately, I play with a small percentage of my portfolio and most remains intact to enjoy the ride.

With the higher cash level, I have decided to complement it with SIA Bond and Astrea Bond for a more balance portfolio to buffer it up to 22%.

Namely,

Frasers Bond 3.65%

CMT Bond 3.08%

SIA bond 3%

AstreaIV Bond 4.35%

Equity investments to me needs to be RISK MANAGED to MY LEVEL. At 19 counters, this is quite manageable for me considering bonds/pref do not need much time to monitor so this leaves me with 15 to watch. At Portfolio size of $1.1 M excluding Gov securities I think is good enough for me right now.

Cory

2019-0630