Reits in the Portfolio

Investing in Real Estate Investment Trusts (REITs) can be a lucrative endeavor, but it comes with its unique challenges. In this article, we will explore the dynamics of REITs in investment portfolios and address common misconceptions.

Understanding REIT Vulnerability to Rate Hikes:

REITs, like any other investment, are influenced by market forces, including interest rate fluctuations. One key factor to consider is that rental contracts for REITs are often signed for years before renewal. Even if a REIT has rental escalations and triple-net leases built-in, rising loan rates can still affect their performance. It's worth noting that non-REIT companies can also face similar challenges due to loan costs.

Adapting to Changing Market Environments:

Some REITs face fundamental changes in their market environments. For instance, the rise of Work From Home (WFH) arrangements in the United States has impacted US Office REITs. In Singapore, there are a few US REITs with significant exposure to this trend. It's crucial to monitor such changes and be ready to adjust your portfolio accordingly.

Performance of Different REIT Categories:

In the current environment, certain REIT categories have shown resilience. Local Retail Mall REITs and Industrial REITs have performed above average. Foreign Data Centers and Business Park exposure, such as Mapletree Industrial, have also weathered the storm. Year-to-date (YTD), many REITs are on the path to recovery from the rate spike costs incurred in 2022.

The Challenge of Foreign Exchange:

However, not all REITs have fared equally well. Take, for example, Elite Commercial REIT, which is UK-based. Despite strong tenant occupancy and double-digit positive rental reversion, foreign exchange fluctuations and loan costs have significantly impacted its distribution. When investing in REITs with significant overseas exposure, careful sizing and risk management are essential.

Dispelling the REIT Myth:

There's a common myth that US Office REIT crashes therefore all REIT are lousy investment using a few examples and paint a dark picture on the entire industry. This bias view is misleading, as many companies fluctuates on downtrend during rate hikes for the short term too. It's important not to oversimplify market dynamics. Evaluating a REIT's performance over a single year doesn't provide a complete picture.

Diversity in the Local Market:

The local market offers a wide range of REIT options. While Capitaland and Mapletree family REITs are popular choices, there are numerous others to consider. For example, Ascendas has delivered impressive returns over the past two decades, even at its current valuation. While past performance doesn't guarantee future results, it's essential to understand that rate spikes take time for REITs to digest and can present buying opportunities and attractive capital gain or yield on cost in the future.

Only few are badly hit due to US Office Exposure. A good example of typical reit that many local investors buy are Capitaland or Mapletree family. They form bulk of many local investor interests and form components in STI Index today.

A good example will be Ascendas as below. More than 300% returns excluding dividends over 20 years even at current fallen price. While we cannot be certain Ascendas will continue to perform in the future we should understand rate spike takes time for Reits to digest and could be a good opportunity for one to collect. In no way we are recommending any Reit stocks and one should dyodd.

|

| More than 300% capital gain over 20 years excluding strong dividends |

Banks in the Portfolio

Incorporating banks into the portfolio has been a strategic move. DBS and OCBC, for instance, have demonstrated resilience, benefiting from high interest rates. They are poised to continue performing well in the medium term. Allocating a portion of your portfolio to banks can serve as a hedge against other segments, while still providing attractive yields.

Challenges in Bank Diversification:

Unlike REITs, which offer a diverse range of options, the local banking sector has limited choices. This concentration risk should be careful when expanding more into this sector. Recent forays into other segments, such as Venture, have posed challenges, reinforcing the need for caution and thorough research. The plan will then be to only further expand into banking sector when opportunity arises. This could mean reserving more dividend cash in the meantime.

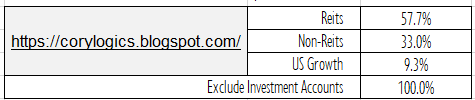

Portfolio Performance

Year-to-date, portfolio has achieved a 9.3% XIRR return, with Q3 '23 expected to show a slightly better improvement. REITs are gradually recovering, and their returns may expand as new contracts are negotiated. The only caveat remains foreign exchange volatility, which is beyond our control.

In conclusion, navigating REITs in your investment portfolio requires diligence and adaptability. Market dynamics are complex, and one must not oversimplify the factors influencing REIT performance. Diversification and careful sizing are key strategies, whether you choose to invest in REITs or explore the banking sector. Remember that past performance is not indicative of future results, and it's essential to stay informed and make well-informed investment decisions.

Currently, I am pretty comfortable with what I have in the portfolio. And the feeling today is we should have a better performance before the year ended.

Cory

2023-0902

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Disclaimer: The articles presented in this blog reflect personal opinions and are intended for informational and sharing purposes only. Not responsible of errors. Readers are advised to seek professional guidance when making financial decisions and should take full responsibility for their choices.