The COVID-19 pandemic brought forth unprecedented challenges, impacting economies and individuals' net worth worldwide. As I reflect on my own financial journey, I can't help but recognize the profound influence of property value increases, strategic investments, regular income, and the responsibilities of parenthood on my net worth during this crisis. In this article, I will share my experience and highlight the significance of these factors in shaping my financial well-being.

Real Estate Market Challenges and Surprising Property Value Increases:

Like many others, I faced uncertainty during the pandemic, particularly in the real estate market. However, amidst these challenges, a remarkable trend emerged - property value increases. As I owned residential properties in desirable locations, I witnessed firsthand the unexpected appreciation in property values. This surge greatly contributed to the improvement of my net worth, as individuals sought larger living spaces and took advantage of favorable mortgage rates during the crisis.

Mitigating Volatility through Diversification:

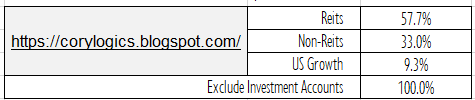

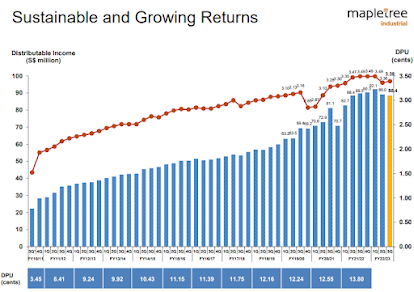

Diversification played a pivotal role in safeguarding my net worth amidst market volatility. By diversifying my investment portfolio across various asset classes, including real estate, stocks, and bonds, I minimized the impact of losses in one sector while benefiting from the property value appreciation in another. This strategic approach not only stabilized my net worth but also provided me with opportunities for growth during uncertain times.

Cash Reserves, Emergency Funds, and Regular Income:

Another crucial aspect of protecting and growing my net worth was maintaining adequate cash reserves and emergency funds. The availability of liquid assets provided me with a safety net, enabling me to handle unexpected expenses, job instability, or business disruptions caused by the pandemic. However, it is important to note that regular income from salary played a significant role as well. Despite the challenges in the job market, having a stable source of income allowed me to maintain financial stability and meet my ongoing expenses. The combination of regular income and strategic investments helped offset any stagnant growth in non-productive assets, ensuring a positive net worth trend.

Parenthood: Balancing Expenses and Prioritizing Future Security:

Over the past four years, the addition of two children to my family significantly impacted my overall expenses. The responsibilities and costs associated with raising children, including healthcare, education, and daily essentials, necessitated careful financial planning. While these expenses undoubtedly had an impact on my net worth, they also brought immeasurable joy and fulfillment. It became imperative to strike a balance between providing for my children's needs and ensuring long-term financial security.

Adjusting Financial Strategies and Priorities:

Parenthood prompted me to reevaluate my financial strategies and priorities. I became more focused on building a solid financial foundation for my children's future. This involved adjusting my investment portfolio to include long-term savings and education funds. While these changes may have temporarily slowed down the growth of my net worth, they provided a sense of security and peace of mind, knowing that I was taking the necessary steps to provide for my family's future.

Conclusion:

The COVID-19 pandemic presented significant challenges to net worth growth, with stock market volatility and stagnant growth in various sectors. However, my journey taught me that property value increases, strategic investments, regular income from salary, and the responsibilities of parenthood all played pivotal roles in shaping my net worth during this crisis. By owning residential properties in desirable locations, I experienced firsthand the positive impact of property value appreciation. Diversifying my investments across asset classes, maintaining cash reserves, and having a stable source of income further fortified my net worth.

Parenthood brought increased expenses and prompted adjustments to my overall financial strategy. The costs associated with raising children, such as childcare, education, healthcare, and daily necessities, added a significant burden to my monthly budget. However, I recognized the importance of prioritizing my children's well-being and future prospects.

To manage these increased expenses, I implemented several strategies. First, I carefully reviewed my budget and identified areas where I could make savings without compromising the quality of our lifestyle. This involved cutting back on discretionary spending, negotiating better deals on necessary expenses, and seeking out cost-effective alternatives.

Additionally, I explored other financial instruments that could potentially benefit my children's future. I researched and invested in low-risk investment options that would gradually accumulate value over time. This approach not only allowed me to grow my net worth but also provided a source of funds that could be tapped into when necessary, such as for college tuition or other major expenses.

In conclusion, the COVID-19 crisis has highlighted the importance of various factors in shaping my net worth. Property value increases, strategic investments, regular income from salary, and the responsibilities of parenthood have all played instrumental roles in my financial journey. While facing challenges, such as stagnant growth in non-productive assets and increased expenses due to raising children, I have learned to adapt, adjust my strategies, and prioritize long-term financial security. Through careful planning, diversification, and a focus on both short-term stability and long-term growth, I have been able to navigate these uncertain times and continue on a positive net worth trend.

Cory

2023-0519

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Articles in this Blog is personal take and sharing purposes only. Reader should seek their own professional help when making financial decision and be responsible for their decision.