Early morning today, dear wife lined me .... "Armoured cars rolling into Hong Kong" which kind of shocked me as I find this possibility remote. But after reading in detail, it was a "Routine" so to speak. We both agree .... is more of trying to intimidate. However, this is enough.

Decided to clear my Mapletree NAC Tr which registered two years of dividends. Could have been three years have it not the riots. We can't win it all can we ? This sale is quite painful because it has hit 6% yield. Decided SPH Reit despite 5% yield is the one I am comfortable to replace with. Obviously larger capital needed if I am to lock in similar dividends size.

The other key trade is I decided to sell my remaining Singtel shares. I took the opportunity when it hit a local spike to offload. One counter less as I decided to try iReit Global. Jio still on the hunt for market shares. Despite Airtel good defense, the battle will be prolonged hence my decision. Frankly, I feel some relief from the sale as I found later there is some mental stress hidden in the background. As I can sleep better, is a Good Choice !

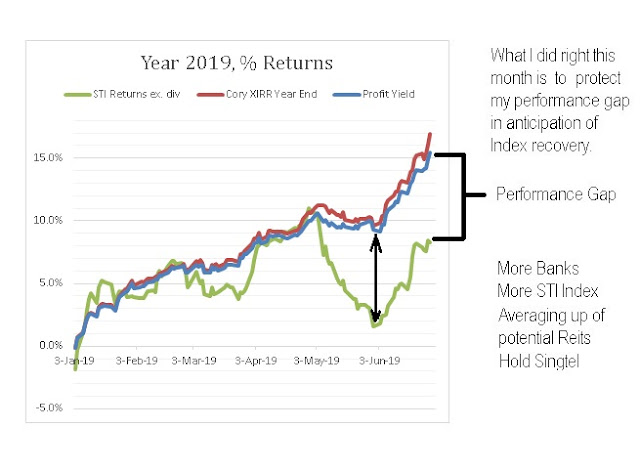

A minor trade on some of my earlier Ascendas Reit shares failed. So I managed to bought back some shares in recent dip therefore boosting my dividends in the counter. I would consider this average up. I do average down on DBS.... which was my plan to align more towards STI for 2nd half of the year to benefit from it rise or rebound.... . Fortunately, the plan aren't so match and so much less impacted by STI Index recent banking segment poor performance.

Other than those key investment decision, I also remember attempting a speculative punt. Wish me luck on this one. Non-bank, non-reits and non-property. Is dangerous feeling rich .... All I could say.

Cory

2019-0829