CoryLogics Invest Chat - No Coin, No Porn, No Penny

Dec 5, 2024

Cory Diary : Straits Times Index (STI)

Dec 4, 2024

Cory Diary : Recent Trades

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Nov 25, 2024

Cory Diary : Cash Flow

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Nov 16, 2024

Cory Diary : How it happens - Retire Series

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Nov 11, 2024

Cory Diary : Portfolio Management Update

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Nov 2, 2024

Cory Diary : Review Sheng Siong Business Update

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Oct 31, 2024

Cory Diary : Review Mapletree Industrial Reit

|

| Picture 1 :DPU Checks |

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Oct 10, 2024

Cory Diary : Year 2025 Strategy

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Oct 5, 2024

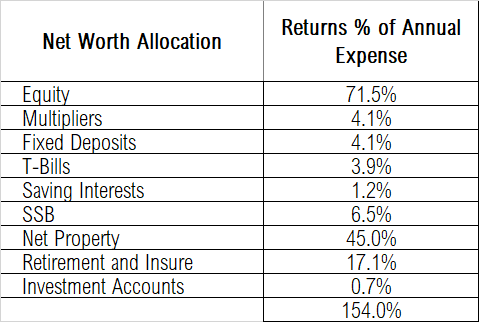

Cory Diary : Asset Allocation 2024

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Sep 28, 2024

Cory Diary : Retirement Reflections: A New Chapter

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Sep 14, 2024

Cory Diary : De-Cluttering our lifes

So I've been doing a thorough decluttering across multiple aspects of my life, from blog articles to personal belongings and hobbies. Streamlining everything can be quite refreshing!

Here's a summary of what I've achieved:

Blog Articles: Cleaned up my blog by deleting outdated dividend tracking posts, making room for more relevant updates.

Aquarium: After years as a corydoras enthusiast, I decided to put aquarium hobby on hold to focus more on family and other responsibilities.

Office Cube: Cleared out a significant amount of accumulated items, like outdated technology and office supplies, creating a more organized and minimalist workspace.

Large Baby Stroller: Letting go of a bulky stroller that’s no longer needed with our children growing up.

Pictures: A big effort to organize decades of photos across various storage devices, though I am leaving the rest for a future project.

I am clearly making space in both physical and digital life, leaving more room for what matters to me, especially investing. Keep up the momentum!

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Sep 7, 2024

Cory Diary : Rising Tide Lifts All Boats

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Sep 1, 2024

Cory Diary : Portfolio Equity allocation updates

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Aug 24, 2024

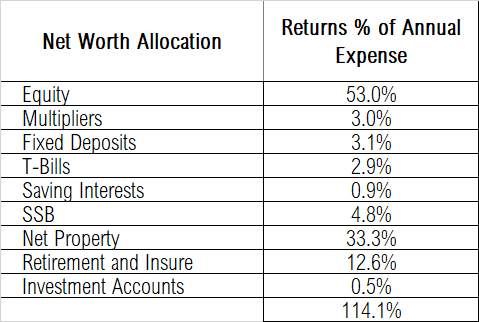

Cory Diary : Strategy for 2025

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Aug 17, 2024

Cory Diary : Yen Carry Trade Crisis P2

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Aug 15, 2024

Cory Diary : Yen Carry Trade Crisis

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Aug 5, 2024

Cory Diary : Retirement Equity Portfolio Size

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Jul 28, 2024

Cory Diary : An Insight into DBS CIO Hou Wey Fook

Hou Wey Fook's Investment Strategy

The Barbell Strategy

- Income Generators: Assets that generate consistent income, such as Singapore T-bills, government bonds, Singapore REITs (Real Estate Investment Trusts), and Singapore bank stocks for their dividends.

- Growth Equities: Investments in companies that are innovators, disruptors, enablers, and adapters. These are best-in-class global companies with wide economic moats – competitive advantages that enable them to maintain profit margins and market share in the long term.

Measured Exposure in Gold ETFs

Additional Retirement Income from CPF SA income for retirement.

Well-Diversified Portfolio: Prefers bonds ETFs rather than single bonds.

Income and Growth Allocation: 60% of his portfolio is in assets that generate regular income streams, while the remaining is primarily in growth stocks. It is likely that, closer to retirement, the 60% weightage of income-oriented investments will rise further.

Universal Life Policy: Acts as a mortgage protector, ensuring that in unforeseen circumstances, his wife and children can continue living in the house without the burden of servicing the housing loan.

Drafted Wills: This saves his children from unnecessary emotional stress.

Real Estate and Lifestyle: He bought a landed home 20 years ago and owns a Tesla.

It looks like we have a similar strategy regarding the Barbell approach. Recently, I added Russell ETFs and iBIT. These are small positions, but I hope to grow the Russell ETF smoothly, in addition to the similar growth stocks we have. iBIT is an insurance product that seems to match his measured exposure in Gold ETFs.

Regarding insurance and wills for the family, this is something I need to plan for the mid to long term. I don't think I can do much about owning a landed home as he does.

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Jul 26, 2024

Cory Diary : Ascott Trust Investment Review

Ascott Trust just released their result. The DPU reduced about 8% YoY but is only 1% if we exclude forex. The table to explain as follow. Base case 5.4% yield. Include other gains 5.7% yield at price 0.895. Price did not drop much after result which likely priced in somewhat currently.

CoryLogics Invest Chat - No Coin, No Porn, No Penny