Updates on Recent Financial Ratios

Started focusing on financial ratios to better assess personal financial situation and hopefully avoid unnecessary distress. Here’s a summary of the key ratios I'm monitoring:

1. Net Property Value (NPV)/Equity Ratio

67%

This ratio helps in determining how much allocate to equity with acquired property. Typically, we can manage fluctuations in equity over time. However, Property values usually increase locally, and based on this ratio, actions might be needed on either side of the balance.

For a single property, having a larger equity base seems logical to maximize returns and ensure diversification. This helps avoid being property-rich but cash-poor. However, this might not suit everyone, especially those wary of equity investment risks. In our case, the property value has been rising, which positively impacts this ratio.

2. Bond/Equity Ratio

43%

Common in many investment books, this ratio for us, includes Singapore Savings Bonds (SSB), Fixed Deposits (FD), Multiplier, and Treasury Bills (T-Bills) for the bond portion. Working cash is high enough for us to include Fixed Deposits. For us, the 43% includes housing loan emergency funding, which is substantial. This ratio has been decreasing due to increasing capital gains in equity to our surprise as we have invested consistently into T-Bills and SSB.

3. Pension/Net Worth Ratio

15%

This ratio measures dependency on pension funds as a safety net for managing our lifestyle. It also indicates available funding for investment. We prefer not to allocate beyond required contributions from work, focusing instead on the necessary safety net amount. This ratio can also be applied to equity or property instead of net worth. We aim to understand how much we invest in higher-risk assets. For us, meeting the Full Retirement Sum (FRS) is sufficient, though some might prefer a higher amount for added security.

4. Loan/Reserve Fund Ratio

145%

This ratio considers funds reserved for housing loans that don’t affect our emergency funds. These reserve funds can partially serve as a war chest. Our 145% ratio indicates the reserve fund cannot fully cover the outstanding loan but good enough to last us to get things in order.

In essence, Reserve fund need to be safely invested and so it could be a liability if we are confident to get much more than typical guaranteed investments. So it becomes our Bond fund.

Is a little tricky what is the idea ratio be. Defintely we want to have enough runway when there is need to unwind. But we also hope it can last as long as possible till say our cashflow can handle the monthly instalement. So this can be quite different between individuals.

As I want to retire early if possible, the goal certainly will be full reserve coverage of the loan. However, I am comfortable to handle loan as long is sustainable to drive more returns. Full coverage also mean other variable ratios may go out of whack. Which means larger networth needed or we have to pay down the loan to somewhere.

Current loan at 1.5% Fixed is a steal. It won't be in the next renewal.

5. Emergency Fund/Annual Expenses Ratio

162%

I recently calculated our annual expenses and multiplied them by 1.15 to include additional support from my partner, and we have about 19.5 months of buffer when the ratio is computed.

This buffer excludes SSB, Multiplier, and T-Bills. Includes working cash, as we don’t have a dedicated account for emergency fund. Funds are spread across various cash and fixed deposit accounts.

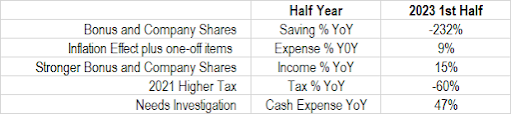

6. Cash Flow / Annual Expenses Ratio

122%

Cash flow is obtained from investment, income, rental support, fixed returns etc. With this number, theoretically Networth should climb consistently as long we keep working and investment not badly affected. However, this value likely varied annually as portfolio size gets bigger whereas salaried income is at much slow pace.

Actions

The Ratio that may need to watch is Loan/Reserve Ratio. Not that the reserve amount could not cover the loan but cash flow ratio needs to manage like any other business.

The whole idea of the loan is to drive or leverage for more returns elsewhere. So if they are fully locked in reserve to minimise the loan risk, then we need to ensure they have sufficient returns.

The easy way out is not to retire voluntarily. Each month income is a boost to the reserve.

Cory Diary

2024-0708

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Disclaimer: The articles presented in this blog reflect personal opinions and are intended for informational and sharing purposes only. Not responsible of errors. Readers are advised to seek professional guidance when making financial decisions and should take full responsibility for their choices.