Managing emotions in the stock market, especially during periods of market highs or when a particular stock like DBS is at an all-time high (ATH), requires a disciplined approach. Here are some considerations and strategies I can think about using this portoflio below as an example :

|

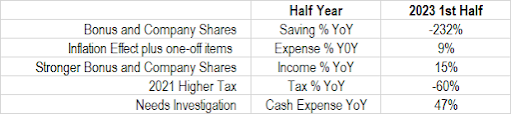

| P/L YTD |

1. Assessing DBS Investment

Current Portfolio Allocation: Evaluate how much of my portfolio is currently allocated to DBS. If it's a significant portion, consider whether this aligns with my risk tolerance and investment goals.

Risk Mitigation: DBS is sized to mitigate high-rate scenarios. Assess if increasing your DBS allocation further fits within your risk management strategy.

2. Criteria for Decision Making

When deciding whether to sell, hold, or buy more DBS shares, consider the following criteria:

Fundamentals: Evaluate DBS's financial health, growth prospects, and market position. If fundamentals are strong and justify a higher allocation, holding or buying more might be prudent.

Valuation: Assess whether DBS is overvalued or undervalued relative to its historical metrics or industry peers. High valuation might warrant caution. For this case sustainability of the dividend.

Portfolio Diversification: Ensure overall portfolio remains diversified across sectors and asset classes to mitigate risk. Limited alternative.

3. Taking Profit

Profit-Taking Strategy: If DBS has generated significant profits for the portfolio, consider taking partial profits to lock in gains and rebalance your portfolio. This can help manage risk and reduce exposure to a single stock.

Reinvestment: Reinvesting profits into other assets or sectors can help maintain diversification and potentially reduce emotional attachment to a single stock.

4. Managing Emotional Threshold

Establish Rules: Define clear rules or thresholds for when to buy, sell, or hold based on investment strategy and risk tolerance.

Stick to Strategy: Avoid making emotional decisions based on short-term market movements. Stick to predetermined investment strategy and criteria.

5. Long-Term Perspective

Quality Investments: Focus on investing in fundamentally strong businesses with good long-term prospects. Quality investments can provide stability during market fluctuations.

Patience: Markets fluctuate, and stocks go through cycles. Having a long-term perspective can help reduce the impact of short-term emotional decisions.

Conclusion

In summary, managing emotions in the stock market, especially with a stock like DBS at ATH, involves assessing portfolio allocation, using objective criteria for decision-making, considering profit-taking to rebalance, and maintaining a disciplined approach aligned with your investment strategy. By focusing on quality investments and diversification, you can better navigate market volatility and emotional biases.

Currently, doing nothing. The logic is simple. Bank is to hedge Reit. So sell at this time seem bad idea as it may or not get worst for Reits. Adding more DBS is no too as it may exceed my mental treshold should DBS got hit.

Cory Diary

2024-06-15

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Disclaimer: The articles presented in this blog reflect personal opinions and are intended for informational and sharing purposes only. Not responsible of errors. Readers are advised to seek professional guidance when making financial decisions and should take full responsibility for their choices.