1QFY23

FIRST QUARTER ENDED

30 JUNE 2023

YoY 3.1% reduction in NPI reflecting in YoY 13.4% increase in borrowing cost and foreign exchange. Into the mix is host of forex considerations and financial derivatives between the YoY comparison including perp, tax write back etc. Large gap if we look into operation return is -24.1% YoY. In net, there is higher distribution due to capital returns as well that tip it into higher distribution this Q. DPU flat. Trying to go through the Quarterly report is quite daunting tasks.

To simplified my perception, the DPU looks ok though not as high as Ascendas, MIT etc. There is PP/PO and there will be slight reduction in DPU assuming all else being equal which is typically not in every new quarter reporting.

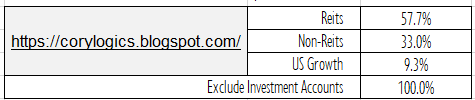

In summary this is what I got into below table.

There are enough Pro to provide conditions to manage debt and high interest rate/hike. The yield is ok based on the DPU. There could be forex risk from China & HK combined. Not saying JPN and other developing economies won't.

The comparison QoQ and YoY, tells me the business impact stabilizing this Q compared to previous Quarters.

Finally, the DPU may move up/down due to capital gains, issue unit etc however I feel we should not see significant move down more than 3~5% with the recovery, new divestments and acquisitions. This is up to the manager to manage them to ensure we stay above. A hallmark of quality manager which they are usually. We shall monitor.

Cory

2023-0731

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Telegram CoryLogics <= Link to Telegram Chat

Disclaimer: The articles presented in this blog reflect personal opinions and are intended for informational and sharing purposes only. Not responsible of errors. Readers are advised to seek professional guidance when making financial decisions and should take full responsibility for their choices.