CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

... CoryLogics ...

Apr 21, 2024

Cory Diary : Portfolio updates

Apr 14, 2024

Cory Diary : Dividend Q1 '24

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Mar 22, 2024

Cory Diary : Equity Portfolio Adjustments Amid Market Uncertainty

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Feb 24, 2024

Cory Diary : Net Worth Update and Milestone Achievements

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Feb 19, 2024

Cory Diary : Expense 2023

- "Home Loan"

- A few one-off Medical Expenses - Therapy Sessions etc

- On/Off there maybe Bonus Company Share Sales

- Parental Allowances

- Income Taxes. I help cover my partner too.

- Partner contributed to some expenses. Assume 15%. May Revisit later on this assumption.

|

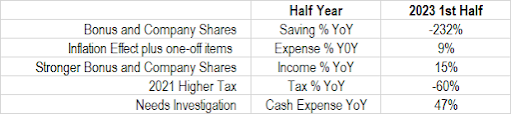

There is basically negative cashflow for 1st half of Y2023. Lumpy Tax. What to focus is the cash expenses YoY 47% Increase but overall expense only 9% up. Compared to Full Year chart, the expense 42% as is much more actively watched in 2nd Half of Y2023

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Jan 23, 2024

Cory Diary : Cash Flow against Assets Investment

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Jan 15, 2024

Cory Diary : CPF Top-Up

At age 54, this is the last year to top up and get the most out of it before the Retirement Account (RA) is formed at age 55. What makes this year special compared to getting good rates in the age 55-65 band?

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Jan 9, 2024

Cory Diary : Investment Ratios

The first ratio is how much liquidity on current assets that i can move easily. This give me an idea if I am to ramp up my equity portfolio to support war chest.

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Jan 6, 2024

Cory Diary : Year 2023 Net Worth

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Jan 4, 2024

Cory Diary : Year 2023 Equity Learning Part 2

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Dec 31, 2023

Cory Diary : Year 2023 Equity Performance

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Dec 21, 2023

Cory Diary : Year 2023 Dividends

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Dec 12, 2023

Cory Diary : Investment Plan for 2024, Navigating Through High Inflation

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Nov 13, 2023

Cory Diary : Putting in a case for Reit today

Currently Rate is Peaking in this high rate environment. While rental contract such as Mall Reit could takes 3 years to cover all tenants. This will mean Reit investors will have to absorb the cost of funding differences even with Reit with strong moat. The good news are most Reits are still profitable. We are in interesting time because the irony is those reits with very short term contract will be able to raise their rental cost quickly and are much more nimble to react to rate hike.

The benefits will be we could see significant rise in reits earning as contract takes time to unwind too and economy could be boosted in lower yield environment again. This is the upper optimism of hope. The fear could be diving deeper into lower dpu such as the high rate causes recession to the broader economy hence nothing is riskless due to the other spectrum of negativity.

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Nov 3, 2023

Cory Diary : Netlink BNB Trust H1 FY24 Review

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Oct 25, 2023

Cory Diary : Mapletree Log Trust 2Q FY23 Report

Have sold 1/3 of my position just recently before the major sell down and today report. Looks like I will be holding the remainder for quite a while. Quite happy with the Reit performance so will Hold and monitor due to many transaction of their properties.

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Oct 11, 2023

Cory Diary : Q3 Dividend Updates

YTD 58K dividend from Equity. On Total Returns after recent day sell down due to another rate hike fear, XIRR is around 8% plus. Still expecting to finish strong this year despite war erupting between Isreal and Hamas. It may have impact if the escalation hits Iran.

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Oct 6, 2023

Cory Diary : Review of Current Reits Position in the Portfolio

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Sep 26, 2023

Cory Diary : Expensive Ventures

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Sep 2, 2023

Cory Diary : Portfolio of Mainly Reits and Banks YTD Performance '23

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )