Have been a long time since I took the MRT here. This is for the trip to the newly built Funan Mall by CMT. As I know there is some concept into the mall designs which I am eager to explore. Ideally I would like it to be connected to the MRT without walking under the hot-sun to get there and back. Fortunately, I have a little distance shaded by the capitol way, underground. Funan Mall main entrance doesn't seems grand or obvious. Maybe is just me as I am quite new to the revamp.

The most interesting will be rock climbing. I like it. Is good to see young folks trying them and get to have fun. There is a crowd on this.

This certainly fits the theme of trees ....

The central ground floor area has a cafe. Some open spaces which I suppose can be provided for future ad-hoc activities.

Behind the cam on the right has a broad stairway where we can see a numbers of people rest on it. Interesting though I do not think it was meant to design for that but I did not explore further. Not in picture.

Other than the escalators on the edge, there are inter-connection stairways at a distance off the edge between the floors where they have additional stores.

However I do not think it drives much revenue from it. The clothing store doesn't fit there as well.

The ceiling has glass right through illuminating the mall other than the purplish neon lighting. This are unique.

The ceiling has glass right through illuminating the mall other than the purplish neon lighting. This are unique.

There are B1 and B2 mainly food stores. Level 1, 2 and 3 are too. Not surprising in order to sustain the mall operations. I would think they also help to bring the crowds from surrounding to support the IT stores thereby feeding on each other attractions.

There are a number of establish IT stores. A cool bicycle shop. The modelling shop seems not ready. I find it out-of-place to find a furniture store. We can do well with a few pet shops, climbing/camping gears shops, boxing/gym, banking services and telcos. WeWork is kind of good fit. There is a cinema on the top floor but I think it can do well to have laser/combat/maze types of team building activities as well.

The metal stair case lead to the roof garden where you find some modern tech farming. There are some height, zig-zag and distance to cover so not that cool for a 49 year old man with a 7 kg load ... to travel up there. For those who still want to attempt, there is actually a lift .... darn.

I heard there is tennis court and barbecue pit but not in this section than I have climbed. It will be nice to have infinity swimming pool though.

Not everything is in-place yet and I think there will be further fine-tuning.

Overall, is a unique concept. However, there are room for improvements.

On my return journey in the MRT, all the seats are occupied. I could see those seats marked for the needy filled by the deserving. However I could not understand why no one please a baby-carrying dad for the normal seat. Ok, lazy me. Maybe I look muscular. haha. I do hope to receive some social grace out from the heart and not due to social pressure or laws. On the later part of the journey, a student alight and a young Indian man standing besides signal me to have the seat right in-front of him. And there's this 50s loving couple sitting beside me, the lady smiled at my baby ....

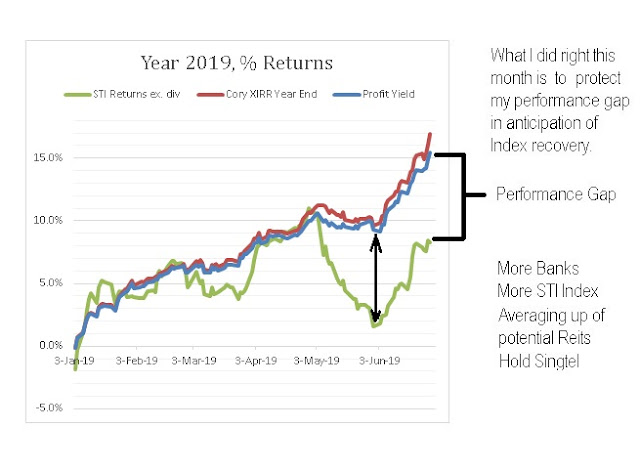

Vested though much smaller than previous.

Cory

2019-0721