CoryLogics Invest Chat - No Coin, No Porn, No Penny

Aug 17, 2024

Cory Diary : Yen Carry Trade Crisis P2

Aug 15, 2024

Cory Diary : Yen Carry Trade Crisis

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Aug 5, 2024

Cory Diary : Retirement Equity Portfolio Size

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Jul 28, 2024

Cory Diary : An Insight into DBS CIO Hou Wey Fook

Hou Wey Fook's Investment Strategy

The Barbell Strategy

- Income Generators: Assets that generate consistent income, such as Singapore T-bills, government bonds, Singapore REITs (Real Estate Investment Trusts), and Singapore bank stocks for their dividends.

- Growth Equities: Investments in companies that are innovators, disruptors, enablers, and adapters. These are best-in-class global companies with wide economic moats – competitive advantages that enable them to maintain profit margins and market share in the long term.

Measured Exposure in Gold ETFs

Additional Retirement Income from CPF SA income for retirement.

Well-Diversified Portfolio: Prefers bonds ETFs rather than single bonds.

Income and Growth Allocation: 60% of his portfolio is in assets that generate regular income streams, while the remaining is primarily in growth stocks. It is likely that, closer to retirement, the 60% weightage of income-oriented investments will rise further.

Universal Life Policy: Acts as a mortgage protector, ensuring that in unforeseen circumstances, his wife and children can continue living in the house without the burden of servicing the housing loan.

Drafted Wills: This saves his children from unnecessary emotional stress.

Real Estate and Lifestyle: He bought a landed home 20 years ago and owns a Tesla.

It looks like we have a similar strategy regarding the Barbell approach. Recently, I added Russell ETFs and iBIT. These are small positions, but I hope to grow the Russell ETF smoothly, in addition to the similar growth stocks we have. iBIT is an insurance product that seems to match his measured exposure in Gold ETFs.

Regarding insurance and wills for the family, this is something I need to plan for the mid to long term. I don't think I can do much about owning a landed home as he does.

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Jul 26, 2024

Cory Diary : Ascott Trust Investment Review

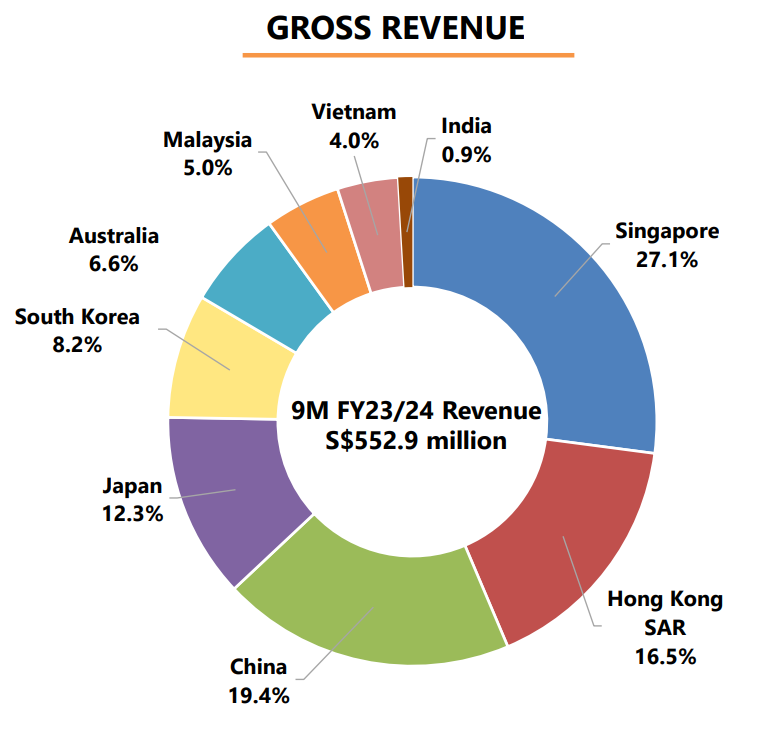

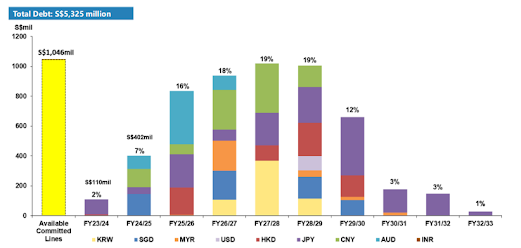

Ascott Trust just released their result. The DPU reduced about 8% YoY but is only 1% if we exclude forex. The table to explain as follow. Base case 5.4% yield. Include other gains 5.7% yield at price 0.895. Price did not drop much after result which likely priced in somewhat currently.

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Jul 8, 2024

Cory Diary : Personal Finance Ratios

67%

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Jul 5, 2024

Cory Diary : Family Expenses 1H24

As table shown, it appears we have managed to stop the problem. 1% expense increase for 1H24 compared to 2H23. This is on the back of additional Travel and Private Tuition Fee.

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Jul 4, 2024

Cory Diary : Portfolio Re-Balance and Result

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Jun 15, 2024

Cory Diary : Emotional Management

|

| P/L YTD |

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Jun 10, 2024

Cory Diary : Turnaround of Reits

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Jun 2, 2024

Cory Diary : Net Worth Update and Milestone Achieved

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

May 28, 2024

Cory Diary : Cory's Investment Insights

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

May 20, 2024

Cory Diary : Equity Portfolio Review

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

May 12, 2024

Cory Diary : Sell in May and go away logic

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

May 3, 2024

Cory Diary : MLT Result Review

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

May 1, 2024

Cory Diary : Sheng Siong Result Review

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Apr 21, 2024

Cory Diary : Portfolio updates

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Mar 22, 2024

Cory Diary : Equity Portfolio Adjustments Amid Market Uncertainty

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Feb 24, 2024

Cory Diary : Net Worth Update and Milestone Achievements

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )