Shifting to a Cash Flow Mindset in Money Management

As I shift my mindset to focus on short term cash flow in managing my finances, it becomes clear that understanding cash flow generation as a whole is essential, especially considering that most stocks pay dividends.

This concept is particularly important for those who do not possess significant wealth that can be safely parked in savings without worrying about potential shortfalls. For retirees and many others, being able to cover bills, fees, and expenses is critical, especially as these expenses are expected to grow over time. Therefore, putting every dollar to work and allocating it according to different risk levels seems like an intuitive approach.

Where to Start

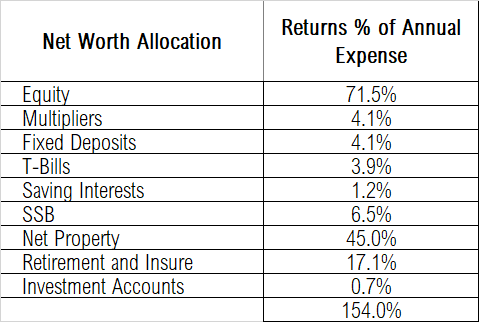

To begin, I can gather current expense estimates and draft a plan outlining various income sources to support these expenses. For instance, let’s assume an annual expense of $100,000. To clarify, the table below uses arbitrary numbers for simulation purposes. In this scenario, the total income is 54% buffer on the annual expenses. [ updated error ]

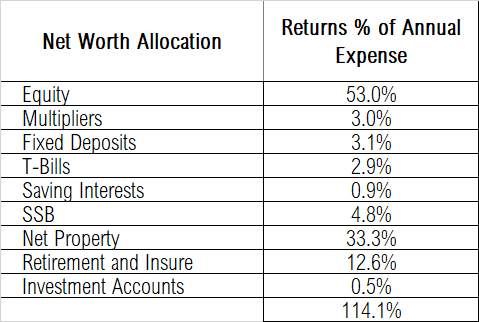

However, if I increase my estimated expenses to $135,000, the revised table would look like this:

Analyzing Expenses

This analysis provides a valuable guide for managing my expenses. I could refine my calculations by reducing the allocations for retirement and insurance since I typically won’t receive my first payout until age 65. Additionally, insurance policies may need to be surrendered to access funds.

There are various levers to adjust in this financial plan.

The fundamental idea is to continuously monitor and improve one’s financial situation while also maintaining motivation throughout the process.

If my planning goes exceptionally well, I might even consider including my spouse's expenses or other discretionary costs. If we find ourselves below our target income, we can optimize returns by reallocating savings or exploring other investment opportunities. The initial table heavily relies on equity and property incomes. As we approach age 65, additional pension streams will become available to us. However, there are always other options to consider as we navigate different levels of risk.

Conclusion

Adopting a cash flow mindset allows for better financial planning and resource allocation. By continuously assessing and adjusting our strategies based on our changing circumstances and goals, we can create a more secure financial future.

Cory Diary

2024-11-25

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Telegram CoryLogics <= Link to Telegram Chat

Disclaimer: The articles presented in this blog reflect personal opinions and are intended for informational and sharing purposes only. Not responsible of errors. Readers are advised to seek professional guidance when making financial decisions and should take full responsibility for their choices.