After a brief hiatus from my blog, I'm back to writing about my equity portfolio and recent market events. With the collapse of several banks, regulators are enforcing quick resolutions to avoid contingencies. The Federal Reserve has been clear about the risks involved, yet some banks like SVB continue to take risks, leading to poor risk management and the risk of losing Other People's Money (OPM) for the sake of performance.

The Middle Class

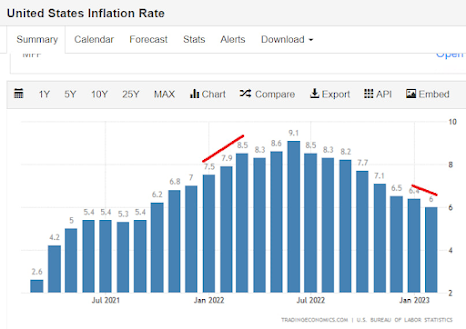

In the past, high-risk investments like those seen in Lehman Brothers in 2008 were a major concern. But today, even low-risk treasury investments can lead to failure if investors become complacent. The recent US rate path to fight inflation shows why the Fed is determined to bring down inflation rates, as basic necessities are becoming increasingly unaffordable for the poor. The middle class is also at risk, as a 9% annual inflation rate could result in a loss of $90k in purchasing power for someone with a net worth of $1 million, which could vaporize a lifetime of savings.

The next inflation report theoretically we could see another reduction. See above Inflation rate chart and we can understand why. The previous year on month has a spike. Again is all about meeting expectation.

Equity Portfolio

To balance my largely REIT-focused portfolio, I've had to increase my bank stake despite the rising rates and high PB ratios. I chose DBS Bank as a long-term performer in the STI Index, with sustainable and conservative returns. On the other hand, my experience with Prime REIT has been disappointing, with poor returns despite management's trying to paint a different picture. After learning my lesson with small-sized positions, I decided to clear off my tiny position in the REIT.

I've also been doing some trading with Mapletree Logistics REIT and have now completed my Mapletree collection with a slightly larger stake. While HK's future looks uncertain and US DCs and rates aren't favorable, I still have sizable positions in Mapletree Pan Asia Commercial Trust and Mapletree Industrial Trust, as they are better off than many others.

Overall, with the recent banking crisis and inflation risks, it's important to stay vigilant and invest wisely in a balanced portfolio to avoid losing hard-earned savings.

Cory

2023-03-25

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Telegram CoryLogics <= Link to Telegram Channel

Articles in this Blog is personal take and sharing purposes only. Reader should seek their own professional help when making financial decision and be responsible for their decision.