To start in proper - Saving is the act of spending less than you earn in income, and placing the remainder into a reserve account for later use. How much ability to save ties somewhat to frugality.

Being Frugal

To me it could means minimize wastage. It can be avoiding large wastage of uneaten food. Imagine the amount of saving from uneaten food of each meal as it forms a large part of our basic cost. However, we cannot trade it over balance diet else illness may visit us which will cost a lot more. Fortunately I do not have crave for titbits and soft drinks. So on both health and saving wise, stars are aligned for me.

If we do often enough, drinking Starbuck instead of KopiTiam where the marginal utility may not be very wide for me, saving could be quite significant. Probably 3 times. So frequency matters in this case. If it provides high satisfaction for your life, do go ahead for your daily Starbuck, while I enjoy my kopi siew tie !

There are items in home we should never brought home. Unused bulky exercise equipment. Souvenirs or tons of fur toys that we never really appreciate when brought home. I would go as far to include massage chair. That's doesn't mean you should if it does bring you big comfort. Being frugal also means able to focus on big ticket items. If Tesla car design is what you need, while it could be luxury for some, may not be for others. Maybe we can go for Model 3 instead of X.

To some others could be stringent control of expenses. I find this unnecessary "suffering" for myself. What we need to take is a balance approach in life before our mind get conditioned to think is ok. Some could think that's the way however I beg to differ. People who track down to tiny expenses daily, for years. Take a step back and think, are you the character type that will spurt or time is better spend else where to grow your income unless you telling me your life is to keep track of such. I close my case.

We should still go for occasional social, cab when is not convenience to use the rail and short holidays. And no way I want to be late for work or appointment just to save on taxi fares. Being early for a meeting may put me in a better shape to kickstart my working day and further my career and therefore income. Once in a long while maybe a delayed major trip. Delay gratification helps but don't push it out too far out. What this mean is we should try to expand our life to some extend to appreciate and enjoy within reasonable budget constraints while we compound our money but not to stop us on to get better on appreciating humanity and cultures.

Things I valued is like walking out in the morning through the garden to freshen up my mind on the way to nearby kopi shop to take my breakfast. I could spend like $5 and enjoy slightly finer things in life. I know some would try to cut down to $2 or have it at home eating bread from QAF. If that's is what one preferred is ok too if that's what you enjoy to do but make sure you do ! A short chat with the stall employees and cleaner brighten up the day.

As one may remember I got a notebook recently after many years till if I find the efficiency beginning to be a drag. Is not like I am stingy to get a new one in a shorter time period but the old unit I had was a power itself for my needs till auxiliary parts start to weaken. And I decided to look for medium range value or better.

Being excessive in saving habits or subconsciously could have unintended consequences when ones life in earth is limited. And yes we live only once ! So don't waste our life time just to skim in everything or for argument sake in most. Often we are so busy we miss out other aspect of life which form our existence in this world instead of enjoying the process of it. I was single for a long time. While people admired the freedom I had which I do have, deep down in my heart, if I could married and have kids, making like full circle, I would. But I am not going to trade it without getting the right partner. Luckily, I did but is ok if we are not as we will find different option paths of different life and my expenses rocketed. Yup, it REALLY does but I am happy. That's what matter.

Personally, the best way is to find ways to improve our earning and this could be spending more to improve ourselves, skillset and broadening our perspective in life. Looking for way to improve our value in the company and leading project to improve efficiency. Time is money too so we need to watch the fine balance between them.

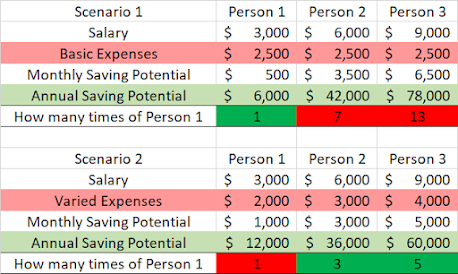

I come up 2 scenarios of different people just to give us a thought in perspectives. Is not trying to convey spending beyond our means definitely or trying to achieve FI by ensuring lifestyle remains the same after salary tripled. I do not think is ok for one to do that. There is no prize saving the extra Million to beat the others when our life is limited. I am more like Scenario 1 Person 3 in the past. Now working towards Scenario 2 Person 3. Not the exact amount of salary though but you know what I mean.

To sum up my idea using above table. Using Scenario 1 assuming varied income with same expenses. Person 3 saving is 13 times ! of person 1. This is a little extreme of higher earning but continue to maintain low expenses of one who only draw 3k years ago.

Scenario 2 is where as one income grow, we adjust our spending. Person 1 in this scenario tried many means to squeeze saving.

Scenario 1 of person 1 and Scenario 2 of Person 2 and 3 are options we could possibly choose. Lesser saving when one is earning less, by proportion. And adjusting for better lifestyle when people earns more. We still ride on larger absolute savings. That's what earning more is about, winning both ways. The Way of life.

Cory

2021-0104