FINANCIAL GOALS

Financial goal is that in my retirement period, investments can well cover the need of my Family & Emergency Expenses and an Equity Portfolio returns that is diverging long term. I see myself continues to manage the portfolio well into my retirement. Has Will drawn up in my bucket list and experience pass down to my children so that they have better head start.

NETWORTH REPORT

As the net worth gets bigger I find it quite impossible to continue on 10% path but manage to get it done for Year 2021 despite increasing expenses. Year 2021 is best remembered for my juggling act on so many things. 24 hours really not enough as I am the type of person who needs a lot of personal space. Is fortunate that our company do well during this Covid period. With the pace of Omicron is spreading, there is good chance that Covid may end soon so that life can return to a Better Normal.

EQUITY

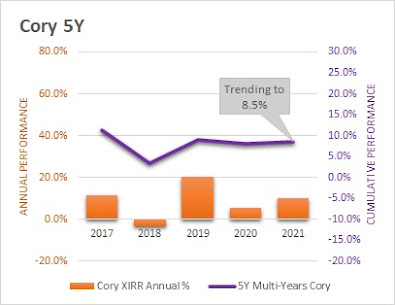

Achieved XIRR 10.1% for Year 2021. ( Absolute return 10.8% ). Two main stocks drive half the profit. DBS and TESLA. Remainders mainly from other US Shares, SGX defensive counters and a few Reits which I locked profits. The move to NASDAQ this year helped the portfolio significantly and also provide a more balanced portfolio to SGX counters.

Manage to reduce stock counters to 15. Their dividend will drive around S$65K for year 2022. The growth stocks are relatively new for me and hope to see continue investment there with baseline dividends achieved. Did more than 250 trades this year choking up almost 8k of fees and expense ratio of 0.52%

Based on recent 5Y performance, every year tells a different story. The portfolio constantly needs to keep pace with market changes each year. Year 2022 will in interesting due to anticipated interest rate hike. This is probable but not definite as personally I feel is tied to the strength of US Economy. Fed maybe forced to print again or maintain status quo after tapering. Regardless, the portfolio has to adapt quickly. One thing I need to keep reminding myself is to cut loss on poor performing companies and this is what Index does too basically.

Below is the lifetime return of equity investing. Investing in strong good companies give a significant better result. Frankly, I am not a good stock picker but I am fast in cutting loss. Cannot stress the importance.

CPF

In summary, after refunding all my CPF housing loan and move them to SA. FRS is Max. In addition VC3AC to Max too. I also did some top up for my toddlers just to try out the process. If you are interested, on detail I have a CPF page for it in the blog.

The plan is to max my top up till 55. And if possible, CPF shielding. After RA allocation, I could see a good amount inside CPF generating Interests which I can withdraw as needed. Still deliberating whether to max out MA as it doesn't look like the interests will hit ceiling of MA annual adjustment.

CPF is the baseline safety net protection of returns. Received more than $10k in interests yesterday. Gov gives free money must take which is basically almost risk free and stress free. Obviously people in this game will like to see continuity.

INSURANCE

Have two main insurances that I have been paying monthly for more than 20 years and has been continuing them. The main issue with saving type of insurance is the bonus portion is not guaranteed. People can find out later ( like after 20 years ) that they may get zero ! and the fear is that there is nothing much they can do about it. This sounds untenable to me even though my current one has bonus that is good enough. So far from calls, the amount confirmed looks reasonable. I will find an optimal time to withdraw it and will be a model learning case for others. For my the other which is Life Insurance it does not seems worth to surrender as the benefits are significantly higher after I passed. Probably will procrastinate this one.

SINGAPORE SAVING BOND

This is held in reserve for bank loan repayment backup which can also double up for family emergency. Is already Max out 200k. As the figure is fixed, over time this 200k will become smaller and smaller in percentage term relative to Net Worth naturally. One do not have to do much and therefore best leave it untouched.

Interests collected is on cascading basis for 10 years. This year will be $4207. By the end of 10 years most of home loan will be paid. We can then decide whether need this reserve amount. Ideally if the gov increase the ceiling further we could do some shuffle to stagger out the bond due dates.

PROPERTY

Have an investment property. Currently the rental supports are not optimized so I foresee room for financial return improvement if needed. The rental is not able to cover the monthly repayment due to the large principal repayment portion as the loan period is short. However considering this is due to larger principal repayment and not the interests itself, in net perspective is still worth the investment as it is positive earning. However there are stress in managing the cashflow as this can limit your choices in life. I am treating it as "Force Saving". This is one item that is driving up expenses.

With the new property curb, it is now much harder for one to own a private property. Chances are young family may need spouse to also be in workforce with reasonable good job for a family to afford staying in one. I am curious how will this affect my property valuation therefore the net property value. Probably flat I guess.

Property is a natural hedge against inflation with added bonus of rental income. Ironically, renting in Singapore is not cheap so is my believe that one should always have a property in their name and using bank loan which is only 1.5% fixed for my case. I could not justify taking a loan from CPF.

Cory

2022-0102

CoryLogics Invest Chat - No Coin, No Porn, No Penny

Telegram CoryLogics <= Link to Telegram

Articles in this Blog is personal take and sharing purposes only. Reader should seek their own professional help when making financial decision and be responsible for their decision.

Congrats Bro. U beat me for 2021. Chasing your tail for 20222.

ReplyDeleteBro, that's 18200 Years ! thanks for the Blessing to us. ;)

DeleteThanks for sharing, Cory. Just now I posted a comment, not sure it got published or not.

ReplyDeleteFor investment property, will it be ideal to have 15-20 years - longer loan tenure, since the interest rate is low. So the monthly repayment will not eat into your cash flow.

Or your plan is to pay off all the loan before retirement. So the rental can be an income for retirement. Ss

Theoretically, we should extend our loan as long as possible and for refinance them lower whenever we can. What this mean is we want to be in housing debt position even if we have the cash in hand. This is to optimise our capital to invest elsewhere. The current rule will kind of force us to pay off loan by 65 if we do nothing. This is assuming the interest rate for home loan is low vs say equity returns. If there are situation or bad reason this is not happening, we should paid back the loan in full immediately. Income for retirement can comes from anywhere. The rental for my case is to help relieve my loan such that I have more cash for equity investment. So need to look at whole package.

DeleteWhat do you mean by "The current rule will kind of force us to pay off loan by 65 if we do nothing."?

DeleteHi Susan, say we buy a property at age 46. The max duration we can take a home loan is 19 years. ( 65-46 = 19 ). Therefore the loan repayment is very high annually. By age 65, your loan will be fully paid up. And we miss the leverage completely.

Delete