As a dividend investor, this principle has never crossed my mind. It seems more aligned with a timer or short-term investment rationale. Coincidentally, many REIT and BANK stocks go ex-dividend in May. As you may be aware, stock prices typically drop upon going ex-dividend. This might give the impression that the local SGX market is down, especially for counters that offer substantial dividends in this region.

What makes this time particularly noteworthy is the market's response amidst an environment of inflation and high rate, where banks are performing well, while REITs have already rebounded from lows. This trend holds, with the exception of US REITs, which are experiencing a serious downturn.

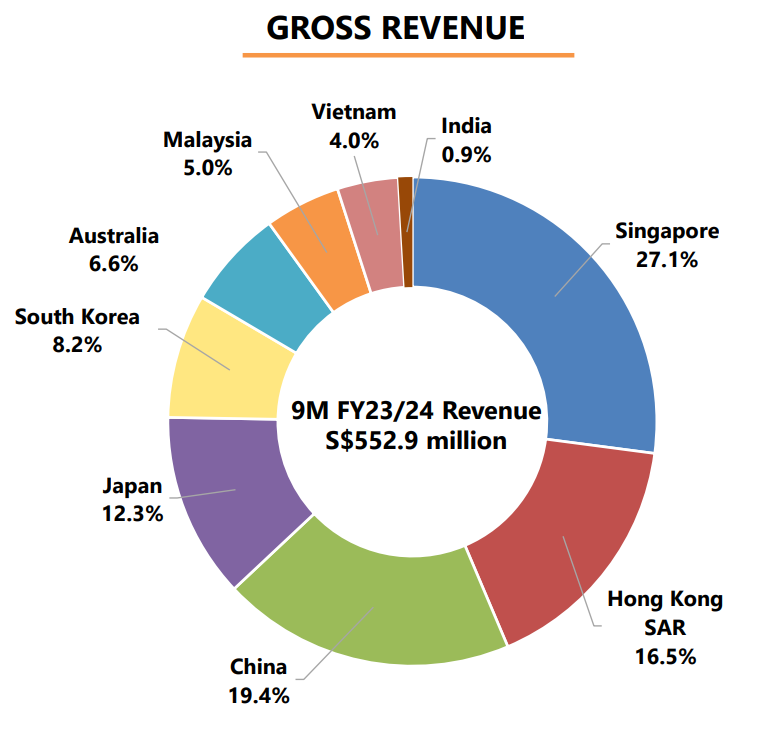

The portfolio is invested in several markets, which can be categorized as follows [positioned at the bottom right].

With REITs and banks combined comprising more than 76% (after selling off UOB before ex-dividend to raise cash), the portfolio was expected to experience drawdown symptoms as they went ex-dividend. However, the portfolio returns achieved another all-time high. Perhaps this is simply a positive market pump, but I foresee further potential in the banks as they report record profits this quarter.

Note : Top Left, Year 2022 drawdown but not as deep as Year 2020 Covid year which aren't reflected in the chart due to it occurs in the mid of the year which then closed up before the year ended.

Nevertheless, it's a good time to capture a snapshot of today for future review.

Cory Diary

2024-05-012

CoryLogics Invest Chat - No Coin, No Porn, No Penny ( Limited to Invitation )

Telegram CoryLogics <= Link to Telegram Chat

Disclaimer: The articles presented in this blog reflect personal opinions and are intended for informational and sharing purposes only. Not responsible of errors. Readers are advised to seek professional guidance when making financial decisions and should take full responsibility for their choices.